Contents

|

Rank-Based Models During a Rebalance |

Introduction

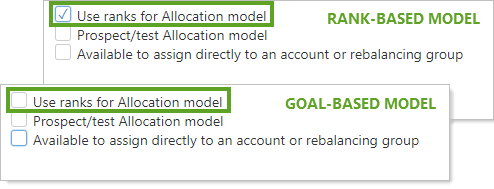

Tamarac Trading allows you to build in flexibility as to how your models are allocated using goal and rank-based logic within your models. When you create or edit a model, you can choose to make that model rank- or goal-based.

Goal-Based Models

During a rebalance, goal-based models focus on obtaining the goal position for individual securities. A multi-tiered model structure allows you the flexibility to customize your models with a mix of both rank and goal-based models. Within that structure, a goal-based model gives a definite allocation mix over time.

During a rebalance, Tamarac Trading will recommend trades to get goal-based models back to these exact target allocations or as close as it can.

Rank-Based Models

Rank-based models give priority to achieving the target for the asset class or Security Level model rather than all the individual securities within the model. You can classify a model as a rank-based model and then assign ranks—anywhere from 0 to 999—within that model. When a rank-based model is rebalanced, the targets are adjusted based on the current holdings, the rank, and the targets of the security or model.

Ranks give your models flexibility. You can blend Security Level models that use ranks with Security Level models that don't use ranks. You can also use ranks to accommodate legacy positions and restricted securities; ranks allow you to keep these positions in your models and have the holdings in legacy securities offset the other securities in the model.

Rank-Based Models During a Rebalance

During rebalances, Tamarac Trading examines ranks and adheres to these guidelines:

-

If a model is underweight, Tamarac Trading will prioritize buying securities with the numerically highest rank.

-

If a model is overweight, Tamarac Trading will prioritize selling securities with the numerically lowest rank.

When to Use Rank-Based Models

These situations are best suited for rank-based models:

-

If your investment strategy has a priority in achieving a target position for a category of securities, such as an asset class, instead of achieving a target for specific securities.

-

If you have many different securities that can fill a target allocation in a portfolio.

-

If your models contain many securities that are restricted or considered legacy positions.

Rules for Creating Rank-Based Models

Consider the following rules for using rank-based models:

-

Ranks cannot be negative. You can use ranks from 0 to 999 where 0 is the highest sell priority and 999 is the highest buy priority. Ranks don't have to be sequential.

-

Securities can have the same rank in a Security Level model. In Allocation models, submodels can have the same rank as well.

-

If the rank-based model is underweight, you will generally only see buys up to the model targets, not buys and sells between the securities. If that model is overweight, you will generally only see sells.

-

Your highest ranks are generally reserved for securities or models with the highest targets.

See Goals and Ranks in Action

The following example illustrates how goal and rank-based models behave:

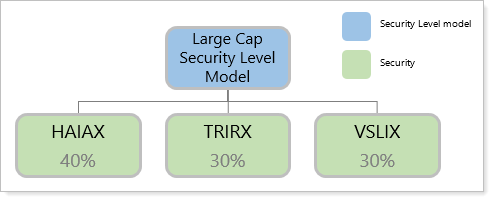

Goal-Based Model Example

You build the Large Cap Security Level Model as a goal-based Security Level model. The model has the following allocations:

| Security | Target Allocation | Current Allocation |

|---|---|---|

| HAIAX | 40% | 30% (Underweight) |

| TRIRX | 30% | 40% (Overweight) |

| VSLIX | 30% | 30% (At target) |

During a rebalance, Tamarac Trading will recommend trades to get Large Cap Security Level Model back to these allocation goals so that the allocations for all three securities match the targets you've set. In this goal-based model, HAIAX is 40% of the model but with a current allocation of 30%, so it's underweight. TRIRX has an allocation of 30% with a current allocation of 40%, so it's overweight. During a rebalance of this model, Tamarac will recommend a buy of HAIAX and a sell of TRIRX.

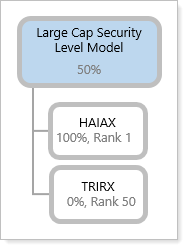

Rank-Based Model Example

You decide to change your model, so you change Large Cap Security Level Model to be a rank-based model with the following allocations:

Today, you are going to rebalance an account which contains this model. The target allocation for Large Cap Security Level Model is 50%. It's current allocation is 50%, so Large Cap Security Level Model is at its target. These are the current allocations for the securities in the model:

| Security | Target Allocation | Current Allocation | Adjusted Target |

|---|---|---|---|

| HAIAX | 100% | 95% | 95% |

| TRIRX | 0% | 5% | 5% |

As you can see, Tamarac Trading adjusts the targets to accommodate the current allocations. Because this is a rank-based model, and the current allocation for Large Cap Security Level Model is at its target of 50%, no buys or sells will be recommended.