Contents

Rebalancing & Trading

Improved Tactical Rebalance Logic

When performing a tactical rebalance, Advisor Rebalancing will now consistently honor account-level and model restrictions and will now only provide trade recommendations for the selected models.

More Accurate Minimum Investment Size Logic

We've updated the minimum investment size restriction to be more accurate in some scenarios.

Example

Let's say you have the following setup:

-

Security Level Model 1 contains the following securities: A (rank 10) and C (rank 0)

-

Security A has a goal of $15,000, a minimum investment size of $20,000 and a substitute that is security B.

-

Security B has no minimum investment size restriction or any other restrictions.

-

Security C has a target of $10,000, a min purchase of $20,000, and no substitutes.

When rebalancing the account, the rank based logic will first process Security A and its substitutes. Because Security A's goal is below its minimum investment size, Security A's allocation will be given to its substitute Security B and Security A will be restricted. Security B will have a goal of $15,000.

When Security C is processed in Advisor Rebalancing the $10,000 target cannot be met since it has a minimum investment size of $20,000. This delta will then be allocated to Security A's substitute (Security B) because Security A is restricted. As a result, Security B will have an allocation of $25,000, which is above Security A's min investment size of $20,000.

In this scenario, the outcome is not optimal since it results in an allocation greater than Security A's minimum investment size for Security A's substitute (Security B) and not for Security A.

To correct these types of issues, Advisor Rebalancing will now first check the model and its substitutes that have targets below the minimum investment size. Once these securities are identified, the securities and assigned substitutes will be removed from processing if the goal of the "parent" or any of its substitutes has minimum investment size restrictions. Before starting the rank based allocation, the sum of the delta from the goal for these restricted securities will be added to the highest ranked security's goal—creating more accurate results.

Improved Custom Rebalance Logic

Prior to this release, when generating a custom strategy, Advisor Rebalancing ignored all restricted lots (redemption fee restrictions, short-term gains, etc.). As a result, sometimes you'd see a change of the lots being sold—even on securities that had no changes made to their trades.

With this release, restricted lots will always go to the bottom of the lot sort order in a custom rebalance—regardless of the closing method.

Account Maintenance

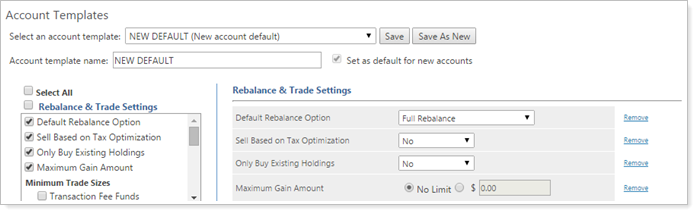

Account Templates

Many of your accounts likely share the same settings. For example, you may have groups of accounts that share the same custodian, minimum trade sizes, holding sizes and other account settings. Account templates provide an easy way to save a group of settings and apply them to other accounts. This change saves time when setting up accounts and helps avoid errors that can occur when manually specifying the settings one-by-one.

You can assign account templates to accounts in bulk using Account Multi-Edit. One account template must be designated as the default for new accounts by selecting the Set as default for new accounts check box on the account template. On the night of the release, your existing Account Defaults will be migrated to a new account template.

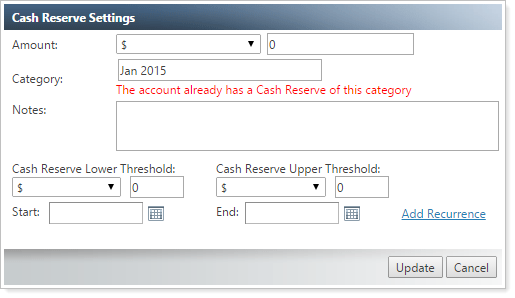

More Streamlined Setup of Cash Reserves

When setting up your cash reserves for an account, you can only use each category once per account. For example, you can't use the Jan 2015 category multiple times for the same account.

To avoid confusion, cash reserve categories that are in use for the account will no longer appear in the list when creating cash reserves.

Reporting

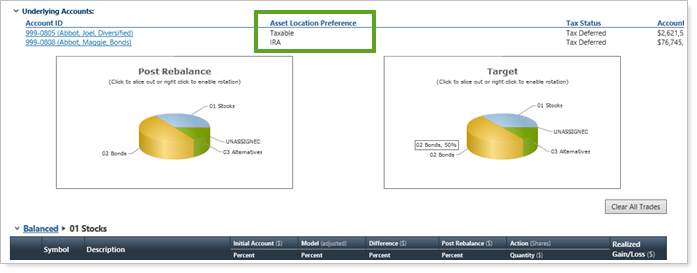

Show Asset Location Preferences for Underlying Accounts on the Rebalance Summary

When rebalancing accounts that are part of a rebalancing group, sometimes it's helpful to see the asset location preferences for the accounts in the rebalancing group. Now, when you expand the Underlying Accounts section of the Rebalance Summary report, you'll see a new column for the asset location preferences.

Trade Summary and Trade Review Updates

We've made some changes to the Trade Summary and Trade Review pages so that you have the information you need to make informed trading decisions.

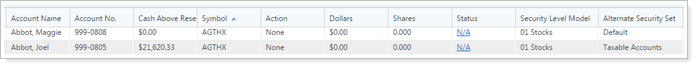

See Alternate Security Sets on the Trade Review and Trade Summary pages

To help you make more informed decisions about your trades, we've added an Alternate Security Set column to the Trade Review and Trade Summary pages. This column shows the alternate security set the security is tied to. If the security is tied to multiple alternate security sets due to the security being held in multiple models, a link will appear that will allow you to see this information.

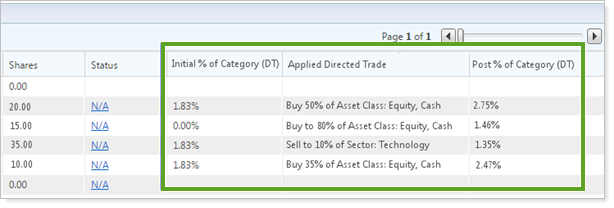

New Columns

You can now add the following columns to the Trade Summary and Trade Review pages:

-

Initial % of Category (DT).Displays the security's initial weight of the selected categories in the applied directed trade. This will only be populated if a % of Category or To % of Category directed trade has been applied.

-

Post % of Category (DT).Displays the security's post-rebalance weight of the selected categories in the applied directed trade. This will only be populated if a % of Category or To % of Category directed trade has been applied.

-

Applied Directed Trade.Displays the applied directed trade for the security. This will display for any applied directed trade, not only for category directed trades.

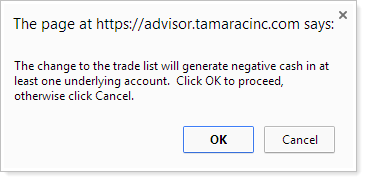

Negative Cash Warning for the Trade REVIEW

When you create a trade on the Trade Review page, Advisor Rebalancing will now let you know if the trade will cause an account to finish with negative cash.

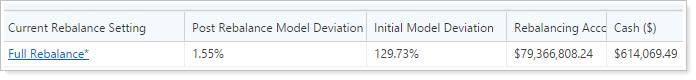

New Columns for Model Deviation

To make it easier for you to see model deviation on account-related pages, we've split the Deviation From Model column into two new columns: Initial Model Deviation and Post Rebalance Model Deviation.

You can add these columns to the following pages:

-

Rebalance

-

New Directed Trade

-

Rebalance Review

-

Trade Review*

-

Trade List

-

Accounts

-

Rebalancing Groups

* We also split the Difference Percent (Relative) column into two new columns: Initial Model Deviation (Relative) and Post Rebalance Model Deviation (Relative). We also removed the Difference Percent (Absolute) column since the new Initial Model Deviation column will display this information.

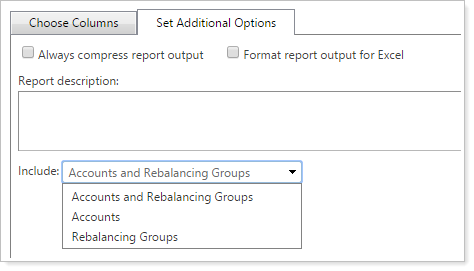

Bulk Report Updates

Include Accounts and Rebalancing Groups in Bulk Reports

When generating bulk reports that contain columns from the Accounts - Rebalancing Group, you now have the option to filter by accounts, rebalancing groups, or account and groups on the report.

Search Enhancements

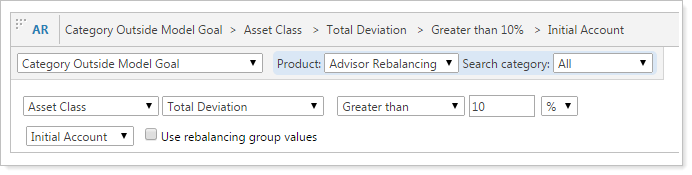

Search by Total Category Deviation

Now you can search by total deviation at the category level. To take advantage of this feature, simply add the new Category Outside Model Goal filter to your saved searches.

Third Party Integrations

Real-Time Pricing Update for BATS Exchanges

Before this release, prices could occasionally become "stale" if the last sale on the exchange was from a previous day. For those of you who use real-time pricing for securities traded on BATS exchanges (which only covers about 10% of the US equity market), Advisor Rebalancing will now provide messaging if a stale price is received and instead use the system price.

Advisor OMS

Trade Type Cleanup

We've removed the following trade types that are not in use and generally not supported:

-

With Or Without

-

Limit With Or Without

-

On Basis

-

On Close

-

Limit on Close

-

Forex

-

Previously Quoted

-

Previously Indicated

-

Pegged

Usability

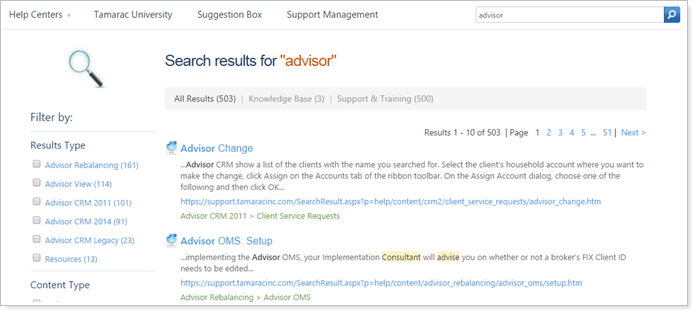

Improved Search for the Support & Training Center

We want you to find relevant information as quickly as possible in the Support & Training Center. With this in mind, we're pleased to announce that we've partnered with a top search provider to deliver fast and accurate search results. This new search engine delivers much more than a simple boolean search—it can weight specific words based on the sentence structure and bring the most relevant results to the top of the page.

Upgrading to the new search provider also paves the way for a new knowledge base that we're very excited about. All the knowledge base framework is in place today and we'll be working on building up the content in the months and years ahead.

The new search engine works the same as most any search engine and you can search it the same way you've searched the Support & Training Center in the past—with one exception—we've removed the search box from the top of Advisor Rebalancing. We made this change because many users inadvertently type account numbers and other confidential information into the search box.

To get to the Support & Training Center, place your mouse pointer over your name and then click Help.