Contents

Introduction

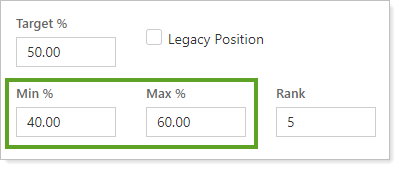

You can add minimum and maximum—referred to as min and max—values to models. These values create a tolerance band around the target allocation. The min becomes the minimum tolerance for that security or model and the maximum is the maximum tolerance for that security or model. This allows you to set allocations more loosely and reduce the number of trades within an account.

Ways to Use Min/Max Tolerances

You can use min and max tolerances to do the following:

-

Monitor accounts and take action on those which have gone outside of their tolerances.

-

Allow for some volatility while reducing the overall number of trades to only those times when the model has gone outside of its tolerances.

-

Minimize turnover and fees.

-

Allow for tolerance-based rebalancing opportunities rather than calendar-driven rebalancing.

Setting min/max values is appropriate for models where drift among the allocations in those models is acceptable. This allows you to maintain your investment philosophy while reducing the number of trades in the account needed to maintain that philosophy.

Min/Max Best Practices

-

Begin setting your min/max range at 20% deviation in either direction. For example, if a security has a target allocation of 40%, your range would be a min of 32% and a max of 48%.

-

We recommend not placing min/max allocations into rank-based models. For example, you have allocations to similar securities and, since both are similar, you'd likely not want to sell out of one to purchase another.

Strict Allocations vs. Min/Max Tolerances: An Example

In some cases, maintaining a more strict model allocation is appropriate and isn't a good use for using min and max tolerances. Consider this example:

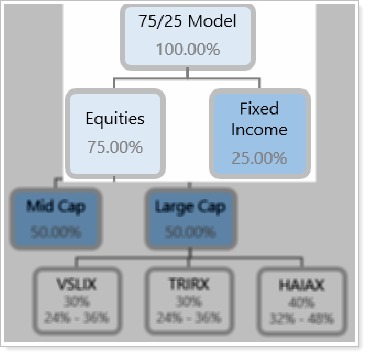

You assign a client's account to a model that is a mix of 75% Equities and 25% Fixed Income:

Due to the agreement you have with the client, as well as the client's risk tolerance and stated preference, the client's account must keep this ratio of securities at 75/25. For this tier of the client's model, you do not want to use min/max tolerances.

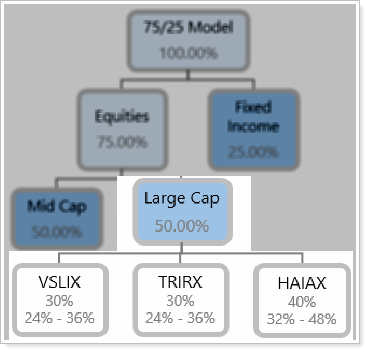

Within the Equities model, you've added a submodel to represent large cap securities. This model contains three securities:

Large Cap is allocated to 50% of Equities. The individual securities within Large Cap have allocations as well as min and max values. This is because you don't mind if the allocations for the securities within Large Cap drift within their tolerance band, provided that the overall model maintains its allocation. In this case, you do want to use min/max tolerances.