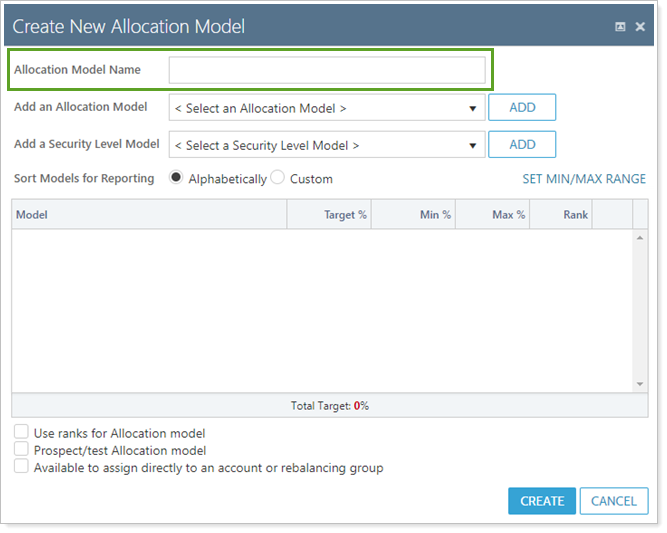

When creating a new Allocation model, Allocation Model Name allows you to enter a unique name for the Allocation model. Use a name that's meaningful to you and others in your firm.

Best Practices

The following best practices will help you name allocation models:

-

Choose a consistent naming convention that works with your overall strategy and other model names.

-

Avoid extra words like model or company branding words in model names to make differentiating your various models easier.

-

Use defining model characteristics like these when naming a model:

-

Risk tolerance (aggressive, moderate, conservative, etc.)

-

Investment type (equity, fixed income, etc.)

-

Target percentages for investment types (80/20, 70/20/10, etc.)

-

Account size (less than $100,000, etc.)

-

A version number if multiple versions of a model exist

-

An example model name might be Aggressive 80/20 Equities - $1 Million +. This shows the risk tolerance, strategy, investment type, and account size of this model at a glance.

Learn More

For more information on creating an Allocation model, see Create, Edit, and Delete Allocation Models.

For more information on basic model concepts, see Learn More About Models.