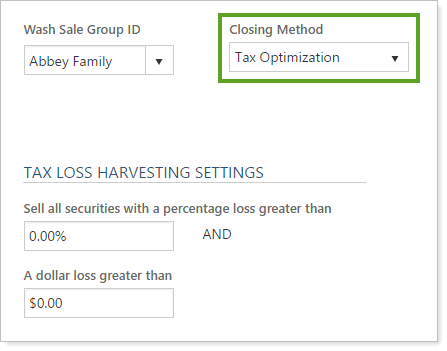

This setting allows you to choose the closing method you'd like to use in this account.

Closing methods allow clients to receive tax benefits at the lot level and the closing method you choose allows you specify how you'd like lots sold in that account. This setting is also used to calculate realized gains and losses when rebalancing an account.

When selecting closing method, be aware that:

-

When using a tax loss harvesting rebalance option—the Tax Loss Harvesting & Rebalance and Tax Loss Harvesting Rebalance rebalance types—the closing method used will automatically be Tax Optimization, regardless of the setting chosen.

-

Closing method is communicated through the "versus purchase" portion of those trade files that support it. Not all trade files support the Tax Optimization closing method.

-

Closing method must be the same at the custodian, in the account's settings, and in your Portfolio Accounting System (PAS).

important

Your established closing method must be the same with your custodian, in the account's settings, and in your Portfolio Accounting System (PAS). Check with the custodian of the account to verify which closing method to use, as some custodians use different names for their closing methods.

The following closing methods are available:

| Option | More Information |

|---|---|

| FIFO |

Tamarac Trading will sell the lots in the order that they were acquired on a first in, first out basis. |

| High Cost |

Tamarac Trading will sell lots with the highest cost basis first. If two or more lots have the same purchase price, the lot with the earliest purchase date is sold first. |

| Tax/Fee Optimization |

Tamarac Trading will assign the lots to one of the following groups based on a count of the number of fees applicable to the lot:

Tamarac Trading will then go through each group—starting with lots with fees—and sell the lots in the following order:

|

| Tax Optimization |

Tamarac Trading will sell lots in the following order:

|