Back

Back

Back Back |

Home > Tamarac Trading > Setup and User Management > Rebalancing System Settings > Rebalancing System Settings: Rebalance Settings

|

Rebalancing System Settings: Rebalance Settings

|

Gross Up Existing Buys to Invest All Remaining Cash Only Warn if Cash Reserves Cannot Be Met |

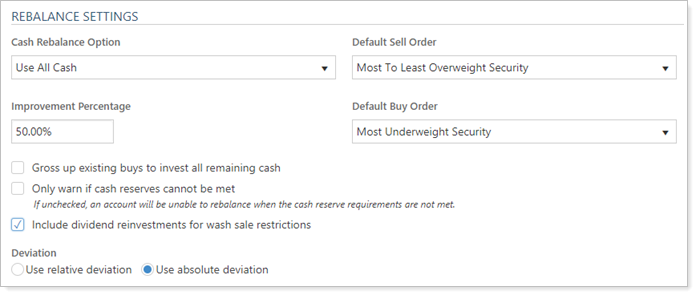

The Rebalance Settings allow you to customize how Tamarac Trading adheres to logic during a rebalance and how it calculates information during that process. These settings are widely applicable to many different rebalance types.

The following settings are available under the Rebalance Settings heading on the Rebalancing System Settings page.

Choose one of the following:

| Setting Option | More Information |

|---|---|

| Use All Cash Excluding Model Target % |

Tamarac Trading tracks cash for the overall group and prevents cash from being overspent, based on your model allocation. Once the cash target is reached, Tamarac Trading no longer makes any buy recommendations. This setting is ignored for directed trades using the Rebalancing Group Value option.

|

| Use All Cash |

Tamarac Trading is not restricted to holding model cash and can invest all cash down to the minimum for cash within the model. This can occur if other positions can't be sold to generate cash to invest proceeds into underweight securities. |

Choose one of the following:

| Setting Option | More Information |

|---|---|

| Least to Greatest Realized Gains |

Sell order is determined in this order:

For tax-deferred accounts, securities are sold from most to least overweight. Restricted securities are removed from consideration. |

| Most to Least Overweight Security |

Sell order is determined in this order:

Restricted securities are removed from consideration. |

Choose one of the following:

| Default Buy Order | More Information |

|---|---|

| Most Underweight Security |

This option prioritizes underweight securities when determining buy order. Buy order is determined in this order:

|

| Most Underweight Security from Most Underweight Security Level Model |

This option respects deviation in underweight Security Level models first when determining buy order. Buy order is determined in this order:

|

| Most Underweight Security from Most Underweight Model |

This option respects deviation at higher-level tiers when determining buy order. Buy order is determined in this order:

|

| Highest to Lowest Rank from Underweight Model |

This option respects ranks you've set for your models, regardless of whether those models use ranks or not. Buy order is determined in this order:

|

Type any number from 0% to 100%.

Improvement Percentage gives you control over the trades recommended. Tamarac Trading will only recommend a trade if the overall improvement produced by that trade is equal to or better than the Improvement Percentage.

Tamarac Trading sets the default improvement percentage to 50%, meaning that the ending result of a trade must reduce the overall deviation from the security's target by 50% or better.The larger the improvement percentage, the more trades the system can recommend as there is a wider range to meet. A smaller improvement percentage becomes more restrictive and could recommend few trades as there is a more narrow range to meet.

A client currently holds 3% of his account in MSFT. The target for MSFT is 5%, so MSFT is underweight. Improvement Percentage is set at 50%

During a rebalance, Tamarac Trading would ideally buy another 2% in MSFT to bring the security to its 5% target, but first needs to determine if a recommended buy would meet the requirement of the Improvement Percentage setting. Here's how this is determined:

Initial Deviation of 2% ✕ Improvement Percentage of 50% =

Trade must be within 1% of the target of 5% for a trade to be recommended.

With this in mind, a buy for MSFT in this client's account must bring the final position to between 4% and 6% of the account to be recommended.

If you changed Improvement Percentage to 25%, here's how Tamarac Trading would determine if MSFT becomes a recommended trade:

Initial Deviation of 2% ✕ Improvement Percentage of 25% =

Trade must be within 0.5% of the target of 5% for a trade to be recommended.

With this in mind, a buy for MSFT in this client's account must bring the final position to between 4.5% and 5.5% of the account to be recommended.

In most cases, we recommend not using this feature.

Select or clear this option:

| Setting Option | More Information |

|---|---|

| Selected | Tamarac Trading buys up to model goals. If there is cash left over, it will put cash to work in already existing buys, potentially buying above model target. If there is a restriction on a security and you have cash remaining, Tamarac Trading will buy other securities instead of the restricted security. |

| Cleared | Tamarac Trading only buys up to model goals. If there is cash left over, it will not be used to purchase securities already at their model targets. |

Select or clear this option:

| Setting Option | More Information |

|---|---|

| Selected | Tamarac Trading only warns the user during a rebalance if cash reserves cannot be met. |

| Cleared | Tamarac Trading prevents a rebalance if cash reserves cannot be met. This is the more restrictive option. |

Select or clear this option:

| Setting Option | More Information |

|---|---|

| Selected | Tamarac Trading will include dividend reinvestments in its lists of transactions to consider when determining which transactions would violate the wash sale rule. |

| Cleared | Tamarac Trading will not include dividend reinvestments in its list of transactions to consider when determining which transactions would violate the wash sale rule. |

Choose one of the following:

| Setting Option | More Information |

|---|---|

| Use relative deviation | When calculating recommended trades, relative deviation calculates deviation relative to the parent model's target. |

| Use absolute deviation | When calculating recommended trades, absolute deviation uses the absolute calculation of deviation. |

You have a Fixed Income model that's holding 45% and a Large Cap model that's holding 6%. The target for Fixed Income is 50% and the target for Large Cap is 10%, so both models are underweight.

The account has excess cash, so you perform a Buy Only to Invest Cash rebalance on the account:

If using absolute deviation, Tamarac Trading will buy in Fixed Income because it has a larger absolute deviation.

If using relative deviation, Tamarac Trading will buy in Large Cap because it has a larger relative deviation.

Model Current Target Absolute Deviation Relative Deviation Fixed Income 45% 50% 5% 10% Large Cap 6% 10% 4% 40%