Contents

Introduction

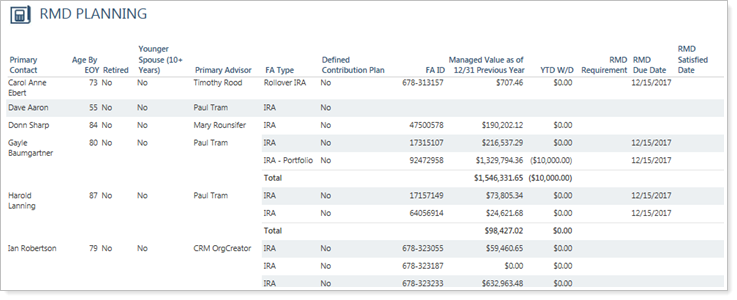

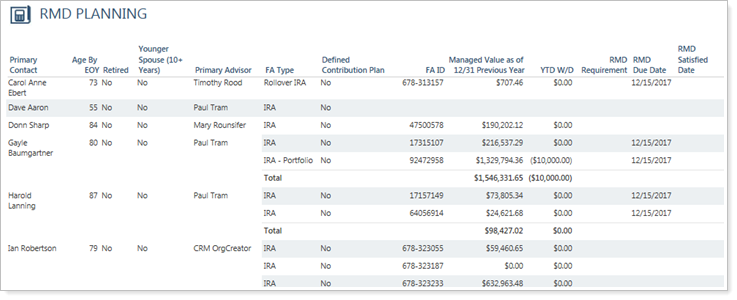

After a client reaches the minimum age, or inherits an IRA, he or she is generally required by federal tax law to withdraw a minimum amount from a retirement savings plan each year. The RMD Planning report will help you identify who will need to take a RMD, as well as provide information needed to calculate the correct distribution amounts using the information available in Tamarac CRM.

This report gives you the information you need, including a link to IRS tables, to calculate the distribution amount and track the progress of your clients. As you update that your clients have met their required minimum distributions for the year, they will no longer appear on the report.

This report searches for tax deferred/tax exempt financial accounts. This field is auto populated in Tamarac CRM with the status in Tamarac Reporting through integration. If this status is not automatically updating for you and you have the appropriate value set in Tamarac Reporting, verify the integration is turned on for this field. If you do not have Tamarac Reporting, you will need to manually update this field in Tamarac CRM for each financial account.

Generate the RMD Planning Report

To run the RMD Planning report, follow these steps:

-

On the side menu, select Reports.

-

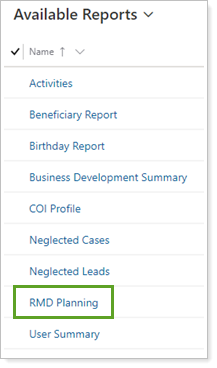

Select RMD Planning. The report viewer opens a separate window with the generated RMD Planning report.

RMD Planning Report Details

The table in this report shows the clients who meet the requirements to take RMD for the year and their corresponding financial accounts.

| field name | More Information |

|---|---|

| Primary Contact |

The primary contact on the financial account and has been identified for RMD. A primary contact must be entered on the financial report in order to be included in this report. |

| Age By EOY |

Age that the primary contact on the financial account will be as of 12/31 of the current year. A birth date must be entered on the contact to be included in this report. |

| Retired |

Is the client retired? If so, click Yes; otherwise, click No. This is identified on the contact record. |

| Younger Spouse (10+ Years) |

Is the client’s spouse 10 or more years younger? If so, click Yes; otherwise, click No. The primary contact on the financial account must have an anniversary date listed on their contact and a matching anniversary must be listed for the secondary contact on their corresponding account. The secondary contact must also have their birth date in the system. |

| FA Type§ |

Type of financial account. This is auto populated by the account type in Tamarac Reporting. You may manually update this if you do not have Tamarac Reporting. |

| FA ID§ |

Financial account number. This is populated through integration with Tamarac Reporting or Tamarac Trading, or entered for manual financial accounts at the time it is created. |

| Managed Value as of 12/31 Previous Year § |

Value of the financial account with the assigned custodian as of 12/31 the preceding year. |

| W/D YTD § |

Year-to-date withdrawals. |

| RMD Due Date |

Indicates the date that RMD must be withdrawn by for the Financial Accounts listed on the report. |

| RMD Requirement |

Indicates the RMD amount for the Financial Accounts listed on the report. |

| RMD Satisfied Date |

Indicates the date that RMD was satisfied. |

| Defined Contribution Plan |

Is this financial account a defined contribution plan? If so, click Yes; otherwise, click No. This is a check box on the financial account. |

| Primary Advisor |

Primary advisor the financial account is assigned to. |

Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.

Filter and Navigate the RMD Planning Report

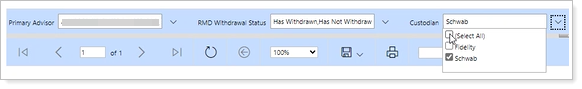

Use the Primary Advisor, RMD Withdrawal Status, and Custodian fields at the top of the report to customize the report output. For example, the report shows all Primary Advisors, but you want to only look at accounts custodied at Schwab that have withdrawn.

To filter the report, select the desired options the Primary Advisor, RMD Withdrawal Status, and Custodian fields, and then select View Report.

| Filter | More Information |

|---|---|

| Primary Advisor | Use this filter to show clients needing RMD for all primary advisors, or for a specific primary advisor. |

| RMD Withdrawal Status | Use this filter to see the Financial Accounts on the RMD Report that—for the current year—have withdrawn from their RMD or have not withdrawn. You can choose All if you don't want to filter by whether RMD has been withdrawn. |

| Custodian | Use this filter to select one or more custodians that your firm uses. The report will display only accounts custodied at the selected custodians. Choose (Select All) to include all custodians. |

You can navigate through multiple pages of your report, search for specific clients, and export the RMD Planning report using the report navigation bar.

| This Button... | Takes you to... |

|---|---|

|

First page of the report. |

|

Previous page of the report. |

|

The page number you enter. |

|

Next page of the report. |

|

Last page of the report. |

|

A specific Lead or Opportunity. Type the name you want to search and press ENTER. The results will be highlighted on your report. |

|

An export of this report in one of these formats:

|

|

Refreshed report data. |

|

Print the report. |