Contents

Introduction

Tamarac provides pricing data in Tamarac Trading for U.S. equities and ETFs listed on U.S. stock exchanges. These prices are delayed by 15 minutes. These include securities listed on:

-

NYSE

-

NYSE MKT

-

NASDAQ

-

BATS and trading on BATS—BATS operates two stock exchanges in the U.S., the BZX Exchange and the BYX Exchange (the BATS Exchanges), which currently account for about 11-12% of all U.S. equity trading on a daily basis.

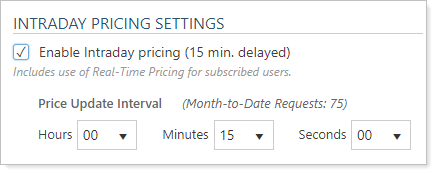

By default, you can make up to 20,000 intraday pricing requests per month. When you're nearing your quota limit, Tamarac will send you an automated email. And you can always check your month to date requests on the System Settings page.

If you anticipate that your firm will require a higher request quota, contact account management by email at TamaracAM@envestnet.com.

You can reduce the number of requests made by increasing the time interval for intraday pricing requests on the System Settings page. The time interval specifies how old a security price can be.

Note

For an additional fee per user, you can add the real-time intraday pricing feature to Tamarac Trading. This service provides even more up-to-date pricing on securities. To add this service, contact Account Management at TamaracAM@envestnet.com.

Set the Intraday Pricing Request Interval

With intraday pricing, you can choose how often you want Tamarac Trading to refresh pricing data for equities and ETFs.

To set the intraday pricing request interval, follow these steps:

-

Contact Account Management at TamaracAM@envestnet.com to enable intraday pricing for your firm.

-

Once Account Management has enabled intraday pricing for your firm, on the Setup menu, select System Settings.

-

Select the Enable Intraday Pricing check box.

-

In the Price Update Interval section, choose how often you want Tamarac Trading to refresh pricing data.

-

When finished, click Save.

Pricing Updates

Tamarac Trading will download the price for an equity or ETF when:

-

The security is part of a directed trade or is a funding source of a directed trade. If you are performing a directed trade, only the directed trade securities will be updated.

-

The security trade was updated by a custom strategy.

-

The security has a minimum weight restriction for the account.

-

The security is a substitute for a security that is having its price updated.

-

The security is held.

-

The security is a cash substitute.

Tamarac Trading will NOT download the price for an equity or ETF when:

-

You save an account.

-

The security has a global unmanaged restriction for the account being rebalanced.

-

The security has a global hold restriction for the account being rebalanced.

-

The security is not held in the account and the security has a target of zero in the account model.

-

The security's last cached price is within the acceptable time interval specified by the firm on the System Settings page.

Best Available Pricing

Best available pricing is the trade price that is the most current and relevant. Tamarac Trading will use the best available pricing whenever it needs a security price that is not updated through intraday pricing—for example, when you save without rebalancing or when you perform a custom strategy for an account and the security was not altered as part of the custom strategy.

To determine the best available trade price, Tamarac Trading will try to use the most recent trade price for a security. If the security price has not been downloaded recently by you or another client, Tamarac Trading will use the custom price established by your firm. If you have not specified a custom price, Tamarac Trading will use the price known as of the last trade date.

For intraday pricing for securities traded on BATS exchanges (which only covers about 10% of the US equity market), Tamarac Trading will provide messaging if a stale price is received and instead use the system price.