Cash Invested is amount of cash the investor took out of pocket and put into the asset. It is exclusive of all reinvested income, including dividends and capital gains. Dividends are not included in the calculation because the asset generates the addition to the position—not the investor.

Cash Invested is calculated as:

Purchase price of all buys (including fees) - Sells remove cash invested based on average cash invested per share

Unlike cost basis, the cash invested number is not considered to be an officially recognized number for any reporting standards. It is not a tax number and does not appear on any other forms. It is possible for Cash Invested and Cost Basis to be the same when you have buys and cash income only. However, once you start adding other transactions like sells and reinvested income, these numbers diverge. Cost Basis numbers increase with reinvested dividends, but Cash Invested is unaffected by dividends, reinvested or not.

Cash Invested is not an average—it focuses on the money invested and gained through buys and sells of the position. The result can be a negative number if the gross proceeds of sell transactions are greater than the original purchase amount.

Tamarac Reporting addresses the Cash Invested calculation by using an averaging logic that excludes reinvested lots entirely. Reinvested shares should not be included, as they were not purchased (out of pocket). Reinvested dividends are not included in the numerator of the calculation.

Notes

-

Cash Invested for Cash and Money funds is blank on reports by default. If you want it displayed, contact your Service Team. If displayed, the Cash Invested number for cash securities will always equal the cash balance in the portfolio.

-

Dollar gain is a related calculation, displaying the Current Value of a position minus the Cash Invested. If you are also displaying the Dollar Gain or Percent Dollar Gain calculations with the Cash Invested column, then your Service Team will pair the columns appropriately.

-

When a cost basis reset is processed, it can impact the Cash Invested calculation for some firms. This is because reinvested dividend shares are changed out. To address this issue, the Custodian Lot Adjustment feature can be turned on. For more details about this feature, see Ignore Cost Basis Reset Transactions.

Example

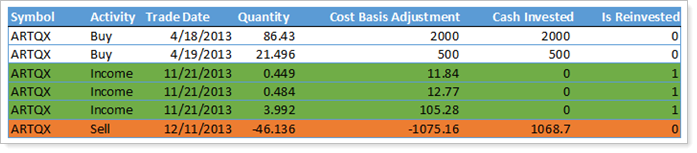

Before Tamarac Reporting can calculate the cash invested for the open lots, it must first calculate it for the sell transactions. Tamarac Reporting calculates the Cash Invested by first calculating an average cash investment:

Average Cash Invested = Total Cost of Shares Bought / Total Shares Held

Based on the example, this is calculated as:

(2000 + 500) / (86.43 + 21.496) = 23.17

Then the sell cash invested is calculated by multiplying the Average Cash Invested by the sell Quantity:

23.17 * -46.14 = -1,068.70

Then, for each of the open lots, the Average Cash Invested is recalculated taking the sell into consideration. (In this case, it's the same)

After the sell transaction, the cash invested is what remains after you remove the sells cash invested:

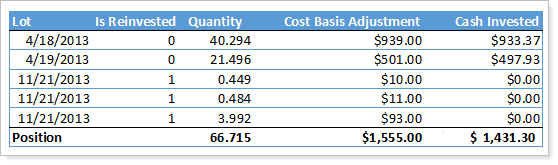

Cash invested is calculated for each open lot by multiplying the average value by the quantity of the lot. This yields the following values: