Contents

Introduction

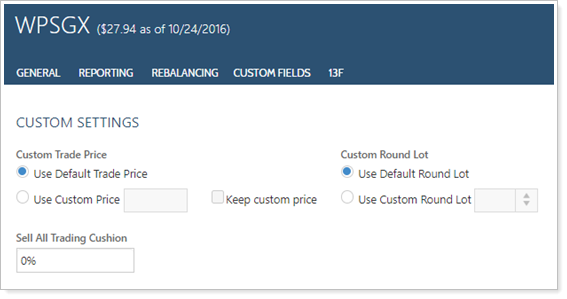

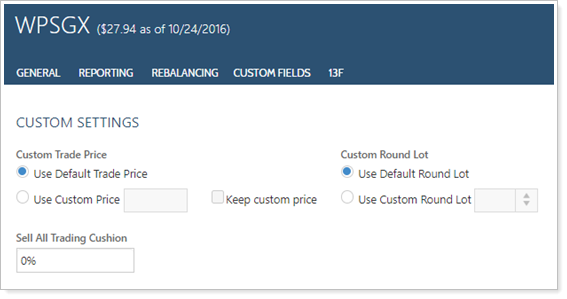

The Custom Settings page allows you to set some custom settings for individual securities, such as a custom trade price for intraday trading and custom round lot. In order to set custom settings, you must first select a security, and then you'll add the custom settings to that security.

To set categories for a security, see Security Categories.

Available Settings

You can set the following custom settings on Custom Settings, available when you click Custom Settings on the Rebalancing tab.

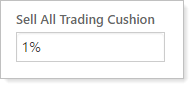

Sell All Trading Cushion %

Enter the percentage amount that will be applied as a fee to the proceeds of the sale in any account that is selling its entire position in that mutual fund. When a mutual fund with this restriction is sold, Tamarac Trading will withhold the fee from the proceeds that are invested in other securities in the model.

The Sell All Trading Cushion does not affect the buy calculation in a linked trade. This setting only applies to mutual funds.

Cash reserves also allow for the reservation of cash to cover fees and allow for more precise trading, as you can sell out of a mutual fund, and any fees can be covered by the cash reserve you set.

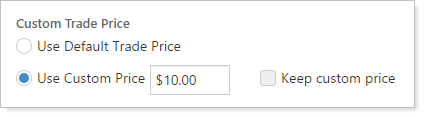

Custom Trade Price

Choose how you would like to adjust a security's trade price for intraday trading by specifying a custom trade price.

When not using this option, Tamarac Trading uses the previous day's closing price for a security or the intraday price, if you have intraday pricing enabled. However, there may be instances where you prefer to update the intraday price of that security, or you may want to trade a security that is priced by a custodian or a third party.

The Custom trade price option allows you to account for market fluctuation and is used primarily when trading ETFs and individual stocks.

The following options are available:

-

Use default trade priceLeave this default option selected to trade using the security's trade price.

-

CustomSelect this option to specify a dollar amount to be used as the trade price of that security. For example, if you enter $10, the security's trade price for today will be $10, regardless of the actual trading price.

-

Keep custom priceSelect this check box to continue to use your specified Custom price in Tamarac Trading until you clear this check box. If this check box is cleared, the trade price will be updated to the most recent trade date's closing price. This option is used primarily for fixed income securities or special securities like private placements that price infrequently.

Important

Don't select Keep custom price until you're certain you want to continue to use the custom price. Accidentally selecting this option could cause you to trade securities at your custom price and not the actual price of the security.

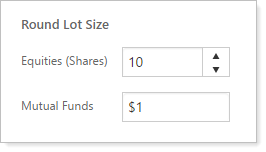

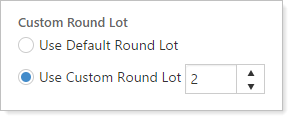

Custom Round Lot

Enter a custom round lot for the security at the global level. This setting allows you to set an incremental number of shares for trades in this security in the number you specify. This is typically used to override an account's round lot setting in order to purchase high cost securities in quantities lower than the account-level round lot setting.

Here's an example of a custom round lot:

In one client's account, the account-level round lot size for equities has been set to 10:

However, you want to purchase ABC, which is a high cost security. You set the Custom round lot for ABC to 2. This means that Tamarac Trading can recommend trades in ABC in increments of 2: 2, 4, 6, etc.

The Custom round lot size of 2 will override the client's account-level setting when Tamarac Trading recommends trades in ABC.

For more information on the account-level round lot setting, see Round Lot Size Setting.

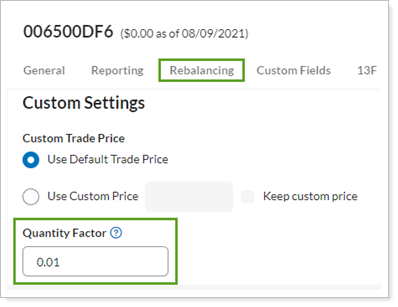

Quantity Factor

When trading fixed income, you may want to use the Quantity Factor security setting to reference a quantity of bonds as the total face value for the client holding. The bond’s market value will not change.

Once you add the appropriate quantity factor for your fixed income securities, you can view and enter share values as face value in trading tools like Quick Trade and Order Blotter.

Enter a factor to apply to bond share quantities on Tamarac Trading pages. We recommend a value of 0.01.

When not using this option, Tamarac Trading calculates bond shares as a reference item with a quantity factor of 1.00.

For more information on the quantity factor security setting, see Quantity Factor.

Configure Custom Settings

To configure custom settings, follow these steps:

-

On the Setup menu, click Securities.

-

Select the security in which you'd like to add the custom settings.

-

Complete any of the available custom settings. For more detailed information about the available settings, see Available Settings.

-

Click Save when finished.