Contents

Tactical Rebalancing for Allocation Models

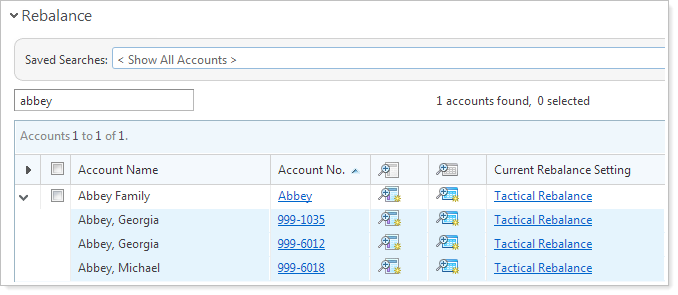

Today, most of you use tactical rebalances to rebalance your accounts against one or more Security Level models. This rebalance type is particularly useful when you have several Security Level models within an Allocation model, and you want to rebalance tactically against a particular asset class.

In this release, we've added tactical rebalancing for Allocation models. This new feature will recommend buys and sells based on the goals of the Allocation model and makes it easy for you to target specific model reallocations to meet your investment objectives. While setting up your Tactical Rebalance and selecting an Allocation model, all underlying allocation and security level models will be included in the rebalance.

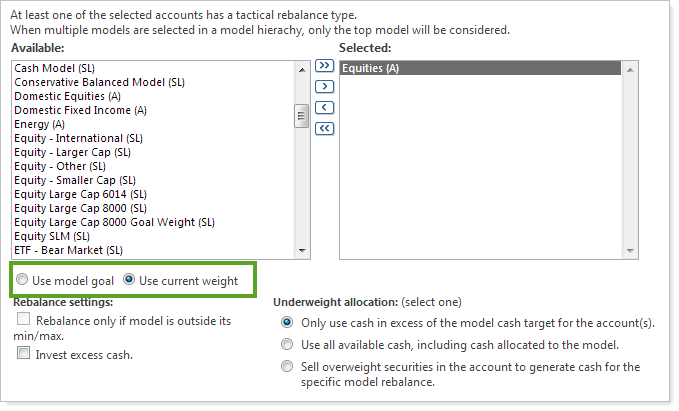

In addition to adding tactical rebalancing for Allocation models, Advisor Rebalancing can either use the account's model goal or maintain the account's current weight for the selected models. This feature will allow you to choose a tier of your Allocation model and rebalance the underlying models while maintaining your current weight held at any tier.

For example, let's say you have an account that is assigned to a 60/40 Equity/Fixed Income model, but you would only like to rebalance the Equity portion, which is currently 63 percent of the account. If you perform a tactical rebalance on the Equities Allocation model and select the Use current weight option, the Equities allocation model will be temporarily adjusted to 63 percent of the account — essentially rebalancing the account back to the underlying model goals while still preserving the current split between asset classes.

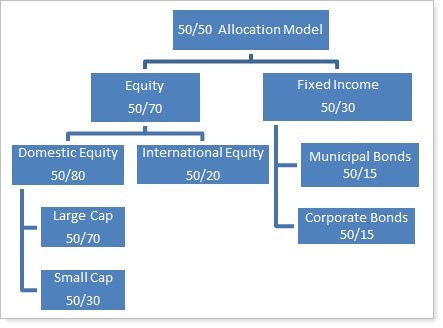

Example

-

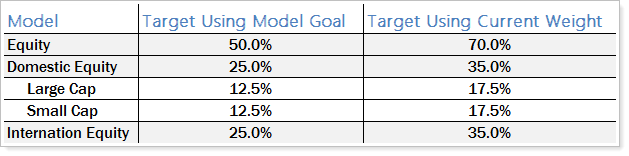

Use model goal.This option will complete a tactical rebalance on all security level models that are implicitly selected. For example, if the Equity Allocation model was selected, this is equivalent to selecting the Large Cap, Small Cap, and International Equity security level models. The tactical rebalance will then rebalance the selected models back to their model goal weights.

-

Use current weight.This option will complete a tactical rebalance and keep the current weight of the selected Allocation model. The goal of all submodels and Security Level model securities will be set relative to the selected Allocation model. If the selected Allocation model or any of its submodels are outside their min/max goal range, the tactical rebalance will rebalance the selected models back to their model goal weights.

With the model above, if the Equity Allocation model was selected, the weight of Equity top tier would remain 70% (if 70% is within the model's min/max goal range). However, Domestic Equity and International Equity would be readjusted to be 50% of Equity (35% each). Large Cap and Small Cap will also have their targets adjusted to 50% of the new target for Domestic Equity (17.5% each).

Designate a Ticker for an SMA Via the Account Information Upload

Today, many of you designate your SMA funding accounts via an uploaded data set. However, you can only specify the ticker for the SMA on the Account Settings page. With this release, you can now designate the account's SMA ticker via the Account Information upload data set when the SMA is represented by only one ticker.

To designate the ticker to use for an SMA, simply add the column SMATicker to the Account Information data upload set.

| Field name | SMATicker |

| Valid characters | A..Z0..9-$./_ |

| Description | When this field has a value, the account will be marked as an SMA and will be represented by 100 percent allocation to this ticker. |

| Field condition | Not Required |

| Data type | String |

| Size | 12 |

| Digits | 0 |

New Default Settings for Directed Trades

With this release, we've made some changes to the default behavior for directed trades. You can change the default behavior on the System Settings page.

In addition, Advisor Rebalancing will always complete a linked trade or mutual fund swap with negative cash if the cash position for the account is improved or if there is no change in the cash position.

The System Settings page now includes the following options:

-

Allow trade if the trade is less than the minimum investment setting for all directed trades.If this box is checked, the minimum investment settings that are defined on the Trade File Group Settings page will be ignored. If the box is unchecked, the security minimums will be adhered to.

-

Allow trade regardless of an account's minimum trade size by default.This option allows you to choose whether or not to honor your account minimum trade size. If the box is checked, the account's minimum trade size will be ignored for the applicable security type.

-

Allow partial trades by default.If you clear this check box, a buy trade can only execute when the entire purchase can be completed. For example, if you have three buys pending, but only enough cash for two, the buy trade will not execute. If you select the check box, a buy trade will purchase as much of the trade as possible, even if the entire trade cannot be completed. In this case, if you have three buys pending and only enough cash for two, the buy trade will execute to the limit of cash, completing the first two trades, but not the third.

-

Allow trade using security substitutes by default.When placing a directed trade for a security with security restrictions, Advisor Rebalancing will perform the trade action using substitute securities if substitutes are available for the security and you have enabled this new option.

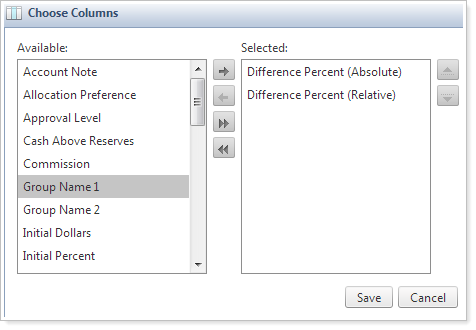

Difference Percent (Relative) and Difference Percent (Absolute) Columns on Trade Review

We've added a Difference Percent (Relative) column and a Difference Percent (Absolute) column to the Trade Review page.

To add these columns, click the  on the Trade Review page.

on the Trade Review page.