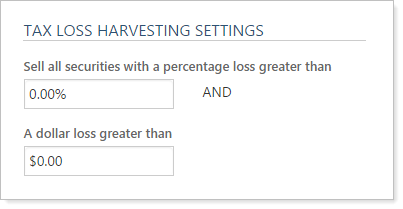

The Tax Loss Harvesting Settings allow you to provide thresholds for tax loss harvesting rebalance activity. These thresholds tell Tamarac Trading the amount of loss you'll accept before selling that security in a tax loss harvesting rebalance.

The following fields are available:

| Setting | More Information |

|---|---|

| Sell all securities with a percentage loss greater than | Calculated as the total value of lot losses for a particular position, divided by the total position value. |

| A dollar loss greater than | Calculated as the total dollar amount of loss for a particular position. |

If both of these thresholds are reached and you perform a Tax Loss Harvesting Rebalance or Tax Loss Harvesting & Rebalance, Tamarac Trading will recommend a sell during these rebalances. The resulting sell recommendation, to either sell the entire position or only sell lots with losses, is dependent on your Tax Loss Rebalance Settings, as set on the Rebalancing System Settings page.

See Tax Lost Harvesting Settings in Action

You have a client account where the tax loss harvesting thresholds are 15% and $5,000.

Your client holds ABC at a loss of 20% of the security's value, but because the client doesn't have many shares of ABC, the total loss held in ABC comes to $1,000. Because this doesn't meet threshold settings in that client's account, ABC will not be sold in a tax loss harvesting rebalance.

Learn More

For more information on how Tax Loss Harvesting Settings interact with the other tax loss harvesting features in Tamarac Trading, see Tax Loss Harvesting and Tax Management Strategies and Using Tamarac Trading for Tax Loss Harvesting.