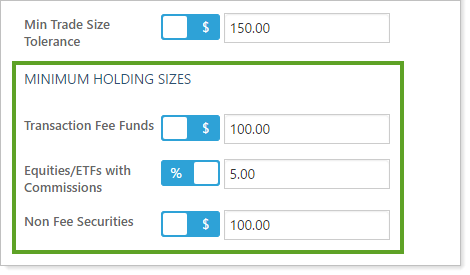

Minimum Holding Sizes settings allows you to set the minimum amount you'd like to hold in the listed security types on an account-by-account basis. These settings apply to all securities held in the account; a rebalance in the account can cause a recommendation to liquidate a security if the resulting trade would cause the security to fall under the minimum holding size.

You can specify these amounts as either a dollar amount or percent of account value.

Enter a dollar or percent of account value for each security type:

| Setting | More Information |

|---|---|

| Transaction Fee Funds |

Enter a dollar or percentage value for the minimum holding size you'll allow for mutual funds that are transaction fee funds.

To designate a mutual fund as a transaction fee fund, see Trade File Group Settings. |

| Equities/ETFs with Commissions |

Enter a dollar or percentage value for the minimum holding size you'll allow for any equities and ETFs subject to a trading commission. |

| Non Fee Securities |

Enter a dollar or percentage value for the minimum holding size you'll allow for mutual funds that do not have transaction fees and ETFs that do not have commissions.

Also included in this category are bonds, LPs, private placements, and separately managed accounts. |

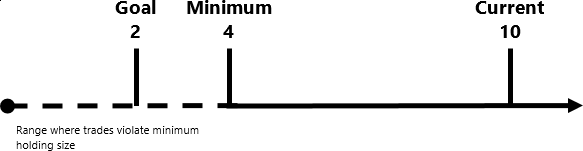

Minimum holding sizes ensure an account holds an amount equal to or greater than the minimum holding size for new purchases and sells of existing positions. Consider this example: A client account currently holds 10% in AAPL. The goal is 2%, so the client is overweight AAPL. Currently, the client's Equities/ETFs with Commissions minimum holding size is set at 4%.

In this scenario, Tamarac Trading would recommend a sell of AAPL to 4%, not to the 2% goal. This will satisfy the minimum holding size setting.

Minimum Holding Size Exceptions

Minimum holding sizes are ignored during a Tax Loss Harvesting rebalance and the Tax Loss Harvesting and Rebalance.

Minimum holding sizes are ignored when using cash substitutes.