Contents

Introduction

For many advisors, tax loss harvesting is the single most important tool they have in their arsenal for reducing taxes on behalf of their clients. There are numerous studies that indicate that, next to inflation, taxes remain the biggest drain on a portfolio as taxes can reduce returns by up to one percent per year.

There are several processes you can complete in Tamarac Trading to find client accounts and harvest losses in those accounts, and these are described below. For an overall look at strategies for tax management in Tamarac Trading, see Tax Loss Harvesting and Tax Management Strategies.

Find Accounts With Tax Loss Harvesting Opportunities

To proactively find tax loss harvesting opportunities, you can use saved searches to identify accounts in which to harvest losses. Here are a few common searches you can use to identify losses:

-

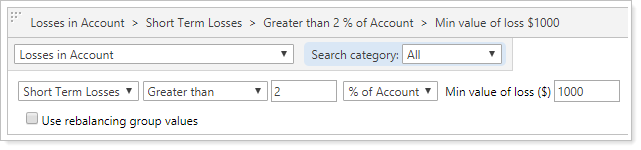

Losses in AccountUse this filter to find short term losses, long term losses, or total losses within an account. You can look for specific dollar amounts or % of account values when searching. You can add filters to only find taxable accounts or accounts of a certain size, if desired.

-

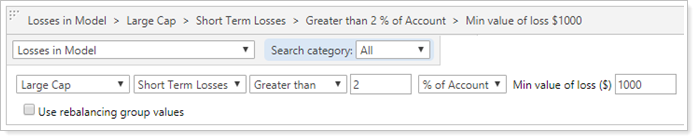

Losses in ModelThis filter allows you to select specific models and identify short term losses, long term losses, or total losses within those models. You can look for specific amounts of loss and can also consider group values when searching. You can add filters to find only taxable accounts or accounts of a certain size, if desired.

-

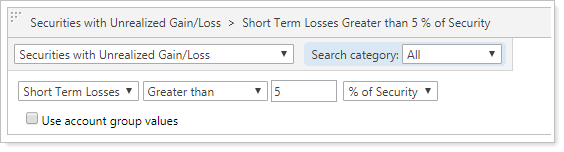

Securities With Unrealized Gain/LossTo find losses in individual security holdings, this filter allows you to pick a security and identify accounts with either losses or gains within that security that meet your threshold criteria. You can add filters to find only taxable accounts or accounts of a certain size, if desired.

-

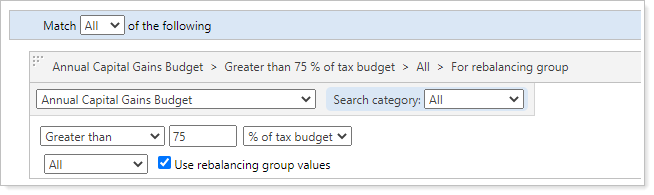

Annual Capital Gains Losses This filter allows you to identify accounts or groups that exceed a certain percentage or have not yet met a certain percentage of their tax budget before or after a rebalance, including accounts or groups with year-to-date losses. You can add filters to find only taxable accounts, or accounts of a certain size, if desired.

You can use saved searches in combination with portfolio-level tax loss harvesting to find accounts in which to tax loss harvest.

Portfolio-Level Tax Loss Harvesting

Portfolio-level tax loss harvesting allows you to find loss opportunities that meet each account's thresholds and harvest those losses at the same time and across many accounts.

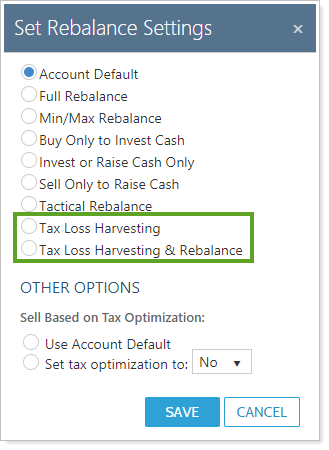

Available Rebalance Types

To accomplish this, Tamarac Trading has the following rebalance options specifically designed for tax loss harvesting:

-

Tax Loss HarvestingA sell-only type of rebalance where securities in accounts that meet the tax loss harvesting thresholds set within the accounts are completely liquidated.

For more information, see Tax Loss Harvesting Rebalance.

-

Tax Loss Harvesting & RebalanceA buy-and-sell type of rebalance where securities in accounts that meet the tax loss harvesting thresholds set within the account are completely liquidated and the proceeds of those sells, as well as any cash available for trading in the account, are reinvested into the account model.

For more information, see Tax Loss Harvesting & Rebalance.

Security Restrictions in a Tax Loss Harvesting Rebalance

When performing one of these rebalances, the rebalance will still follow some global and account security restrictions and ignore others. Tamarac Trading warns you that the restrictions have been ignored and you can choose to proceed with the trade or not. The following are the restrictions that are ignored and adhered to in a tax loss harvesting rebalance:

It is important to review all warnings when performing a tax loss harvest rebalance. The warnings show trades which violate the ignored settings.

These are the security restrictions that are followed during a tax loss harvesting rebalance:

- Buy

- Hold

- Sell

- Range to hold

These are the security restrictions that are ignored during a tax loss harvesting rebalance:

- Redemption fees,

- Minimum trade size

- Minimum holding

- Min/max model settings

- Round lot size

For more information on starting the rebalance process, see Start the Rebalance Process.

Security Equivalencies and Tax Loss Harvesting

When using a tax loss harvesting rebalance, equivalent securities support your goals by allowing you to define which securities are similar to the securities in your clients' models at the individual account level or at the global security level. During a tax loss harvest rebalance, these equivalent securities can help you reinvest back into your models quickly after selling losses.

For more information and rules for setting up substitute securities, see Security Substitutes.

Equivalent Securities in a Rank-based Security Level Model

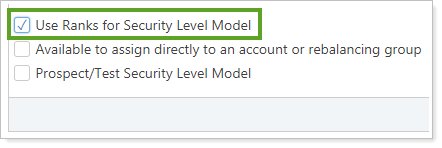

In rank-based Security Level models, you can rank the securities in that model. If one security is not available to purchase, the ranking process tells Tamarac Trading which securities are also suitable as an equivalent during the rebalance process.

In order to add equivalent securities this way, be sure the Use Ranks for Security Level model option is checked to indicate that this is a rank-based model.

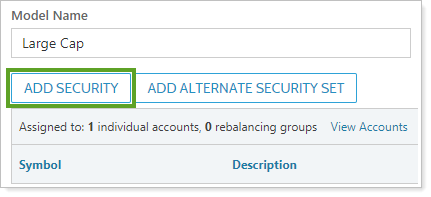

To add additional securities in a rank-based model that will serve as equivalent securities, follow these steps:

-

Under Rebalance & Trade, choose Security Level Models.

-

In the Create New list, choose the model in which you want to add ranks.

-

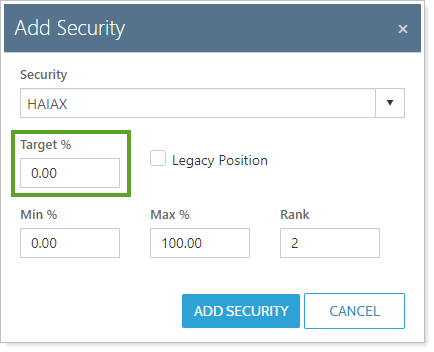

Click Add Security.

-

Add the equivalent security with a 0 in the Target % field.

-

Add a ranking to the equivalent security. Rank it as the second-highest ranked security in the model.

-

Click Add Security.

For more information on creating and editing Security Level models, see Create, Edit, and Delete Security Level Models.

Direct Security Equivalencies for Goal-based Models Using Substitutes

Using security settings, you can set up direct security equivalents. For example, you can add XYZ as a substitute for ABC if you know that they are similar securities and one could be used as an equivalent for the other during the rebalance process.

Before you begin this process, consider this:

-

The security in the model to which you're adding a substitute—sometimes called the parent security—should have a rank higher than your substitute security.

-

This method is only for goal-based models. If you are using a rank-based model, see Equivalent Securities in a Rank-based Security Level Model.

To create an equivalent security at the individual security level, follow these steps:

-

Under Setup, choose Securities.

-

Find the security to which you want to add a substitute, and click the security to open the security's settings.

-

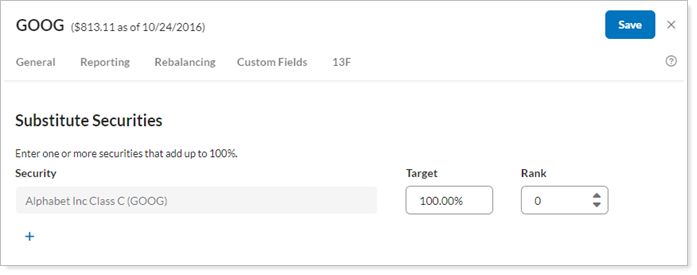

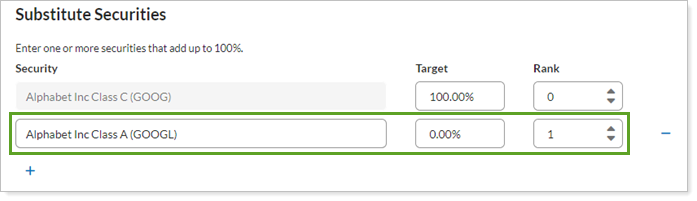

In the Rebalancing tab, choose Substitutes. By default, each security appears grayed out on the Security Substitutes page as its own substitute with a goal percentage of 100% and a rank of 0.

-

Select + to add a row where you'll add the substitute security.

-

In the Search securities box, find the substitute security. Add the desired Target and Rank. Your total under Target for the security and all substitutes must add up to 100%.

-

Click Save.

Single Security Tax Loss Harvesting

A directed trade can be used as a tax management tool when a single security presents an opportunity to harvest a loss or a gain within an account. The Sell Losses and Sell Gains directed trade types allow you to find lots with losses or gains and sell that security if it meets the loss or gain thresholds you specify. For more information, see Trade Type and Quantity Definitions in Directed Trades.

Though directed trades aren't the typical method used to harvest losses, using a saved search as well as a directed trade can be a good way to harvest losses from a security with known losses. You can also use the Allow trade using security substitutes option when creating the directed trade to trade using any equivalent securities you've established.

Create a Filter to View Accounts With Losses in a Specific Security

First, create a saved search to find accounts with losses you can sell. To create this saved search, follow these steps:

-

On the Reports menu, choose Saved Searches.

-

Click Add Filter.

-

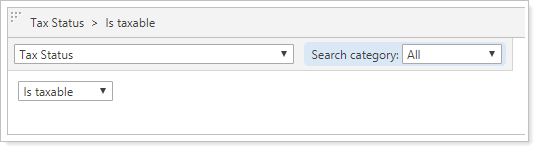

Select the Tax Status search filter and then select Is taxable.

-

Click Add Filter to add another filter.

-

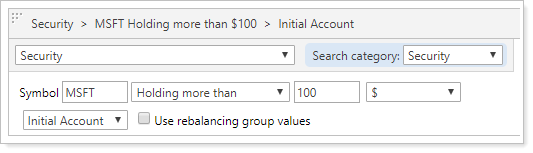

Select the Security in the Search category list.

-

Enter the desired ticker symbol and value and whether the value is in the initial account, post rebalance account, or all accounts. You may also want to check the box to use group values instead of individual account values.

-

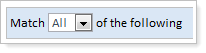

On the Match all/any of the following list, select All.

-

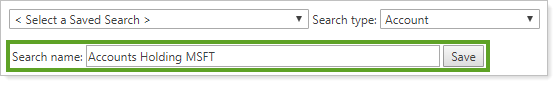

Give this saved search a name in the Search Name box and then click Save.

Create and Apply Trades

Next, you can use the saved search you created to apply a directed trade for tax loss harvesting. To create that directed trade, follow these steps:

-

On the Rebalance & Trade menu, choose Directed Trades.

-

In the Create Trade list, choose Linked Trade and then click Create.

-

Create the directed trade using the following settings:

In the Sell field, add the fund to be sold.

Enter 100% to sell the entire quantity.

In the Buy field, add the ticker of the fund to purchase.

For quantity, enter the desired percentage of proceeds to be used for the buy. If you want to use all of the proceeds, enter 100%.

Since the linked trade processes both buys and sells on the same day, you may want to consider using a reduced percentage on the buy side to provide a small buffer—for example, buy only 98% of sell value.

-

Click Create. Next, you'll need to apply the accounts to your trade.

-

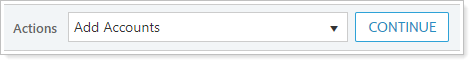

Select the saved search and select Add Accounts in the Actions list and click Continue.

-

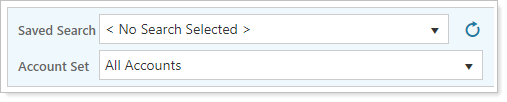

In the Saved Search list, select the saved search you created in Step 1 above. Click Save & Apply.

See Directed Trades Process or more information on creating directed trades.

Prevent Wash Sales

To help prevent wash sales, Tamarac Trading can use the Wash Sale Group ID. Transactions for all accounts with the same Wash Sale Group ID are considered when Tamarac Trading considers which transactions could be wash sales. The Wash Sale Group ID can be any alpha-numeric combination. Accounts in the same group are not considered part of a wash sale group unless they have all been set with the same Wash Sale Group ID.

If you reinvest on a regular basis, you'll run into wash sale or wash buy restrictions. Avoid wash sales by using the Wash Sale Group ID for all of the client's accounts, including any tax-deferred accounts.

If you have a wash buy position and hold a security at a loss and reinvest, that security is prohibited from being bought and can inhibit a tax loss harvest rebalance.

For more information, see Wash Sales.