Contents

|

Trade File Group (Custodian) Security Settings |

Cash Substitute Securities

Advisor Rebalancing now has the ability to treat any security as cash for monitoring and allocation purposes. However, unlike cash, the securities will actually create a trade when traded.

Set Cash Substitute Securities at the Global Level

To set up cash substitutes at the global level, follow these steps:

-

On the Models menu, click Security Substitutes.

-

In the Enter Symbol box, type $$$ and then click View Details.

-

Click + Add Security.

-

In the Rank box, type a rank number for the cash substitute. If Advisor Rebalancing needs to generate cash during a rebalance of directed trade, the cash substitute securities should be sold in order of rank, with 0 being the highest sell priority.

-

Click + Add Security to add another cash substitute. You can add as many cash substitutes as you want.

-

When finished adding substitutes, click Save.

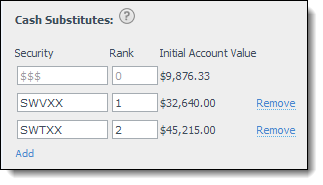

Set Cash Substitute Securities at the Account Level

To set up cash substitutes at the account level, follow these steps:

-

On the Accounts menu, click Account Settings.

-

In the Type account name or number box, start typing the account where you want to set the cash substitute securities. When you see it in the list, click it and then click Select.

-

Click the Cash Management Settings tab.

-

Under Cash Substitutes, do the following:

In the Security box, start typing the ticker of the security that you want to designate as a cash substitute. When you see it in the list, click it and then press Tab.

In the Rank box, type a rank number for the cash substitute. If Advisor Rebalancing needs to generate cash during a rebalance of directed trade, the cash substitute securities should be sold in order of rank, with 0 being the highest sell priority.

Click Add to add another cash substitute. You can add as many cash substitutes as you want.

-

When finished adding substitutes, click Save.

Notes

-

As a result of this enhancement, we've modified the definition of the following terms:

-

Sweep cash.The total amount of real cash ($$$), which includes all securities mapped to $$$ through a custom input symbol or security type mapping.

-

Tradable cash.The total value of the cash substitutes.

-

Account total cash.The total amount of sweep cash plus the amount of tradable cash including cash reserves.

-

Cash available for trading.The total amount of sweep cash plus the amount of tradable cash minus the amount of cash reserves.

-

Sweep cash above reserves.The total amount of sweep cash minus the cash reserves.

-

-

The rank for each cash substitute security must be unique.

-

You cannot modify the rank for $$$ sweep cash.

-

When using ranks, $$$ sweep cash will be used before any substitutes are sold.

Trade File Group (Custodian) Security Settings

Many of you have asked for a way to specify an equity, ETF, or mutual fund as exempt from fees or commissions at the custodian level. We've also heard that users would like to specify that a fund has transaction fees for one custodian but not another. That's why we've introduced trade file group security settings. With trade file group security settings you can:

|

Specify an ETF, Equity or Mutual Fund as a Fee Exempt Security Specify Whether a Mutual Fund Has a Transaction Fee for Each Trade File Group Custodian) |

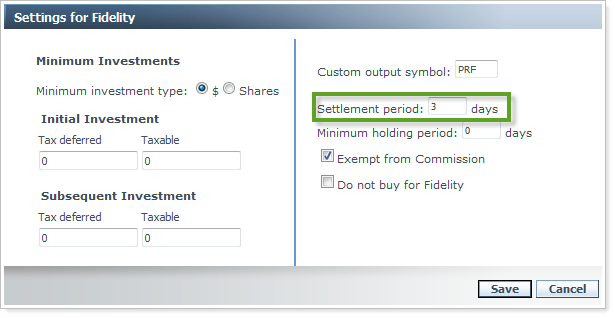

Specify an ETF, Equity or Mutual Fund as a Fee Exempt Security

To set an ETF, equity or mutual fund as a fee exempt security, follow these steps:

-

On the Securities menu, click Trade File Group Settings.

-

In the Enter Symbol box, start typing the ticker that you want to set as fee exempt. When you see it in the list, click it and then click View Details.

-

In the custodian list, choose the applicable custodian, and then click Add Trade File Group.

-

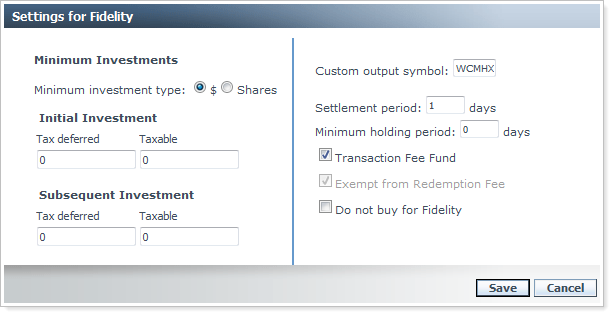

For equities and ETF's, select the Exempt from Commission check box. For mutual funds, select Exempt from Redemption Fee. Any fund identified as a transaction fee fund is automatically exempt from redemption fees.

-

Click Save.

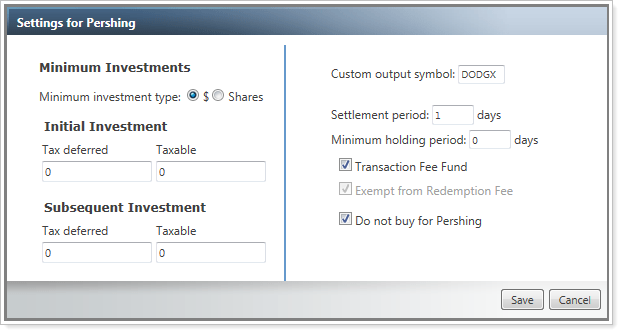

Specify a Settlement Period

To specify a settlement period, follow these steps:

-

On the Securities menu, click Trade File Group Settings.

-

In the Enter Symbol box, start typing the ticker where you want to set the settlement period. When you see it in the list, click it and then click View Details.

-

In the custodian list, choose the applicable custodian and then click Add Trade File Group.

-

In the Settlement Period box, type the settlement period. The default settlement period for ETF's and equities is three days, and the default settlement period for mutual funds is one day.

-

Click Save.

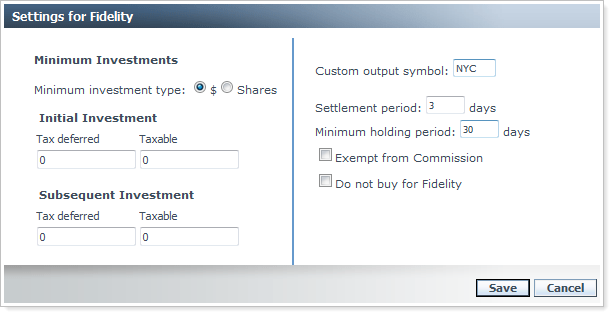

Set a Minimum Holding Period

Based on the purchase date of the oldest lot of the security, the minimum holding period determines how long a security must be held before it can be sold without penalty.

To set a minimum holding period, follow these steps:

-

On the Securities menu, click Trade File Group Settings.

-

In the Enter Symbol box, start typing the ticker where you want to set the minimum holding period. When you see it in the list, click it and then click View Details.

-

In the custodian list, choose the applicable custodian and then click Add Trade File Group.

-

In the Minimum Holding Period box, type the minimum holding period.

-

Click Save.

Specify Whether a Mutual Fund Has a Transaction Fee for Each Trade File Group (Custodian) Level

To specify whether a mutual fund has a transaction fee for each trade file group (custodian) level, follow these steps:

-

On the Securities menu, click Trade File Group Settings.

-

In the Enter Symbol box, start typing the ticker of the mutual fund that you want to set as a transaction fee fund. When you see it in the list, click it and then click View Details.

-

In the custodian list, choose the applicable custodian and then click Add Trade File Group.

-

Select the Transaction Fee Fund check box.

-

Click Save.

Trade File Group Upload Updates

As a result of these changes, we've added some new fields to the Trade Group Security Settings upload data set.

The new fields are:

| Field name | More information | Field condition | Data type | Size | Digits |

|---|---|---|---|---|---|

| TransactionFeeFlag |

0 = transaction fees don't apply. 1= transaction fees apply. Only applicable to mutual funds. If transaction fees apply, the fund is automatically exempt from redemption fees. |

Not required | Numeric | 1 | 0 |

| RedemptionFeeExemptFlag |

0 = redemption fees apply. 1= redemption fees don't apply. Only applicable to mutual funds that do not have transaction fees. |

Not required | Numeric | 1 | 0 |

| CommissionExemptFlag |

0 = commission fees apply. 1= commission fees don't apply. Only applicable to ETF's and equities. |

Not required | Numeric | 1 | 0 |

| SettlementPeriod | The number of days between the trade date and the settlement date. For mutual funds, this value defaults to 1. For all other securities, this value defaults to 3. | Not required | Numeric | 4 | 0 |

| MinHoldingPeriod | The number of days a security lot must be held before it can be sold without penalty based on the lot purchase date. | Not required | Numeric | 4 | 0 |

In addition, the TransactionFeeFlag field has been removed from the Custom Security Settings upload data set. This field has been added to the Trade Group Security Settings data set to allow for trade file group specific security settings.

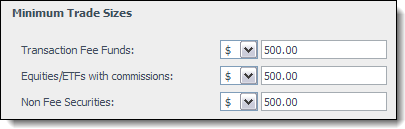

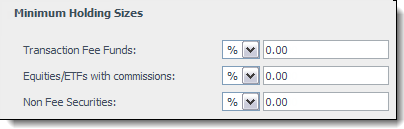

Updates to Minimum Trade Size and Minimum Holding Size Field Definitions

As a result of the trade file group security settings enhancement, we've modified the definitions for the minimum trade sizes and minimum holding sizes, as shown in the pictures below.

How this change affects you

| Setting before this release... | Setting after this release... | More information... |

|---|---|---|

| Transaction Fee Funds | Transaction Fee Funds | No change. This minimum trade size applies to your mutual funds with a transaction fee. |

|

Non Transaction Fee Funds (This setting did not include dummy tickers) |

Non Fee Securities | This minimum trade size applies to your non fee ETF's, equities, mutual funds and dummy tickers. |

|

All Other Securities (This setting included dummy tickers) |

Equities/ETF's with Commissions | This minimum trade size applies to your equities and ETF's with commissions. |

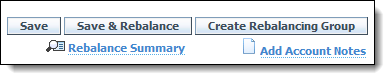

Save and Save and Rebalance Buttons at the Top of the Page

We've heard a lot of feedback from clients that they would like Save and Save and Rebalance buttons added to the top of the Account Settings and Rebalancing Group pages. With this release, we've added the buttons to the top of the pages. The additional placement of the buttons is much more convenient and user-friendly.

Usability Enhancements

-

You can now update the UniqueAccountId by uploading the Modify UniqueAccountId data set, which allows users to retain all account settings, notes, and trade history when moving between custodians and changing the account number.

-

To meet SEC compliance, we've added the following fields to the trade tickets that Advisor Rebalancing creates: Custodian and Discretionary. Additionally, we've made some improvements to help distinguish an advisor's role in approving, trading, and reconciling trades by adding additional notations for Traded by and Manually Reconciled by.