Contents

|

Add Insurance Planning Records |

Introduction

Tamarac CRM allows you to track insurance coverage for your clients. You can track the following insurance types: life, auto, home, disability, business, health, LTC, renters, and umbrella. You will be able to track information related to each insurance type based on the type of insurance you select.

Add Insurance Planning Records

To add insurance information, follow these steps:

-

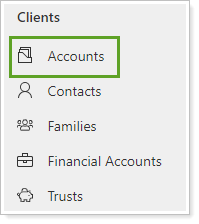

On the side menu, select Accounts under Clients.

-

Click the name of the account where you want to add insurance planning.

If needed, search for the account.

-

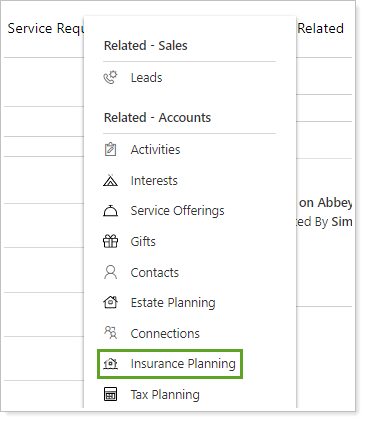

Click Related and then select Insurance Planning.

-

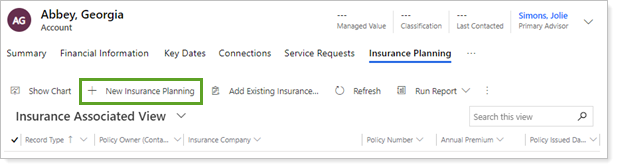

Click New Insurance Planning.

-

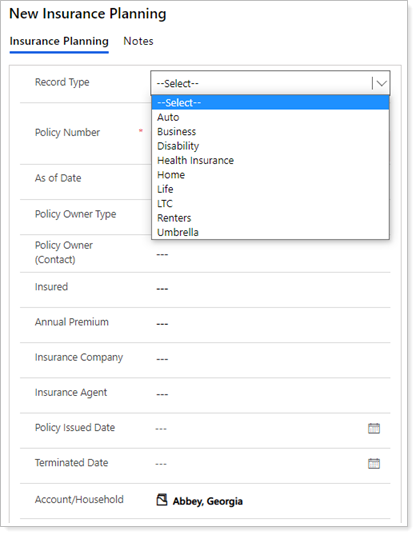

In the Record Type list, click the policy type you want to add. When you select the record type, additional fields may appear.

For more information, see these record types:

-

Complete the following information:

Field Name More Information As of Date As of date for the policy information. Policy Number* Insurance policy number. Policy Owner Type Select the appropriate type from the list. Policy Owner The contact that owns the insurance policy. Insured Select the appropriate value from the list. Annual Premium The dollar amount of the annual premium on the policy. Insurance Company Select the issuing Insurance Company. Insurance Agent Insurance agent on the policy. Policy Issued Date Date the policy was issued. Terminated Date Date the policy terminated. Account/Household Assigns the record to the appropriate client account. This is pre-filled when the form is created. Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.

-

When finished, click Save.

Insurance Planning Record Types

Auto Record Type

| Field Name | More Information |

|---|---|

| Liability Coverage – Bodily Injury | Dollar amount of liability coverage for bodily injury. |

| Liability Coverage - Property | Dollar amount of liability coverage for property. |

| Comprehensive Deductible | Dollar amount of comprehensive deductible under the policy. |

| Collision Deductible | Dollar amount of deductible under the policy for collisions. |

| Underinsured Motorist – Bodily Injury | Dollar amount of coverage for bodily injury to underinsured motorists. |

| Underinsured Motorist – Property Damage | Dollar amount of coverage for property damage for underinsured motorists. |

| Personal Injury Insurance | Dollar amount of coverage for personal injury. |

Disability

| Field Name | More Information |

|---|---|

| Policy Type | Type of disability policy. |

| Monthly Benefit | Dollar amount of monthly benefit. |

| Definition of Disability‡ | Definition name of disability being covered. |

| Benefit Period‡ | Length of time benefit is paid. |

| Pre-Tax | If the coverage amount is a pre-tax amount. |

| After Tax | If the coverage amount is an after tax amount. |

| COLA Included | If COLA is included in the coverage. |

Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.

Health Insurance

| Field Name | More Information |

|---|---|

| Policy Type | Type of health insurance policy. |

| Deductible | Dollar amount of deductible. |

| Co-Pay | Dollar amount of client co-pay. |

| Plan Type‡ | Type of health insurance plan. |

Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.

Home

| Field Name | More Information |

|---|---|

| Liability Coverage | Dollar amount of liability coverage. |

| Medical Payment to Others Amount | Dollar amount of payout to others for medical. |

| Property Deductible | Dollar amount of deductible for property. |

| Dwelling Coverage | Dollar amount of coverage on home. |

Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.

Life

| Field Name | More Information |

|---|---|

| Policy Type | Type of life insurance policy. |

| Benefit Taxable | If the benefit under the policy is taxable. |

| Death Benefit | Dollar amount of payout to beneficiaries upon death. |

| Face Amount | Dollar amount policy purchased for. |

| Length of Coverage‡ | Length of coverage period. |

| Cash Surrender Value for Current Year | Current year cash value if insurance is terminated prior to maturity. |

| Cash Surrender Value for Last Year | Previous year cash value if insurance had been terminated prior to maturity. |

| Requires Beneficiary |

Select this check box to indicate that a beneficiary is required, and to display the Insurance Policy on the Beneficiary report. Additionally...

|

Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.

LTC

| Field Name | More Information |

|---|---|

| Daily Benefit | Amount of daily LTC benefit under the policy. |

| Waiver of Premium Protection | If premium protection is waived. |

| Elimination Period‡ | Time period between disability and benefit payout. |

| Home Care | If policy includes home care. |

| Inflation Protection Rider | If policy includes an inflation protection rider. |

Fields marked with an * are required.

Fields marked with a ‡ are configurable by your firm's Data Manager.

Fields marked with a § are integrated values from Tamarac Reporting.