Back

Back

Back Back |

Home > Tamarac Trading > Rebalances and Trades > Directed Trades > Trade Type and Quantity Definitions in Directed Trades

|

Trade Type and Quantity Definitions in Directed Trades

|

Underlying Account vs. Rebalancing Group Value |

Tamarac Trading allows you to create targeted, security-specific trades with directed trades. Below, you'll find a description and the logic behind these options to help you create the best directed trade for your needs.

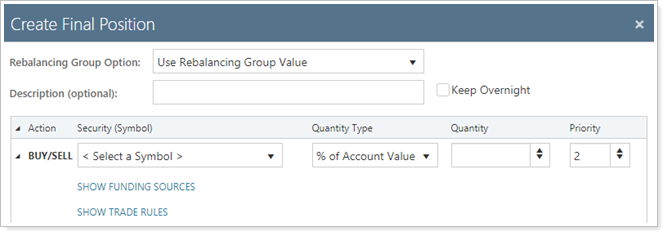

The following options are available when creating a directed trade:

Rebalance Group Option.Allows you to choose whether to use individual account values or rebalancing group values.

Description.Optional name you can give to a directed trade.

Keep Overnight.Select this option to save trade details overnight.

Action.The type of trade you are creating (i.e. Buy, Sell, Final Position, Linked Trade, and Mutual Fund Swap).

Security.Specify the security you'll be trading.

Quantity Type.Specify how Tamarac Trading will calculate the quantity of the directed trade.

Quantity.The amount of the directed trade.

Priority.In the instance of multiple directed trades, specify the order in which the trades will be executed. Tamarac Trading will execute directed trades beginning with priority 1 and continue numerically.

Show/HIDE Funding Sources.Click this link to specify securities to sell in order to generate cash for the buy in a directed trade. You can enter in multiple funding sources and specify sell order.

Show/Hide Trade Rules.Click this link to specify the trade rules for this specific directed trade. You can set your default trade rules on the Rebalancing System Settings page, but the settings you choose here will override any system settings. For more information, see Directed Trade Settings.

For information and warnings about creating a directed trade, see Directed Trades Process. For more information on strategies you can use with directed trades, see Strategies Using Directed Trades.

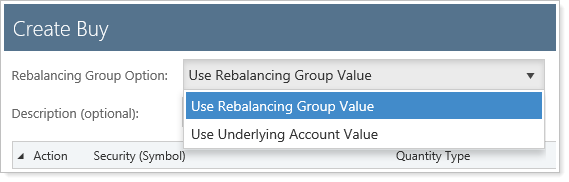

When creating a directed trade, you have the option to use individual account values or group values. Select the appropriate option in the Rebalancing Group Option drop-down list:

Use Underlying Account Value calculates the trade based on the value of the individual account.

Use Rebalancing Group Value calculates the trade based on the group in which the account belongs.

For most directed trades, you'll be using the Use Rebalancing Group Value. However, some trades are best executed with the Use Underlying Account Value option. A few examples:

Swapping securities between individual accounts within a group.

Single security trading within individual accounts.

Accounts which must be kept in equal weights or allocations, like two identical education accounts for the two children of a family.

The following directed trade types are available within directed trades:

Buy: Buys a security in the quantity you specify.

Sell: Sells a security in the quantity you specify.

Final Position: A security-specific trade that buys or sells based on the model goal of the model which contains that security.

Linked Trade: Sells one security and buys another using a percentage of the proceeds that you specify; trades are completed on the same day.

Mutual Fund Swap: A T+1 trade which swaps mutual funds by selling one and purchasing another. This kind of trade is only available for accounts with Schwab, TD Ameritrade, and Fidelity as their custodian and is only available for mutual funds.

Note that mutual fund swap is not available with the TD Ameritrade integration. You must manually upload the mutual fund swap trade file to TD Ameritrade.

Directed trades will adhere to custom round lot sizes you've created for specific securities.

Trades will not be recommended in directed trades where the group or individual account does not have enough cash to execute the full specified trade.

The following are the quantity types you'll see when generating a directed trade to buy a security and what to expect when using either group or underlying account values:

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Buys the number of shares you specify. |

Example Trade

You have an account with excess cash and create a directed trade to buy 100 shares of AAPL using the Shares directed trade.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Buys the dollar amount you specify; dollar amount will be used to calculate the number of shares. |

Example Trade

You have an account with $5,000 in excess cash and create a directed trade to buy $5,000 worth of AAPL using the $ Amount directed trade.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Buys a specific percent of the group value. |

| Use Underlying Account Value |

Buys a specific percent of the account value. |

Example Trade

An account currently holds a 2% position in AAPL. You use % of Account Value to purchase 3% of AAPL. Tamarac Trading will purchase 3% of the account's value and the account will then have 5% of its total value in AAPL.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

|

| Use Underlying Account Value |

|

Example Trade

A group holds $5,000 in cash above a set cash reserve. You create a % of Cash directed trade to use 50% of that cash to purchase $2,500 worth of AAPL.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Buys to the goal percent of the model for the group; quantity is set automatically for each individual account. |

| Use Underlying Account Value |

Buys to the goal percent of the account's model. |

Example Trade

AAPL has a model goal of 5%. You create a directed trade using To Model Goal % to buy AAPL which is underweight. Tamarac Trading will buy AAPL to the 5% goal.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Buys a security to the adjusted target that would be traded if completing a full rebalance for the group. |

| Use Underlying Account Value |

Buys a security to the adjusted target that would be traded if completing a full rebalance for the individual account. |

Example Trade

AAPL has a model goal of 5%. If you were to conduct a full rebalance, AAPL's adjusted goal would be 3% due to a legacy security in the model whose current holding is 2%. The client's account is underweight in AAPL. By creating a directed trade to buy AAPL using To Account Goal %, Tamarac Trading will purchase AAPL to the adjusted 3% goal.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

|

| Use Underlying Account Value |

|

Example Trade

An account currently holds a 2% position in AAPL. You use the To % of Account directed trade to purchase 3% of AAPL. Tamarac Trading will purchase 1% of the account's value and the account will then have 3% of its total value in AAPL because there is enough cash available in the account to cover this trade.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Functions as a % of Account directed trade based on what is currently held in the selected categories within the group. |

| Use Underlying Account Value |

Functions as a % of Account directed trade based on what is currently held in the selected categories within the account. |

Example Trade

A group holds 40% in US Equities. If you perform a % of Category trade for 10% of AAPL, which is categorized as US Equities, Tamarac Trading will purchase 4% of group value (10% × 40% = 4%).

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Functions as a To % of Account directed trade based on what is currently held in the selected categories within the group. |

| Use Underlying Account Value |

Functions as a To % of Account directed trade based on what is currently held in the selected categories within the account. |

Example Trade

A group holds 40% in US Equities and also holds 2% AAPL. If you perform a To % of Category trade for 10% of AAPL, Tamarac Trading will purchase 2% of AAPL. AAPL started at 2%, so Tamarac Trading buys to 4% of the category.

The following are the quantity types you'll see when generating a directed trade to sell a security and what to expect when using either group or underlying account values:

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Sells the number of shares you specify. |

Example Trade

You have a group with excess AAPL and you create a directed trade to sell 100 shares of AAPL using the Shares directed trade.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Sells the dollar amount you specify; dollar amount will be used to calculate the number of shares. |

Example Trade

You have a group with excess AAPL. You create a directed trade to sell $5,000 worth of AAPL using the $ Amount directed trade.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a specific percent of the group value. |

| Use Underlying Account Value |

Sells a specific percent of the account value. |

Example Trade

An account currently holds a 7% position in AAPL. You use the % of Account Value directed trade to sell 5% of AAPL. Tamarac Trading will sell 5% of the account's value using AAPL, leaving 2% of the account's value in AAPL.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a specified percent of the security's value within the group. |

| Use Underlying Account Value |

Sells a specified percent of the security's value within the individual account. |

Example Trade

You have an account that currently holds $5,000 in AAPL. You generate a % of Security Value directed trade to sell 50% of the security's value, or $2,500.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

|

| Use Underlying Account Value |

Sells to the goal percent of the account's model. |

Example Trade

AAPL has a model goal of 5% but is currently overweight. You create a directed trade using To Model Goal % to sell AAPL. Tamarac Trading will sell AAPL to the 5% goal.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a security to the adjusted target that would be traded if completing a full rebalance for the group. |

| Use Underlying Account Value |

Sells a security to the adjusted target that would be traded if completing a full rebalance for the individual account. |

Example Trade

AAPL is overweight in a group. AAPL currently has a model goal of 12%. If you were to run a full rebalance on an account, the adjusted target for AAPL would be 14% after considering ranks, restrictions, and available cash. By choosing To Account Goal % for the directed trade sell, Tamarac Trading will sell the security to the adjusted target of 14%.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells up to a specific percent of the group's value. |

| Use Underlying Account Value |

Sells up to a specific percent of the individual account's value. |

Example Trade

An account currently holds a 5% position in AAPL. You use the To % of Account directed trade to sell 2% of the account's value in AAPL. Tamarac Trading will sell 2% of the account's value of AAPL, leaving 3% remaining.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Functions as a % of Account directed trade based on what is currently held in the selected categories within the group. |

| Use Underlying Account Value |

Functions as a % of Account directed trade based on what is currently held in the selected categories within the account. |

Example Trade

A group holds 40% in US Equities. If you perform a % of Category trade to sell 10% of AAPL, which is categorized as US Equities, Tamarac Trading will sell 4% of group value (10% × 40% = 4%).

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Functions as a To % of Account directed trade based on what is currently held in the selected categories within the group. |

| Use Underlying Account Value |

Functions as a To % of Account directed trade based on what is currently held in the selected categories within the account. |

Example Trade

A group holds 40% in US Equities and also holds 2% AAPL. If you perform a To % of Category trade to sell 10% of AAPL, Tamarac Trading will sell 2% of AAPL. AAPL started at 2%, so Tamarac Trading sells to 4% of the category.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

|

Example Trade

An individual account holds AAPL and some lots are held at a loss and this is a good opportunity to harvest losses on AAPL. You create a Sell Losses directed trade using the criteria Sell securities with a percentage loss greater than at 3% and and a dollar loss greater than at $10,000. Tamarac Trading then examines all lots of AAPL held at a loss and calculates the total percentage loss and total dollar loss. In this case, the AAPL lots held at a loss have a loss percentage of 4% and a total dollar loss of $10,500. Tamarac Trading then sells all AAPL lots held at a loss.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value | NOT AVAILABLE |

| Use Underlying Account Value |

|

Example Trade

An individual account holds AAPL at a gain and is an opportunity to realize gains for a single security. You create a Sell Gains directed trade using the criteria Sell securities with a percentage gain greater than at 3% and and a dollar gain greater than at $10,000. Tamarac Trading then examines all lots of AAPL held at a gain and calculates the total percentage gain and total dollar gain. In this case, the AAPL lots held at a gain have a gain percentage of 4% and a total dollar gain of $10,500. Tamarac Trading then sells all AAPL lots held at a gain.

Final position trades trade to a specific goal that you specify. If the account is overweight, Tamarac Trading recommends a sell; if the account is underweight, a buy is recommended. Final Position buys use available cash and any cash generated from sells.

The following are the quantity types you'll see when generating a Final Position directed trade and what to expect when using either group or underlying account values:

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Buys or sells the security to reach a specified final position of shares in the account. |

Example Trade

You would like 10 separate accounts to all own 100 shares of AAPL. Some of those accounts have fewer than 100 shares and some have more. You create a final position directed trade using Shares as your quantity type and apply this trade to the 10 accounts. Five accounts are overweight and will sell shares to reach 100 shares. Five accounts are underweight and will buy AAPL to reach 100 shares.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Buys or sells the security to reach a specified final dollar amount; dollar amount will be used to calculate the number of shares. |

Example Trade

You would like 10 separate accounts to each have $10,000 worth of AAPL. Some of those accounts have no AAPL and some have more than $10,000 in AAPL. You create a final position directed trade using $ Amount as your quantity type and apply this trade to those 10 accounts. Five accounts are overweight and will sell shares to reach the $10,000 amount. Five accounts have no AAPL and will purchase to reach $10,000 in AAPL.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Buys or sells the specified percent of the group's account value. |

| Use Underlying Account Value |

Buys or sells to the specified percent of the individual account's value. |

Example Trade

You have an account in which you'd like to own 1% of the account value in AAPL. You create a final position directed trade using the % of Account Value quantity type. Because the account currently has no position in AAPL, Tamarac Trading will recommend a purchase to 1% of the account's value.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

|

| Use Underlying Account Value |

|

Example Trade

You have several accounts and you'd like to trade AAPL in each account to its model goal percentage of 2%. You create a final position directed trade using the To Model Goal % quantity type. Tamarac Trading will create either buys or sells for each account so that AAPL is at its model goal percent of 2% in each account.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Buys or sells a security to the adjusted target for the group that would be traded if completing a full rebalance. |

| Use Underlying Account Value |

Buys or sells a security to the adjusted target for the account that would be traded if completing a full rebalance. |

Example Trade

You have an account in which AAPL has a model goal of 2%. However, if you were to complete a full rebalance on that account, due to other restrictions, the model goal would be 3%. You create a final position directed trade using the To Account Goal % quantity type. AAPL is underweight, so a buy to the 3% adjusted model goal will be recommended.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Functions as a % of Account directed trade based on what is currently held in the selected categories within the group. |

| Use Underlying Account Value |

Functions as a % of Account directed trade based on what is currently held in the selected categories within the individual account. |

Example Trade

A group holds 40% in US Equities and is underweight in AAPL. If you perform a % of Category final position trade for 10% of AAPL, which is categorized as US Equities, Tamarac Trading will purchase 4% of the group value (10% × 40% = 4%).

The Linked Trade directed trade allows you to sell one position and purchase another at the same time. This option uses only cash generated from the sell for the corresponding buy and does not use cash available for trading.

Linked Trade directed trades are similar to mutual funds swaps in that you create a sell and a buy at the same time. However, their behavior and uses are different. Consider the following best practices when using Linked Trade:

Both trades will be submitted on the same day. Because of changes in market price and because a Linked Trade only uses cash generated from the sell side of the trade, you may want to adjust your buy amount accordingly.

Linked Trade can be used for mutual funds as well as other security types.

You can buy and sell in any combination and linked trades don't have to be one-for-one. For example, you can sell four securities and use the proceeds to purchase two securities.

You don't have to use 100% of the cash generated from the sell. Any remaining cash can be used later.

The following are the quantity types you'll see when generating a Linked Trade directed trade and what to expect when using either group or underlying account values:

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Sells the number of shares you specify. |

Example Trade

You have an account and want to create a buy and a sell at the same time. You create a Linked Trade directed trade using Shares to sell 1,000 shares of AAPL while at the same time creating a buy to use 98% of those proceeds to purchase AMZN.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Sells the dollar amount you specify; dollar amount will be used to calculate the number of shares. |

Example Trade

You have an account and want to create a buy and sells at the same time. You create a Linked Trade directed trade using $ Amount to sell $5,000 of AAPL. At the same time, you create a buy to use 50% of those proceeds to purchase AMZN and 48% of those proceeds to purchase MSFT.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a specified percent of the security's value within the group. |

| Use Underlying Account Value |

Sells a specified percent of the security's value within the individual account. |

Example Trade

You have a group and want to create buys and a sell at the same time. You create a Linked Trade directed trade using % of Security Value to sell 50% of the group's position in AAPL and 50% of the group's holdings in MSFT. You also create a buy to use 50% of all proceeds to purchase AMZN, leaving excess cash in the account.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells to the goal percent of the group's model; quantity is set automatically for each individual account. |

| Use Underlying Account Value |

Sells to the goal percent of the account's model. |

Example Trade

You have a group and want to create a buy and a sell at the same time. Within the group, AAPL has a model goal of 2% but is currently overweight. You create a Linked Trade directed trade using To Model Goal % to sell AAPL to its model goal of 2%. You also create a buy to use 98% of those proceeds to purchase AMZN.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a security to the adjusted target that would be traded if completing a full rebalance for the group. |

| Use Underlying Account Value |

Sells a security to the adjusted target that would be traded if completing a full rebalance for the individual account. |

Example Trade

You have a group and want to create a buy and sell at the same time. Within the group, AAPL has a model goal of 2% but, due to restrictions, would have an adjusted model goal of 3% if you completed a full rebalance. AAPL is currently overweight. You create a Linked Trade directed trade using To Account Goal % to sell AAPL to its adjusted model goal of 3%. You also create a buy to use 98% of those proceeds to purchase AMZN.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

|

Example Trade

An individual account holds AAPL and some lots are held at a loss and this is a good opportunity to harvest losses on AAPL. You create a Sell Losses directed trade using the criteria Sell securities with a percentage loss greater than at 3% and and a dollar loss greater than at $10,000. Tamarac Trading then examines all lots of AAPL held at a loss and calculates the total percentage loss and total dollar loss. In this case, the AAPL lots held at a loss have a loss percentage of 4% and a total dollar loss of $10,500. Tamarac Trading then sells all AAPL lots held at a loss. In the linked trade, you concurrently create a buy for the proceeds of the sale to purchase AMZN.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

|

Example Trade

An individual account holds AAPL at a gain and is an opportunity to realize gains for a single security. You create a Sell Gains Linked Trade directed trade using the criteria Sell securities with a percentage gain greater than at 3% and and a dollar gain greater than at $10,000. Tamarac Trading then examines all lots of AAPL held at a gain and calculates the total percentage gain and total dollar gain. In this case, the AAPL lots held at a gain have a gain percentage of 4% and a total dollar gain of $10,500. Tamarac Trading then sells all AAPL lots held at a gain. In the linked trade, you concurrently create a buy for the proceeds of the sale to purchase AMZN.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

|

| Use Underlying Account Value |

|

The Mutual Fund Swap directed trade allows you to sell one position in a mutual fund and purchase another the next trading day.

Mutual Fund Swap directed trades are similar to Linked Trade directed trades in that you create a buy and a sell at the same time. However, their behavior and uses are different. Consider the following best practices when using Mutual Fund Swap:

The Mutual Fund Swap is a two day trade; a trade created today will be submitted tomorrow, meaning you're out of the market for a day. This option is good for clients who are willing to be out of the market for a day.

You can reinvest up to 100% of the proceeds from the sell, meaning there's no need to create a buffer for the buy side of the trade. However, you don't have to use all proceeds if you'd like available cash in the account.

This kind of trade is only available to those who use Schwab, TD Ameritrade, and Fidelity as their custodian and is only available for mutual funds.

Note that mutual fund swap is not available with the TD Ameritrade integration. You must manually upload the mutual fund swap trade file to TD Ameritrade.

The following are the quantity types you'll see when generating a Mutual Fund Swap directed trade and what to expect when using either group or underlying account values:

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Sells the number of shares you specify. |

Example Trade

You have an account that currently holds 1,000 shares of ABCX fund. You create a Mutual Fund Swap directed trade using the Shares quantity type and sell 1,000 shares of ABCX. You also create a buy using 100% of the sell value to purchase the XYZX fund.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

NOT AVAILABLE |

| Use Underlying Account Value |

Sells the dollar amount you specify; dollar amount will be used to calculate the number of shares. |

Example Trade

You have an account that currently holds $5,000 in ABCX fund. You create a Mutual Fund Swap directed trade using the $ Amount quantity type to sell $5,000 of ABCX. You also create a buy using 50% of the sell value to purchase XYZX fund. The remaining 50% of the proceeds will remain as available cash.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a specified percent of the security's value within the group. |

| Use Underlying Account Value |

Sells a specified percent of the security's value within the individual account. |

Example Trade

You have a group that currently holds $5,000 in ABCX fund. You create a Mutual Fund Swap directed trade using the % of Security Value quantity type to sell 90% of the value of ABCX. You also create a buy using 100% of the sell value, 90% of the total value of ABCX held, to purchase XYZX.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells to the goal percent of the group's model; quantity is set automatically for each individual account. |

| Use Underlying Account Value |

Sells to the goal percent of the account's model. |

Example Trade

You have an account that holds ABCX fund with a model goal of 2%, but ABCX is currently overweight. You create a Mutual Fund Swap directed trade using the To Model Goal % quantity type to sell ABCX to its model goal of 2%. You also create a buy to use 100% of those proceeds to purchase XYZX fund.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

Sells a security to the adjusted target that would be traded if completing a full rebalance for the group. |

| Use Underlying Account Value |

Sells a security to the adjusted target that would be traded if completing a full rebalance for the individual account. |

Example Trade

You have an account that holds ABCX fund with a model goal of 2% but, due to restrictions, has an adjusted model goal of 3% if you completed a full rebalance. ABCX is currently overweight. You create a Mutual Fund Swap directed trade using To Account Goal % to sell ABCX to its adjusted model goal of 3%. You also create a buy to use 100% of those proceeds to purchase XYZX fund.

| Rebalancing group option | Trade Behavior |

|---|---|

| Use Rebalancing Group Value |

|

| Use Underlying Account Value |

|