Contents

|

Security Substitutes in Models Security Substitutes and Tax Loss Harvesting Equivalent Securities in Rank-Based Security Level Models |

Introduction

Security substitutes allow you to designate direct equivalent securities that can be purchased or sold in place of the original security, often called the primary or parent security. Any parent security can have an unlimited number of substitutes.

You can assign substitutes globally or for accounts individually. The following table provides details on each method.

| Type of Security Substitute | Level | What it applies to | When to use it |

|---|---|---|---|

| Account-level | Account | One account |

Set up account-level substitutes when you want to apply a security substitute to only one or few accounts. Common reasons to set account-level security substitutes include managing a portfolio with legacy holdings that you want to manage, accommodating accounts holding the same security have different goals, and more. For example, one client wants to transition out of holding MSFT, but you don't want do globally replace MSFT in all other clients' accounts. You can set up an account-level security substitute to replace the one client's MSFT holdings with other securities without impacting any other clients' portfolios. |

| Security-level | Security | All accounts holding the security |

Set up security-level substitutes that apply to all accounts holding a security. This is useful when you've decided to phase all clients out of a particular holding, for restricted securities, closed funds, and more. For example, to set GOOGL as a substitute for all portfolios containing GOOG, define the substitute for the GOOG security. All accounts holding GOOG would use GOOGL as a substitute as appropriate. |

| Zero-target (equivalent) security | Model | Everyone assigned to the model |

Add a zero-target security in rank-based Security Level models to create equivalent securities. For more information, see Legacy Positions. |

Substitutes are included as part of the allocation for the security for which they are substituting. When you add a substitute security, you will designate a target allocation percentage for the substitute.

You can also use rank-based Security Level models to achieve model flexibility. For more information, see Goals and Ranks in Models.

Why Security Substitutes?

The following are situations where you might create substitute securities:

-

Mutual fund share classesIn cases where you include mutual funds in your models with share classes, you can add the various share classes as substitutes.

-

Funds closed to new investorsIf a fund in your model has closed to new investors, add a replacement security as a substitute for the closed security in accounts not currently holding the closed fund.

-

Restricted securityIn cases where a security in your model cannot be purchased by some of the accounts because of restrictions like minimum investments, custodian restrictions, tax status, or account value, you can create a substitute for the restricted security for a more appropriate security.

-

Securities only available from one custodianIf you have a security in your model that can only be purchased by accounts held at a specific custodian, you can substitute another security for those accounts using a different custodian.

-

Legacy positionsIn some cases, clients may have legacy holdings that they can't or won't sell. In that case, you can designate the legacy position as a substitute for a security in your model.

-

Tax Loss HarvestingIn cases where you sell securities to harvest losses, you can choose to buy back into equivalent or substitute securities so that money goes back into the market. For more information, see Security Substitutes and Tax Loss Harvesting.

Security Substitutes in Models

For information about how substitutes behave in models, see Substitute and Equivalent Securities in Models.

Security Substitutes and Tax Loss Harvesting

When using one of the tax loss harvesting rebalance types—the Tax Loss Harvesting & Rebalance or the Tax Loss Harvesting Rebalance type—equivalent securities support your goals by allowing you to define, at the account or security level, which securities are similar to the securities in your clients' models. During a tax loss harvest rebalance, these equivalent securities can help you reinvest back into your models quickly after selling losses.

For more information on tax loss harvesting, see Using Tamarac Trading for Tax Loss Harvesting.

Equivalent Securities in Rank-Based Security Level Models

When creating rank-based Security Level models, you can set up your models so that some securities are considered equivalents, not substitutes, of other securities. In rank-based Security Level models, you can rank the securities in that model. If one security is not available to purchase, the ranking process tells Tamarac Trading which securities are also suitable as an equivalent during the rebalance process.

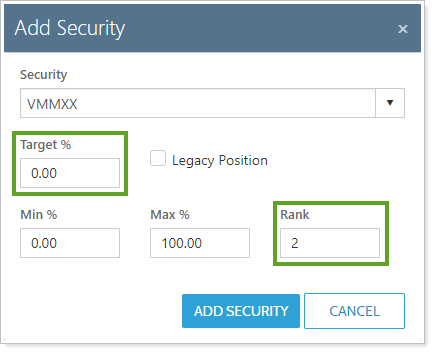

To do this, add the equivalent security to the Security Level model with a 0% target and the second-highest ranked security in the model.

For directions to create and edit Security Level models, see Create, Edit, and Delete Security Level Models.

Direct Security Substitutes in Goal-Based Models

By using security substitutes, you can set up direct security equivalents in individual accounts or globally throughout Tamarac Trading. For example, you can add XYZ as a substitute for ABC. Then, during tax loss harvesting, you sell losses in one security and buy into the other security without violating the wash sale rule for all accounts holding that security. To do this, add a substitute security using the steps in Add Account- or Security-Level Security Substitutes.

The security in the model to which you're adding a substitute—sometimes called the parent primary, or parent, security—should have a rank higher than your substitute security.

Available Settings

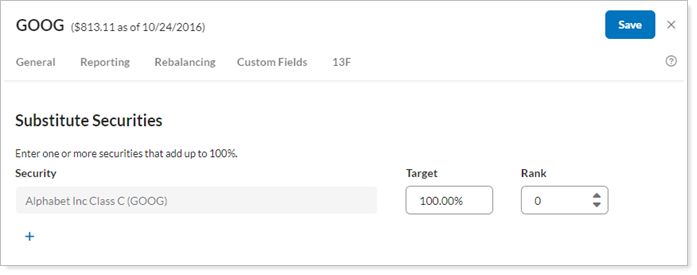

Security-Level Substitutes

You can set substitute securities on the Securities page, which you can find by choosing Substitutes on the Rebalancing tab:

Account-Level Substitutes

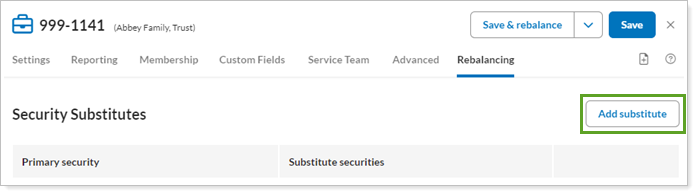

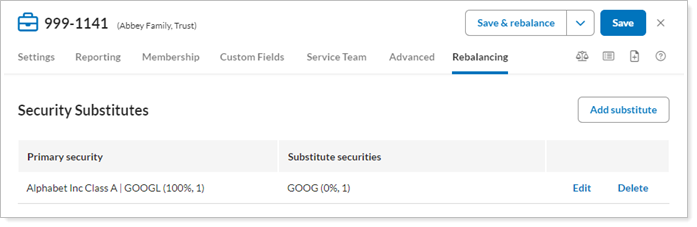

You can set substitute securities for individual accounts when you click the Security Substitutes panel on the account's Rebalancing tab:

Add a Security Substitute

To add a security substitute at the security or account level, see Add Account- or Security-Level Security Substitutes.