Contents

Introduction

Cash reserves in Tamarac Trading allow you to set aside specific amounts of cash for any cash needs for the client. Cash reserves can be created for one-time or recurring cash needs for the client, such as Required Minimum Distributions (RMDs), DCA security purchases, management fees, taxes, or client expenses.

Cash reserves give you the following benefits:

-

Adherence during Rebalance.Tamarac Trading will always seek to meet cash reserves, plus or minus any thresholds you've established. Because of this, cash reserves are a powerful tool you can use to ensure the client's cash needs are always met.

-

Fewer models.With cash reserves, you don't have to add additional models to account for cash needs.

-

Asset location.Cash reserves can also be used to specify where cash is held in asset location within groups because you can establish cash needs at the individual account level rather than at the group level.

Actions to Avoid

-

Do not add a cash reserve to an SMA because Tamarac Trading will look to raise cash and all cash holdings will be counted towards the SMA's dummy ticker rather than any cash reserves you've set.

-

Do not set cash reserves in accounts where you want to maintain a margin balance.

Cash Reserves in a Rebalance

You can view cash information, including reserve amounts, on the Rebalance Summary. This will give you a fuller picture of reserve cash during the rebalance process.

Rebalance Summary

The Rebalance Summary report shows cash information at the top of the report using the following widgets:

Cash Information Widget

The Cash Information widget gives you an at-a-glance view of valuable cash information you'll need to consider like cash reserve goals, fees, and commissions.

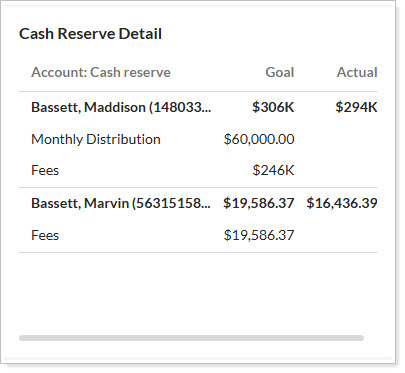

Cash Reserve Detail Widget

The Cash Reserve Detail widget gives you insights into the cash reserves set for the account or group you're viewing. If you're viewing a group, you can see details about any cash reserves set in each underlying account, including goal and actual amounts.

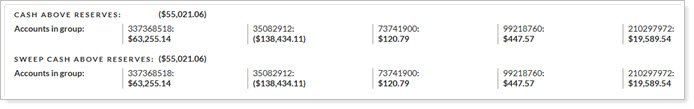

The reserves information section in the Spreadsheet View of the Rebalance Summary gives you the status of your cash reserves.

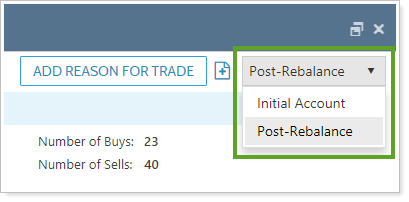

In addition, you can toggle cash information to show initial account or post-rebalance details.

Cash Definitions

When reviewing cash information throughout Tamarac, these are the cash data points you'll see:

| Field | More Information |

|---|---|

|

Cash Above Reserves |

The amount of cash an account has in excess of the cash reserves, calculated as (Total Cash ($) – Cash Reserves Actual). |

| Cash Available for Trading |

The amount of cash that exceeds the cash reserve goal, in addition to any cash above the total cash reserve upper threshold. This amount will be negative if the account needs to raise cash to meet its cash goals and is below the total cash reserve lower threshold. |

|

Cash Reserve Actual |

The amount of cash held in reserves. This can be different from Cash Reserve Goal because of upper and lower thresholds of any cash reserves. |

|

Cash Reserve Goal |

The target amount of cash reserves. This amount reflects the total cash reserves amount set at the account level. |

|

Cash to Raise |

The amount of cash the account needs to raise for cash reserves. This amount doesn't consider model cash, if any. This total can also be seen in Cash Management within the account's settings. |

|

Commission |

The total amount which will be paid to the broker for trades in equities and ETFs. These commissions are set at the account level using Equity Per Trade Commission Setting and Equity Per Share Commission Setting. |

|

Custodian Net Cash |

This is the cash value from the custodian and is available if you have integration with the custodian. |

|

Custodian Transaction Fee |

The total amount of fees which will be charged by the custodian. This is set up on the Fee Schedules page. |

|

Custodian Value |

The account value from the custodian; available if you have integration with the custodian. |

|

Custodian Values Last Updated |

The date when the custodian values were last updated; available if you have integration with the custodian. |

|

Rebalancing Account Value |

The value of the account, excluding any cash reserves. |

|

Sweep Cash Above Reserves |

The excess amount of cash an account has available in an account, including sweep money market cash, calculated as (Total Sweep Cash – Cash Reserves – Cash Substitutes). |

|

T+1 Cash |

The T+1 cash available after a rebalance. This value is calculated as (Initial Cash + Value of Sells settling T+1) – Value of Buys, excluding fees. |

|

Total Account Value |

The total value of the account, including all positions in the account and any cash reserves. |

|

Total Cash |

The total value of cash in the account, including any cash reserves. |

|

Total Redemption Fee |

The total amount that will be charged upon the sale of funds. This is set up on the Fee Schedules page. |

Create a Cash Reserve

To add a cash reserve, follow these steps:

-

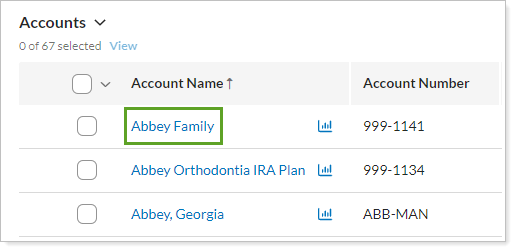

On the Accounts menu, click Accounts.

-

Click the account where you want to add a cash reserve.

-

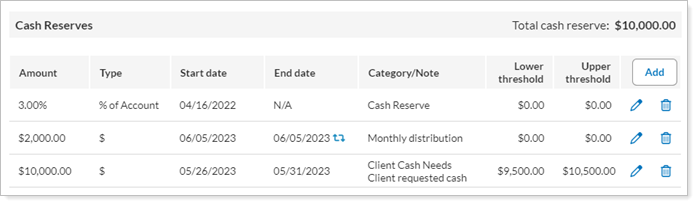

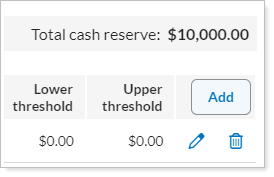

Select Cash Management in the Rebalancing tab.

-

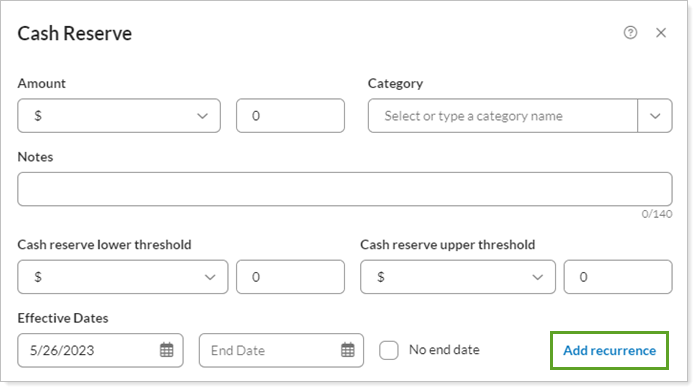

Click Add. This opens the Cash Reserve Settings dialog box.

-

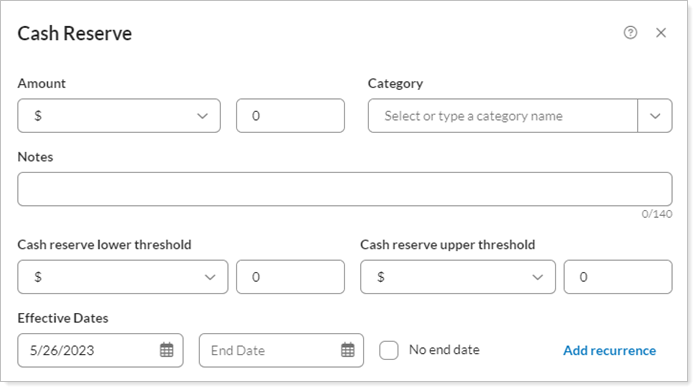

Complete the following information:

Amount

Designate the amount you want set aside for the reserve. Select one of the following to designate the amount:

- $ (used to designate a fixed dollar amount)

- % of Account

- % of Cash

- % of Rebalancing Group

Category

Type the classification for this cash reserve. You can choose any category you want and categories you've used before will automatically populate in the Category list. Examples may include management fee, quarterly taxes, RMD, DCA, etc.

Notes

Add an optional note to add information to the cash reserve. For example, you can specify an RMD date or information about a fee change.

Cash Reserve Lower Threshold

Add an optional lower threshold amount for the cash reserve. This amount is the lowest acceptable cash amount before Tamarac Trading must recommend sells to raise cash.

If the sum of Total Beginning Cash and the Lower Threshold amount is less than the Total Cash Reserve amount, then Tamarac Trading will seek to raise the difference to replenish the reserved amount.

For example, an account has $25,000 in total beginning cash, a $35,000 cash reserve, and a lower tolerance of 25% of the reserve, or $8,750. If you add Total Beginning Cash ($25,000) and the Lower Threshold amount ($8,750), you'll end up with $33,750. This is less than the required Total Cash Reserve amount of $35,000. Therefore, Tamarac Trading will seek to raise the remaining $10,000 so that Total Beginning Cash will be $35,000.

Cash Reserve Upper Threshold

Add an optional upper threshold amount for the cash reserve. This amount is the highest acceptable cash amount before Tamarac Trading must recommend buys to invest excess cash.

If Total Beginning Cash is greater than the sum of the Upper Threshold amount and the Total Cash Reserve, then Tamarac Trading will invest the cash in excess of the Total Cash Reserve amount.

It's best practice to make your upper threshold 0. This allows all investable cash to be traded and prevents excess cash in the account rather than in the market.

Start

Enter the start date for the cash reserve. Click the calendar icon. In the calendar that appears, click the start date for the cash reserves. If you do not specify a start date, the start date will take effect immediately.

End

Enter the "effective to" date for the cash reserve. Click the calendar icon. In the calendar that appears, click the end date for the cash reserves. If you do not specify a date in this box, the cash reserve will always be applied.

Add Recurrence

Click if you want to create a recurring cash reserve. See Recurring Cash Reserves for more information.

-

Click Update.

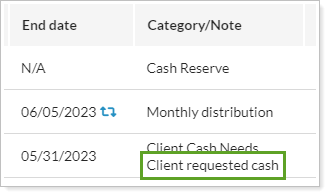

Notes in Cash Reserves

When you add a cash reserve, you can add a note about the cash reserve in the Notes field—for example, you may add a note to let others know that the client needs to take an RMD by a particular date.

You can see the notes you've added for cash reserves when you:

-

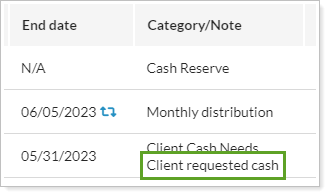

Cash Management.On Cash Management, within the account's settings, the note will appear beneath the name of the category.

-

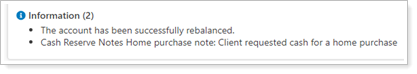

Rebalance an Account.When you rebalance an account, the cash reserve note will appear as a rebalance status message on the Rebalance Summary report.

-

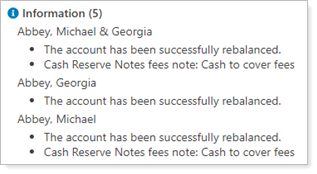

Rebalance a Group. When viewing groups, the cash reserve note will appear for all underlying accounts.

For more information on notes, see Overview of Notes in Tamarac Trading.

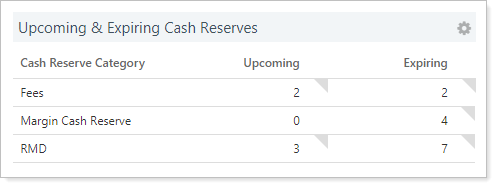

Cash Reserves on the Dashboard

The Upcoming & Expiring Cash Reserves widget shows a list of all upcoming or expiring cash reserves, along with their corresponding categories, for the date range you specify. You can view underlying accounts immediately without navigating away from the dashboard, or add page links to customize the widget.

You can also adjust the My Information widget to either include or exclude cash reserves as part of your AUM calculation.

Applicable Settings

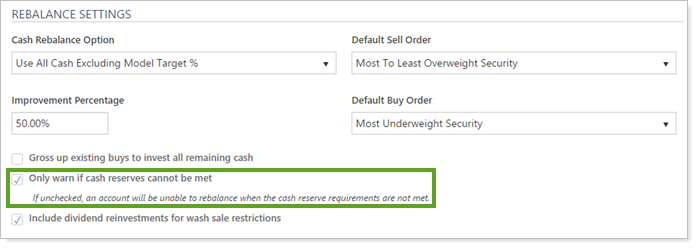

The Rebalance Settings on the Rebalancing System Settings page allow you to change how you ware warned about cash reserves during a rebalance using the Only warn if cash reserves cannot be met option. When you select this option, Tamarac Trading only warns you during a rebalance if cash reserves cannot be met. If you clear this option, Tamarac Trading prevents a rebalance if cash reserves cannot be met.

For more information on this setting, see Rebalance Settings.

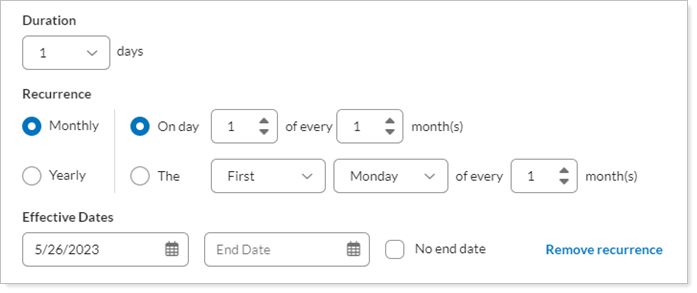

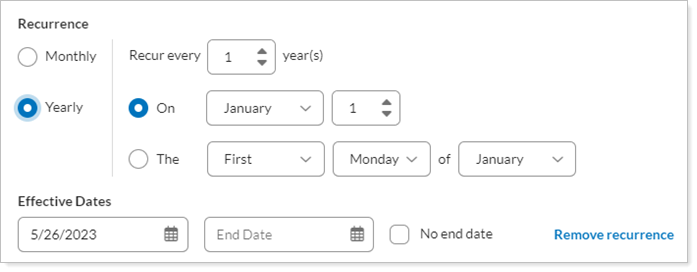

Recurring Cash Reserves

When creating a cash reserve, you can add a recurrence. Before setting up a recurring cash reserve, keep these details in mind:

- Tamarac Trading won't adjust recurrences if they occur on weekends, so verify that dates occur on days where trading can take place.

- Recurring cash reserves don't reserve cash between duration.

It's best practice to use recurring cash reserves if the recurrence is quarterly or less frequent.

To create a recurring cash reserve, follow these steps:

-

Create a new cash reserve and fill in the required fields for the cash reserve.

-

On the Cash Reserve Settings dialog box, click Add recurrence.

-

Choose Monthly or Yearly for the recurrence period.

-

Complete the following if you chose Monthly recurrence:

Duration

Choose the number of days for which you want to keep the cash reserves and Tamarac Trading will keep the cash reserves until midnight of the last day of the duration period you choose.

Recurrence Type

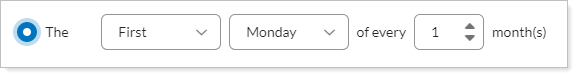

Choose your preferred recurrence type:

-

By dateChoose the date during the month and the monthly duration period.

-

By dayChoose the day of the month and the monthly duration period.

Start

Enter the start date for the cash reserve. Click the calendar icon. In the calendar that appears, click the start date for the cash reserves. If you do not specify a start date, the start date will take effect immediately.

End

Enter the "effective to" date for the cash reserve. To choose a specific date, click the calendar icon. In the calendar that appears, click the end date for the cash reserves. If you do not specify a date in this box, the cash reserve will always be applied.

To keep the recurrence going forever, choose No end date.

-

-

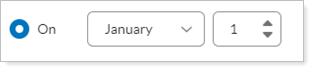

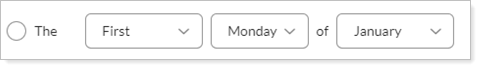

Complete the following if you chose Yearly recurrence:

Duration

Choose the number of days for which you want to keep the cash reserves and Tamarac Trading will keep the cash reserves until midnight of the last day of the duration period you choose.

Recurrence Type

Choose your preferred recurrence type:

-

By dateChoose the date during the year.

-

By dayChoose the day of the month.

Start

Enter the start date for the cash reserve. Click the calendar icon. In the calendar that appears, click the start date for the cash reserves. If you do not specify a start date, the start date will take effect immediately.

End

Enter the "effective to" date for the cash reserve. To choose a specific date, click the calendar icon. In the calendar that appears, click the end date for the cash reserves. If you do not specify a date in this box, the cash reserve will always be applied.

To keep the recurrence going forever, choose No end date.

-

-

Click Update.

Cash Column Definitions

The following definitions may help you differentiate various cash reserves columns and fields you see in Tamarac Trading :