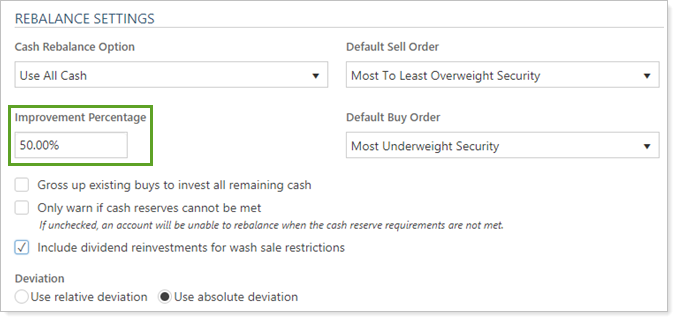

Rebalance Settings on the Rebalancing System Settings page allow you to customize how Tamarac Trading adheres to logic during a rebalance and how it calculates information during that process. These settings are widely applicable to many different rebalance types. Improvement Percentage gives you control over the trades recommended. Tamarac Trading will only recommend a trade if the overall improvement produced by that trade is equal to or better than the Improvement Percentage.

Type any number from 0% to 100% in Improvement Percentage. Tamarac Trading sets the default improvement percentage to 50%, meaning that the ending result of a trade must reduce the overall deviation from the security's target by 50% or better.

The larger the improvement percentage, the more trades the system can recommend as there is a wider range to meet. A smaller improvement percentage becomes more restrictive and could recommend few trades as there is a more narrow range to meet.

See Improvement Percentage in Action

A client currently holds 3% of his account in MSFT. The target for MSFT is 5%, so MSFT is underweight. Improvement Percentage is set at 50%

During a rebalance, Tamarac Trading would ideally buy another 2% in MSFT to bring the security to its 5% target, but first needs to determine if a recommended buy would meet the requirement of the Improvement Percentage setting. Here's how this is determined:

Initial Deviation of 2% ✕ Improvement Percentage of 50% =

Trade must be within 1% of the target of 5% for a trade to be recommended.

With this in mind, a buy for MSFT in this client's account must bring the final position to between 4% and 6% of the account to be recommended.

If you changed Improvement Percentage to 25%, here's how Tamarac Trading would determine if MSFT becomes a recommended trade:

Initial Deviation of 2% ✕ Improvement Percentage of 25% =

Trade must be within 0.5% of the target of 5% for a trade to be recommended.

With this in mind, a buy for MSFT in this client's account must bring the final position to between 4.5% and 5.5% of the account to be recommended.