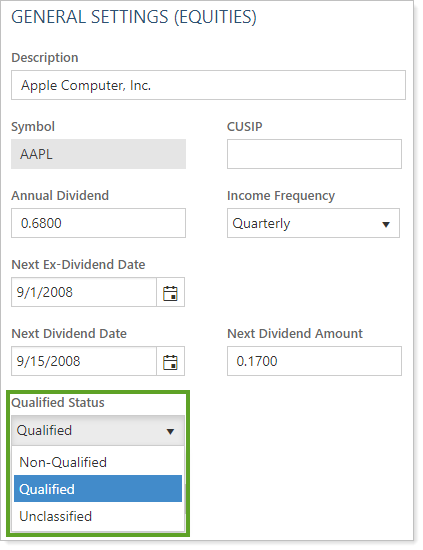

Any security where Qualified Status is set to Unqualified.

When the Income and Expense Report is run, Tamarac Reporting checks to see if the securities paying dividends meet the Holding Period requirement for Qualified Dividends:

-

All of the shares of the security held on the day prior to the dividend's Ex Date, must be held for more than 60 days out of a 120 day period, beginning 60 days before the Ex Date. If any of the shares do not meet the holding period requirement, then the income based those shares is considered Non-Qualified.

-

More information about the Holding Period Requirement: The period begins the day following acquisition and includes the day of sale. For a stock purchased on 4/10/03, that pays a dividend shortly after it is purchased, the earliest date you could sell and still have the dividend be Qualified is 6/10/03. The position was held for 20 days in April, 31 days in May, and 10 days in June = 61 days.

-

If the security's Holding Period is 90 days, use the same logic as described above, except that the Holding Period Requirement is 90 days out of a 180 day period beginning 90 days prior to the Ex Date.

-

If some of the shares meet the Holding Period requirement, but others do not, then part of the dividend is considered Qualified, and part is considered Non-Qualified.

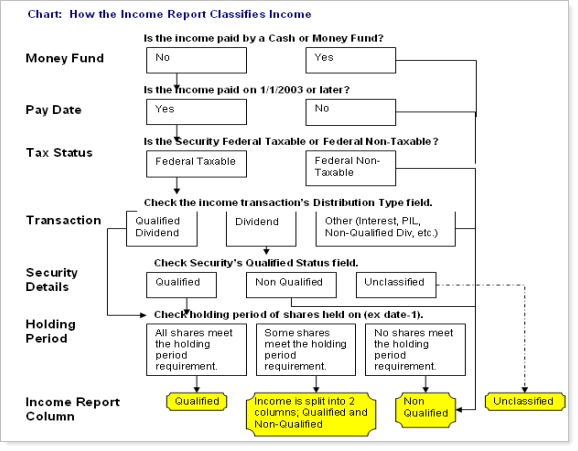

The chart below demonstrates the logic used by the Income Report to decide which column an income amount should go into.