Contents

|

Best Practices for the Advisor Available Settings and Settings Logic Determine Your Tax Loss Harvesting Thresholds |

Introduction

For many advisors, tax loss harvesting is the single most important tool they have in their arsenal for reducing taxes on behalf of their clients. There are numerous studies that indicate that, next to inflation, taxes remain the biggest drain on a portfolio as taxes can reduce returns by up to one percent per year.

Tamarac Trading offers options for tax loss harvesting and tax management which are outlined below. For more information on the specific actions you can take within Tamarac Trading for tax loss harvesting and tax management, see Using Tamarac Trading for Tax Loss Harvesting and Using the Annual Capital Gains Tax Budget.

Tax Management Benefits

Tax loss harvesting can reduce an investor's taxes. Although tax loss harvesting can't restore losses, it presents opportunities to increase the return in a client's account. As with any advice about taxes, please consult a tax professional for specific advice on tax management.

Investor Benefits

Tax-managed investing provides the following benefits to the investor:

-

Taxes can bring down averages by 75 to 100 basis points per year. Tax-advantaged investing may add roughly 60 basis points of after-tax alpha per year.

-

When investment losses are harvested, this triggers reductions in the client's tax bill and delivers a reliable and measurable tax alpha for the client's after-tax return.

-

By realizing losses, over a 25 year period, portfolios can add about 27 percent to a typical buy-and-hold strategy in typical market conditions.

Advisor Benefits

Tax-managed investing provides additional benefits to the advisor as well:

-

Tax loss harvesting can increase the depth of relationships with clients. The strategy can allow you to consider all of the client's investments rather than just the assets that you are currently managing.

-

Harvesting losses can offset gains generated outside of a client's portfolio. For example, harvesting losses can offset income such as gains from the sale of real estate.

-

Tax loss harvesting can bring about referrals from custodians, CPAs, attorneys, etc.

Best Practices for the Advisor

-

If the long-run return of the retained asset is at least 90 percent of the security considered for replacement, then the taxable investor is ahead of the game by retaining that stock.

-

Proactively monitor mutual fund capital gain distributions and avoid buying them prior to record date.

-

Use directed trades to sell out of securities that have upcoming distributions.

Available Settings and Settings Logic

The following is a summary of the settings available within Tamarac Trading that affect tax management. You can adjust these settings to fit your needs and specific strategies.

Rebalancing System Settings

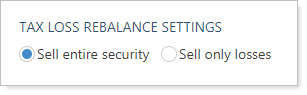

On the Rebalancing System Settings page, you can choose one of these Tax Loss Rebalance Settings which will then apply to all accounts:

-

SELL ENTIRE SECURITYWhen you select this option, Tamarac Trading will sell out of a position that has surpassed the loss threshold you've specified at the account level.

-

SELL ONLY LOSSESWhen you select this option, Tamarac Trading will sell only the lots that have incurred losses for the security which are beyond the loss threshold you've specified, and will not sell the lots that do not meet the loss criteria or that have gains.

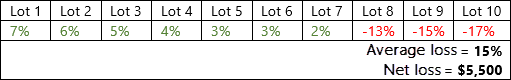

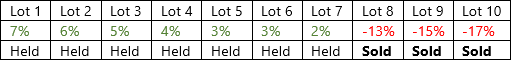

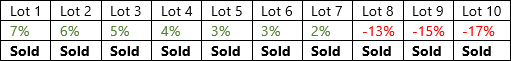

For example, a client's tax loss harvesting thresholds are 15% and $5,000. The client has a security with 10 lots. Seven of those lots have gains and three have losses, and the average loss and net loss surpass the account thresholds:

-

With the Sell only losses option selected, when you perform a Tax Loss Harvesting rebalance, only the three lots with losses will be sold. The losses on the individual lots do not need to meet the loss threshold, only the average of losses for the security:

-

With the Sell entire security option selected, when you perform a Tax Loss Harvesting rebalance, all 10 lots of the security will be sold:

Account Settings

When changing the account-level settings for existing accounts or opening new accounts, you can change the following settings for tax optimization:

| Setting | What it Does |

|---|---|

| Sell Based on Tax Optimization |

Sell securities in the most tax efficient way possible. When you select Yes, Tamarac Trading will rebalance to your investment targets at the lowest possible tax cost to the client. |

| Closing Method |

Closing methods allow clients to receive tax benefits at the lot level and the closing method you choose allows you specify how you'd like lots sold in that account. This setting is also used to calculate realized gains and losses when rebalancing an account. |

| Asset Location Preferences |

Specify where assets will be placed in a group during the rebalance process. This is a useful tool because it can mean more tax-advantaged placement of assets and potentially higher returns because of reduced tax burden. |

| Tax Loss Harvesting Settings |

Use the Sell all securities with a percentage loss greater than field to set a percentage of loss value compared to the total position value. Use the A dollar loss greater than field to set a specific dollar amount of loss. Securities will be recommended for sale in a tax loss harvesting rebalance if they meet these two thresholds. |

| Annual Capital Gains Tax Budget |

Set the desired maximum annual capital gains tax amount for an account or group. This setting is used in the annual capital gains tax budget tool in combination with realized gains/losses fields and capital gains tax rates. |

| Realized Gains and Losses fields |

The realized gains/losses on the Tax Management panel are synced with the information that appears in Tamarac Reporting. If you don't use Tamarac Reporting, these fields can still be uploaded using the Account Information upload. These fields are used in the annual capital gains tax budget. |

| ST Capital Gains Tax Rate |

Set the account's short-term capital gains tax rate. This field is used in the annual capital gains tax budget. |

| LT Capital Gains Tax Rate | Set the account's long-term capital gains tax rate. This field is used in the annual capital gains tax budget. |

Determine Your Tax Loss Harvesting Thresholds

On an account-by-account basis, you can define the minimum size of loss you are willing to realize before tax loss harvesting. Many firms choose to only define a loss threshold in dollars and leave the percentage at zero.

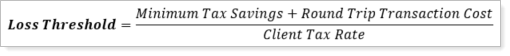

Loss threshold is generally arrived at based on the round trip cost, the minimum tax savings, and the client's tax rate. You can use this calculation as a general rule of thumb to start with:

Use the percentage loss field in Tax Loss Harvesting settings to avoid realizing a small loss and selling a very large sized position. For example, a client's account may have a $2,000 loss in a security, but may get a recommendation to sell a large position of 15,000 shares just to realize this relatively small loss.

Restore Accounts Back to Their Models

After harvesting losses in accounts, you may find those accounts need to be rebalanced to be brought back to their model allocations. In some cases, you may have excess cash in the account. Depending on your strategies, you can use these tactics in Tamarac Trading to reinvest excess cash and restore accounts back to their models.

Track and Use Excess Cash

After harvesting losses, you can reinvest cash back into your clients' models using a saved search or create a custom field to track accounts with tax loss harvesting activity that also have excess cash:

-

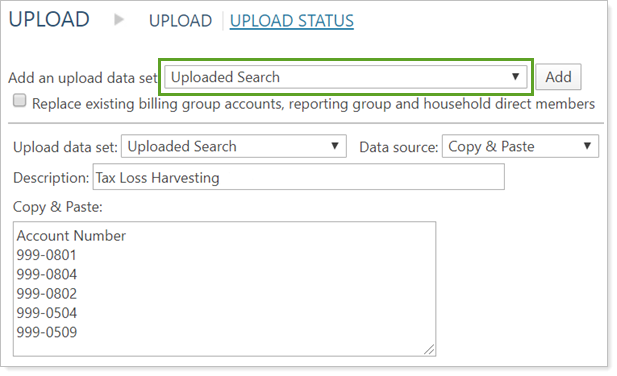

Uploaded Saved Search Method.Track accounts with excess cash as a result of tax loss harvesting by going to the Upload page and creating an Uploaded Search saved search. Upload a list of the accounts with excess cash. You can then use that saved search for future trading activities.

-

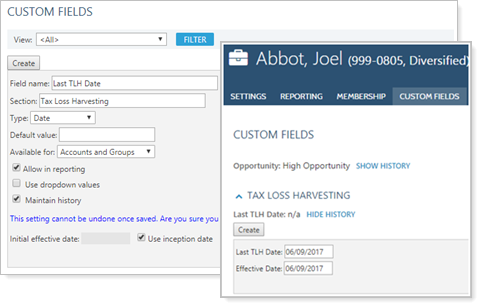

Custom Field Method.Create a custom field to track accounts where you have excess cash as a result of tax loss harvesting. Then, in the account's settings, you can track information about the tax loss harvest, such as the date. For example, you can create the Last TLH Date custom field to track tax loss harvesting dates within accounts and groups.

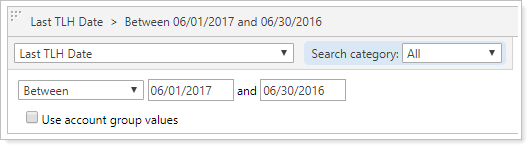

Once you create a custom field, you'll also find a corresponding saved search filter based on that custom field. You can use that filter in saved search to find accounts that were tax loss harvested within a specific time period. This allows you to identify accounts that may have excess cash to invest.

You can track excess cash by putting the cash into reserve. This prevents the cash from being reinvested during the rebalance process. After 31 days, you can then remove the cash from reserve and reinvest into the same security.

Immediately Reinvest

If you want to ensure that cash is immediately reinvested into the account, you have these options:

-

Remove the securities being sold for their losses from clients' models and then run a rebalance. This will get accounts back into their models.

-

You can reinvest into equivalent securities. Immediately purchasing a similar security avoids a wash sale but puts cash back into the market instead of sitting in the account.

-

You can use a Buy Only rebalance after sells settle to invest in alternative securities in your Security Level models or substitutes for the securities sold.

- You can use an account-level security substitutes to reinvest in equivalent securities when you sell out of a particular position.