Contents

Introduction

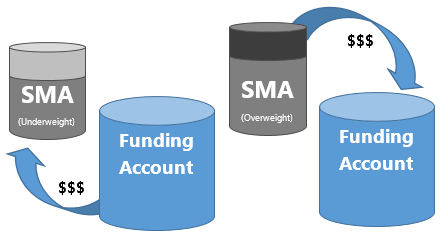

A funding account is an account associated with a separately managed account (SMA). When you include an outside SMA in a client's overall strategy, you can use a funding account to help calculate buys and sells in the SMA for manual execution.

Funding accounts must be designated to SMAs. Since the SMA is separately managed, you will need to complete final trading in the SMA manually, whether that's executing sells from the SMA or buys into the SMA.

Funding Account Example

You have a client with a small outside account at another investment firm. The client wants to keep that account managed outside of your firm. However, you want to manage the client's overall strategy, including allocations to the SMA, even though you don't control that account.

You set up a funding account for the client and associate it with the outside SMA. This will allow you to see net money movement for the SMA account, even though the SMA is not directly within your control. This helps you do the math for buy and sell recommendations to the SMA and helps you calculate the amount of money to manually contribute or withdraw from the SMA.

Add a Designated Funding Account

To add a designated funding account to another account, follow these steps:

-

On the Accounts menu, click Accounts.

-

Select the account where you want to designate a funding account.

SMAs and the designated funding accounts should be similar account types. For example, set up a tax-deferred funding account for a tax-deferred SMA.

-

Click Account Configuration under the Rebalancing tab.

-

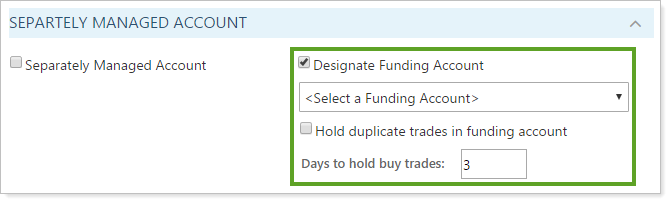

Under the Separately Managed Account section, select the Designate Funding Account check box.

-

In the Select a Funding Account list, select the account you want to use as the funding account.

-

If you want Tamarac Trading to hold duplicate trades in the funding account, select the Hold duplicate trades in funding account check box.

-

If you want Tamarac Trading to wait a particular number of days before buying trades with the funding account, type the appropriate number of days in the Days to hold buy trades box.

-

-

Click Save.