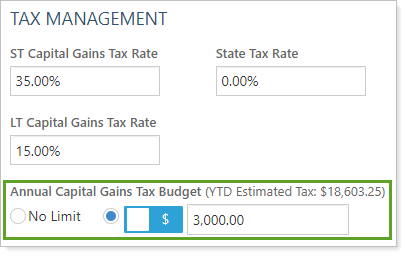

Use this account setting to set a maximum allowable amount of annual capital gains tax for the account or group. This setting uses the ST Capital Gains Tax Rate and LT Capital Gains Tax Rate fields to estimate the year to date taxes incurred by the annual short-term and long-term gains and by the proposed rebalance. Configuring this setting to create an annual capital gains tax budget will not prevent a rebalance if the budget is exceeded; it just provides a way to track the budget and see warnings to help you make tax-aware investing decisions.

For groups, find this setting on the Rebalancing tab. For accounts, find this setting on the Rebalancing tab under Tax Management.

You can choose:

-

No Limit.Choose No Limit to not set annual capital gains budget for the account or group. Because you have not set an annual capital gains budget, the capital gains tax budget columns will be blank and you will not see any warnings on rebalance workflow pages.

-

% amount.Choose % to enter a value that is a percentage of total rebalancing group or account value. For example, if a rebalancing group has a total value of $1,000,000 and you enter 1%, the annual capital gains tax budget would be $10,000.

You can enter a minimum of 0% up to a maximum of 100%.

-

$ amount.Choose $ to enter the maximum desired capital gains tax amount in dollars. For example, if you enter $10,000, the annual capital gains tax budget would be $10,000.

You can enter a minimum of $0 up to a maximum of $999,999,999,999.

Note that the capital gains tax budget does not affect the current Maximum Gain Amount setting, which will still limit the amount of gains a rebalance can recommend.

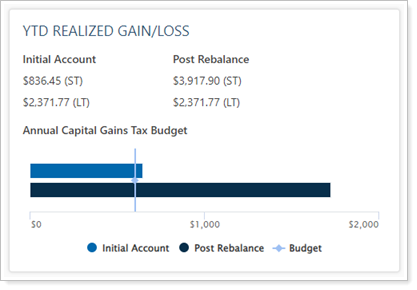

Rebalance Summary

On the Rebalance Summary, you can view the value entered in this setting to initial and post-rebalance capital gains tax values in a chart. You'll be able to see this for rebalanced taxable accounts and groups that contain at least one taxable account.

Permissions

Administrators see this setting by default. To allow other users to see this setting, add the Accounts | Edit annual capital gains tax budget settings permission to the role.

Edit in Bulk

To configure these settings for multiple accounts at once, use an Account Information upload data set. In the data set, the following columns allow you to configure tax budgets in bulk:

-

Annual Capital Gains Tax Budget: Enter the number value you want to set as the budget.

-

Annual Capital Gains Tax Budget Value Type: Choose Dollar or Percent to set the budget amount to a dollar value or a percentage amount.

Learn More

For more information about updating data in bulk, see Upload Bulk Data.

For more information about capital gains budgeting, see Using the Annual Capital Gains Tax Budget.