Contents

|

Set Annual Capital Gains Budget for an Account or Group Set Annual Capital Gains Budget for Many Accounts or Groups at Once |

Introduction

One way you can use Tamarac for tax loss harvesting is to create an annual capital gains tax budget to track the amount of capital gains taxes realized year to date and compare it with the maximum allowable capital gains tax amount.

You can set up an annual capital gains tax budget for accounts, groups, or both. Non-taxable accounts are not monitored for tax budgets. Group tax budgets exclude non-taxable account values.

This page provides steps for how to set up an annual capital gains tax budget. For more information about capital gains tax budgets, see Using the Annual Capital Gains Tax Budget.

Set Annual Capital Gains Budget for an Account or Group

To set up the capital gains budget for one or more accounts:

-

On the Accounts menu, click Accounts.

-

Click the account you want to edit.

If you're editing multiple accounts, select the check box next to each account and, in the Actions menu, click Edit.

-

On the Rebalancing tab, click Tax Management.

-

Configure the following settings:

-

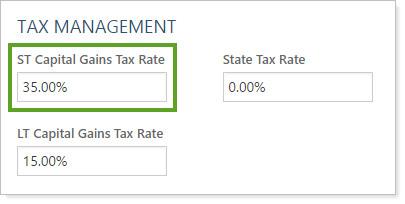

ST Capital Gains Tax Rate: Enter the desired rate for the account.

-

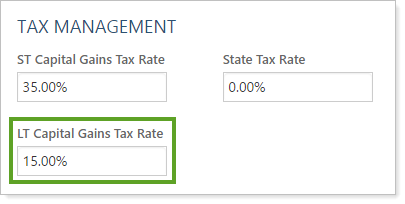

LT Capital Gains Tax Rate: Enter the desired rate for the account.

-

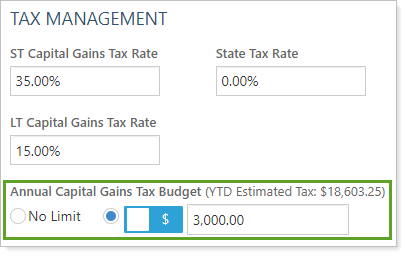

Annual Capital Gains Tax Budget: Enter the desired rate for the account or group.

If you haven't previously configured tax rates, get started quickly by setting all clients to the same short-term and long-term rates and all accounts or groups to the same budget percentage—for example, 1%.

-

-

Click Save.

Set Annual Capital Gains Budget for Many Accounts or Groups at Once

To update these values for many accounts or groups at once:

-

On the Reports menu, under Global Reports, click Bulk Reports.

-

Create an Account Information bulk report.

-

Under Available columns, add at least the following to the Selected columns list:

- Upload Account ID

- Annual Capital Gains Tax Budget

- Annual Capital Gains Tax Budget Value Type

-

Run the bulk report. For more information, see Run a Bulk Report to Export Data in Bulk.

-

On your computer, configure the following columns in the exported CSV file:

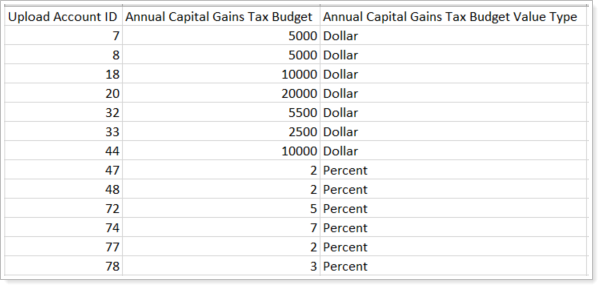

- Annual Capital Gains Tax Budget: Enter number that is the dollar amount or percent value.

- Annual Capital Gains Tax Budget Value Type: Enter either Dollar or Percent.

Note that every row in the upload must have data in these two columns. Any row where the columns are not populated will cause an upload error.

-

Upload the data into Tamarac using an Account Information upload data set. For more information, see Upload Bulk Data.

Review the Capital Gains Tax Budget During a Rebalance

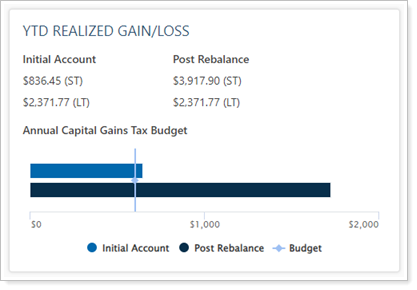

The Rebalance Summary report offers a way to see the capital gains tax budget for an account or group at a glance. On the YTD Realized Gain/Loss widget, you'll see a graph of positive capital gains values compared to the value entered in the Annual Capital Gains Tax Budget setting. This chart gives you an at-a-glance view of capital gains taxes for the year to help you make tax-aware trading decisions.

When viewing this widget, you won't see a chart in the following circumstances:

- When viewing a non-taxable account or a group without any taxable accounts.

- If there is no capital gains tax budget set for the account or group you're viewing.