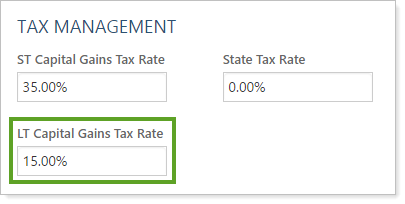

This setting allows you to specify the account's long-term capital gains tax rate. If you track an annual capital gains tax budget, this setting works with the Annual Capital Gains Tax Budget setting as part of the estimated annual capital gains calculation.

The following are some possible ways to set up the ST Capital Gains Tax Rate and LT Capital Gains Tax Rate values to create specific tax budgets.

| Desired tax Budget | ST Capital Gains Tax Rate value | LT Capital Gains Tax Rate value |

|---|---|---|

| Capital gains tax | The client's short-term tax rate | The client's long-term tax rate |

| Long-term gains tax only | 0% | The client's long-term tax rate |

| Short-term gains tax only | The client's short-term tax rate | 0% |

| Long-term capital gains | 0% | 100% |

| Short-term capital gains | 100% | 0% |

For more information on annual capital gains, see Using the Annual Capital Gains Tax Budget.