Back

Back

Back Back |

Home > Tamarac Trading > Rebalances and Trades > Start a Rebalance > Tax Loss Harvesting & Rebalance

|

Tax Loss Harvesting & Rebalance

The Tax Loss Harvesting & Rebalance is buy-and-sell type of rebalance where securities in taxable accounts that meet tax loss harvesting thresholds are sold to harvest those losses. After harvesting losses, the rebalance will use the available cash and reinvest it back into the account's model.

This rebalance type can be confused with the Tax Loss Harvesting rebalance. The difference between the two is the reinvestment of available cash. The following table compares these two rebalance types:

| Tax Loss Harvesting Rebalance | Tax Loss Harvesting & Rebalance |

|---|---|

| A sell-only type of rebalance where securities in accounts that meet the tax loss harvesting thresholds set within the accounts are completely liquidated. | A buy-and-sell type of rebalance where securities in taxable accounts that meet the tax loss harvesting thresholds set within the account are sold and the proceeds of those sells, as well as any cash available for trading in the account, are reinvested into the account model. |

For more information on using Tamarac Trading for tax loss harvesting, see:

The Tax Loss Harvesting & Rebalance is used to harvest losses, and then reinvest the cash generated from the sale of losses. First, Tamarac Trading finds the securities with losses in the accounts selected. It then uses available account-level tax loss harvesting thresholds, as well as other system and account-level settings to determine which lots meet the criteria for sale. It then sells those securities and applies the Tax Optimization closing method.

Once cash has been generated in the account, Tamarac Trading uses the same logic as the Buy Only to Invest Cash rebalance to reinvest the cash generated. For the buy side, Tamarac Trading recommends buys for the most underweight security or model first. The Default buy order setting in Rebalancing System Settings dictates the priority of the buy.

The specific tax loss harvesting thresholds are set at the account level, so this rebalance can only be done in taxable accounts where you've set these thresholds. See Applicable Settings for more information on the various settings that affect this rebalance.

During the rebalance, any min/max settings for individual models are ignored.

The Tax Loss Harvesting & Rebalance is useful for quickly harvesting losses across accounts without having to find losses in individual securities or accounts.

This rebalance is not available as an account default.

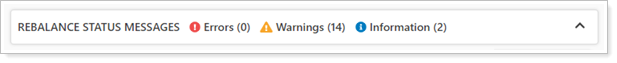

It is important to review any warnings under Rebalance Status Messages on the Rebalance Summary. These warnings let you know about any applicable account, security, or system-level settings.

Tax Loss Harvesting & Rebalance is affected by various settings across the individual account, individual securities, and system-wide settings. The following is a summary of the settings that apply to this rebalancing type:

| Setting | More Information |

|---|---|

|

Choose how Tamarac Trading uses cash during the rebalance. |

|

|

Allows you to define the order in which the rebalance will generate buys. |

|

|

Tells Tamarac Trading how to calculate deviation away from model targets when determining buy and sell order. Absolute deviation uses the absolute calculation of deviation. Relative deviation calculates deviation relative to the parent model's target. |

|

|

| Setting | More Information |

|---|---|

|

When Yes, Tamarac Trading temporarily ignores model ranks and rebalances to your investment targets at the lowest possible tax cost to the client. It will then ignore ranks and sell losses first, followed by securities with no tax consequences, and then finally, it will sell gains. |

|

|

These are ignored in a Tax Loss Harvesting & Rebalance. |

|

|

These are ignored in a Tax Loss Harvesting & Rebalance. |

|

|

This is ignored in a Tax Loss Harvesting & Rebalance. |

|

|

If this is selected, you will not be able to complete the rebalance. |

|

|

The rebalance adheres to account-specific restrictions like Range to Hold and any Buy/Sell Restrictions. |

| Setting | More Information |

|---|---|

|

These are ignored in a Tax Loss Harvesting & Rebalance. |

| Setting | More Information |

|---|---|

|

When using a tax loss harvesting rebalance option, the closing method used will automatically be Tax Optimization, provided the trade file you use supports VSP trading. |

|

|

Set the loss threshold for tax loss harvesting. If both the percentage loss and dollar amount loss thresholds are met, Tamarac Trading will recommend a sell during this rebalance. |

| Setting | More Information |

|---|---|

|

The rebalance adheres to security-specific restrictions like Hold Do Not Trade. |

|

|

The rebalance adheres to security-specific custom settings like Custom round lot or Custom trade price. |