Contents

|

Set Up an Annual Capital Gains Tax Budget |

Introduction

For many advisors, managing tax implications is an essential part of the trading process. There are numerous studies that indicate that, next to inflation, taxes remain the biggest drain on a portfolio as taxes can reduce returns by up to one percent per year.

To assist with managing tax implications in a portfolio, you can use the annual capital gains tax budget to track the amount of capital gains taxes realized year to date and compare it with the maximum allowable capital gains tax amount.

Once you've set up short-term and long-term tax rates and an annual capital gains tax budget, you can:

-

Proactively plan trade strategies by adding rebalance workflow page columns that display the amount of capital gains realized, the budgeted amount, and the percentage of the budget used for each account or group.

-

See warnings on the Rebalance Summary page when a proposed rebalance would exceed the capital gains budget.

-

Export the capital gains budget data in bulk for further analysis.

With these tools, you have everything you need to implement targeted trading strategies that optimize for each account or group's current capital gains situation.

Example

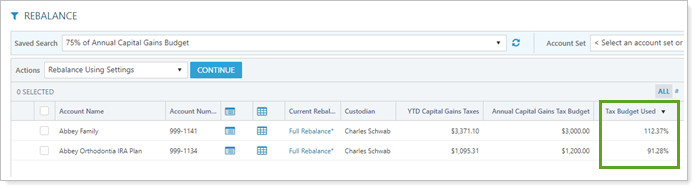

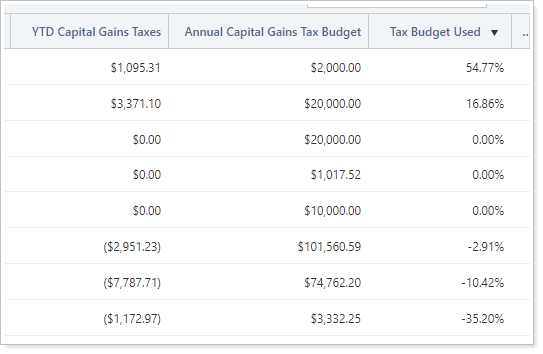

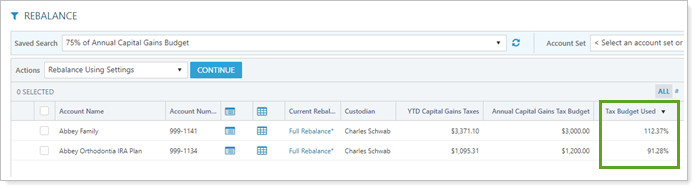

In October, you use a saved search filter to see all the groups that are at greater than or equal to 75% of their tax budget. With this list available, you know exactly how much leeway you have for realizing gains in the future for each account. You can quickly see that some accounts have already met or exceeded their capital gains tax budget for the year, and you may try to offset those gains in future rebalances.

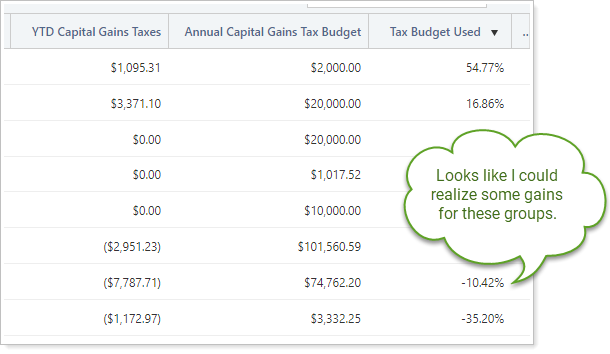

On the other hand, you could also evaluate groups that have negative capital gains—that is, that have incurred losses—and strategically offset the losses by realizing gains when you rebalance those groups in the future.

Creating an annual capital gains tax budget will not prevent a rebalance if the budget is exceeded; it just provides a way to track the budget and see warnings to help you make tax-aware investing decisions.

Note that the capital gains tax budget does not affect the current Maximum Gain Amount setting, which will still limit the amount of gains a rebalance can recommend.

Create Specific Tax Budgets

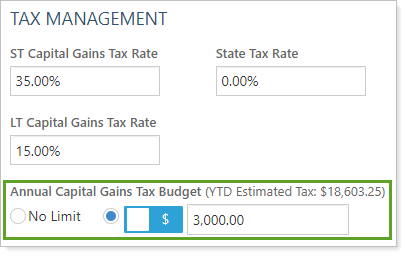

Tamarac calculates an expected tax bill for an account or group by tracking year-to-date short-term and long-term gains and short-term and long-term gains realized in the current rebalance, then subtracting the respective carryover amounts. This allows you to track short-term and long-term gains using the same budget.

However, the budget tool is flexible enough to track only short-term or long-term gains, depending on your needs. This method involves strategically configuring the short-term and long-term capital gains tax rates so the budget tool output displays the specific gains you're interested in. For example, if you only want to see the long-term capital gains tax incurred so far this year, you enter 0% in ST Capital Gains Tax Rate and enter the client's long-term gains tax rate in LT Capital Gains Tax Rate. With this configuration, the value shown in the YTD Capital Gains Taxes column will reflect only the long-term capital gains tax incurred year to date, and the value entered in the Annual Capital Gains Tax Budget will apply only to long-term gains.

The following are strategies for configuring the ST Capital Gains Tax Rate and LT Capital Gains Tax Rate values to create specific tax budgets.

| Desired tax Budget | ST Capital Gains Tax Rate value | LT Capital Gains Tax Rate value |

|---|---|---|

| Capital gains tax | The client's short-term tax rate | The client's long-term tax rate |

| Long-term gains tax only | 0% | The client's long-term tax rate |

| Short-term gains tax only | The client's short-term tax rate | 0% |

| Long-term capital gains | 0% | 100% |

| Short-term capital gains | 100% | 0% |

Set Up an Annual Capital Gains Tax Budget

You can set up an annual capital gains tax budget for accounts, groups, or both. Non-taxable accounts are not monitored for tax budgets. Group tax budgets exclude non-taxable account values. Individual tax budgets take precedence over group tax budgets if you configure a tax budget at both levels.

For steps, see Set Up an Annual Capital Gains Tax Budget.

Tax Budget Tracking Tools

Use the following tools to monitor the amount of capital gains taxes realized for accounts and groups.

Rebalance Workflow Page Columns

Add the following columns to the Rebalance, Trade List, and Rebalance Review pages:

- YTD Capital Gains Taxes: Value updated daily in Tamarac.

- Annual Capital Gains Tax Budget: The amount you set in the Annual Capital Gains Tax Budget. This is always displayed as a dollar value. If you enter a percent for the budget, the dollar value is calculated based on the rebalancing group's taxable value.

- Tax Budget Used: Calculated as YTD Capital Gains Taxes ÷ Annual Capital Gains Tax Budget.

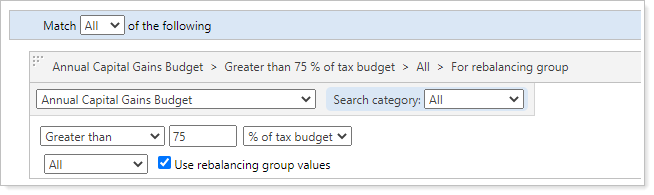

Saved Search Filter

Create a saved search that includes Annual Capital Gains Budget as one of the filters.

When you apply this saved search to a rebalance workflow page, you can quickly filter the page based on the percentage of tax budget met.

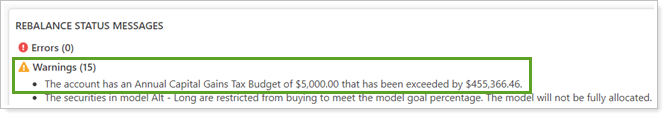

Rebalance Warnings

On the Rebalance Summary page, see warnings for an account or group that exceeds the annual capital gains tax budget amount. The warning includes the budgeted amount and how much the proposed rebalance exceeds it by. Even if a proposed rebalance triggers an annual capital gains tax warning, the warning will not prevent the rebalance.

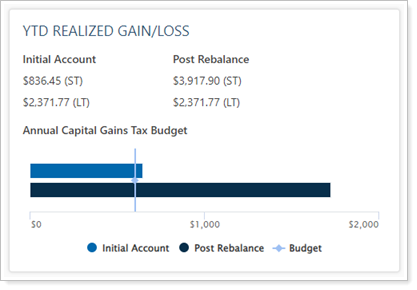

Rebalance Summary

The Rebalance Summary page offers a way to see the capital gains tax budget for an account or group at a glance. On the YTD Realized Gain/Loss widget, you'll see a graph of positive capital gains values compared to the value entered in the Annual Capital Gains Tax Budget setting. This chart gives you an at-a-glance view of capital gains taxes for the year to help you make tax-aware trading decisions.

When viewing this widget, you won't see a chart in the following circumstances:

- When viewing a non-taxable account or a group without any taxable accounts.

- If there is no capital gains tax budget set for the account or group you're viewing.