Contents

|

Refreshing Targets in Dynamic Models |

Introduction

Security Level models can be created with either static or dynamic targets. While the majority of models will be static, dynamic targets can be useful in some circumstances.

Static models have targets that remain consistent, regardless of the performance of the securities within that model. While you have the option to adjust target allocations for your models in the future, a static model's allocations will stay the same.

Dynamic models automatically adjust target allocations based on the performance of securities in the model. You may want to choose this option if you have a momentum investing strategy and you want the allocations of the securities in the model to track with performance.

Dynamic models are usually used with individual stock models without legacy securities or restricted securities.

Refreshing Targets in Dynamic Models

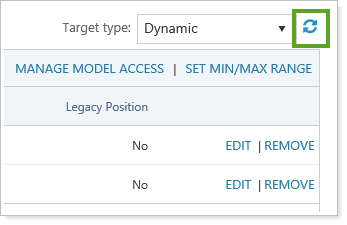

If you have a dynamic Security Level model, you can refresh the targets in your model manually. In order to get the latest target percentage calculations for a dynamic model, refresh your model targets using the Refresh Targets icon.

Keep the following in mind when refreshing targets for a dynamic model:

-

The dynamic values replace the model target and min/max range.

-

Any changes are applied when the model is saved.

-

Saving the model without first refreshing the targets resets the dynamic targets.

See Static and Dynamic Model Logic in Action

The following example illustrates how static and dynamic models behave:

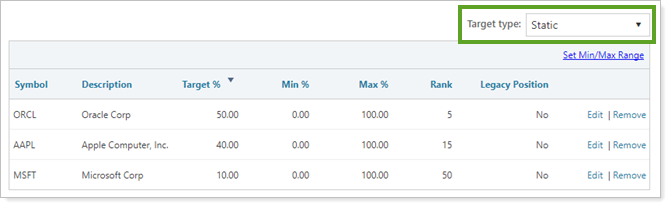

Static Model Example

You create Large Cap Technology as a static Security Level model.

Over time, prices for these securities will change. However, if one of these securities has significant increase or decrease in price, its Target % will remain the same.

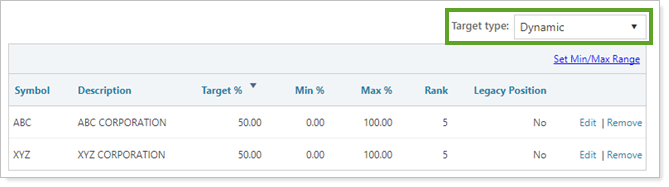

Dynamic Model Example

You create Large Cap Technology as a dynamic Security Level model.

Over time, the prices of ABC and XYZ will change. Because the target is dynamic, the allocations for those securities will adjust based on changes in price. If both ABC and XYZ were priced at $50 a year ago, but their prices became $60 and $40 as of yesterday, Large Cap Technology will adjust accordingly:

| Security | Price 1 Year Ago | Target % 1 Year Ago | Price Today | Target % Adjustment |

|---|---|---|---|---|

| ABC | $50 | 50% | $60 | 60% |

| XYZ | $50 | 50% | $40 | 40% |