Contents

|

Substitute and Equivalent Securities in Models |

Introduction

Tamarac Trading allows you to provide alternative securities for instances where a client can't or won't hold a position in a specific security within your models. These substitute securities are directly assigned either for an account or security.

Tamarac Trading can also be used to accommodate equivalent securities, securities that aren't set to be substitutes for other securities but are similar enough that they can be used within your models to achieve the mix of assets you're looking for. In cases where clients bring in legacy positions over time, using techniques to either hold or sell off legacy positions can minimize trading while also accommodating and reporting on the value of those holdings.

Substitute and Equivalent Securities in Models

Security substitutes allow you to designate direct equivalent securities that can be purchased or sold in place of the original security, often called the primary or parent security. Any parent security can have an unlimited number of substitutes.

You can assign substitutes globally or for accounts individually. The following table provides details on each method.

| Type of Security Substitute | Level | What it applies to | When to use it |

|---|---|---|---|

| Account-level | Account | One account |

Set up account-level substitutes when you want to apply a security substitute to only one or few accounts. Common reasons to set account-level security substitutes include managing a portfolio with legacy holdings that you want to manage, accommodating accounts holding the same security have different goals, and more. For example, one client wants to transition out of holding MSFT, but you don't want do globally replace MSFT in all other clients' accounts. You can set up an account-level security substitute to replace the one client's MSFT holdings with other securities without impacting any other clients' portfolios. |

| Security-level | Security | All accounts holding the security |

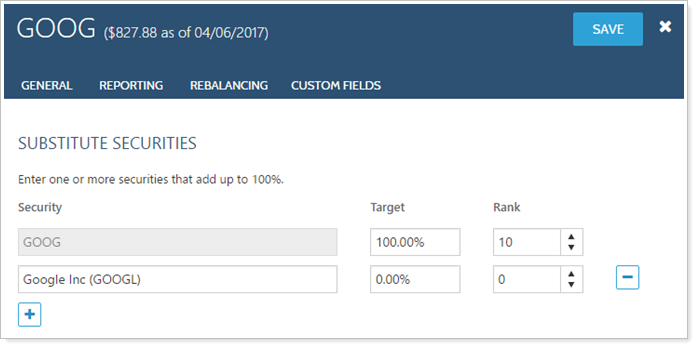

Set up security-level substitutes that apply to all accounts holding a security. This is useful when you've decided to phase all clients out of a particular holding, for restricted securities, closed funds, and more. For example, to set GOOGL as a substitute for all portfolios containing GOOG, define the substitute for the GOOG security. All accounts holding GOOG would use GOOGL as a substitute as appropriate. |

| Zero-target (equivalent) security | Model | Everyone assigned to the model |

Add a zero-target security in rank-based Security Level models to create equivalent securities. For more information, see Legacy Positions. |

Substitute Securities Rules

You can set security substitutes for all accounts holding the security or for one individual account. For more information, see Security Substitutes.

When you add a security with substitutes to a model, the following rules apply:

-

Only the substitute securities you create for a given security are considered as possible substitutes. Consider this example:

Example

You create the following security substitutes:

-

ORCL is a substitute for MSFT.

-

IBM is a substitute for ORCL.

During the rebalance process, Tamarac Trading will recognize the direct substitutes (ORCL for MSFT and IBM for ORCL) but will not substitute IBM for MSFT. Tamarac Trading doesn't assume substitute relationships you don't specifically designate.

However, if IBM and ORCL are both designated as substitutes for MSFT, either security could be considered as a possible substitute.

-

-

When using substitute securities in your client's models, do not use securities in the same Security Level model or Allocation model that share the same substitute. This includes both goal- and rank-based models.

-

Ranks in substitute securities work similarly to rank-based models. If a model is underweight, Tamarac Trading will prioritize buying securities with the highest rank. If a model is overweight, Tamarac Trading will prioritize selling securities with the lowest rank. Substitute securities must be ranked; the available range is 0 to 99.

-

Crossing security substitutes will create errors. For example, if security A is a substitute for security B, you cannot also make security B a substitute for security A.

For instructions on creating a substitute security, see Add Account- or Security-Level Security Substitutes.

Account-Level Security Substitute Rules

For account-level security substitutes, the following rules apply:

-

You can't add a security as a primary more than once in an account. For example, you can't add MSFT as primary two times in one account, but you can add multiple substitutes to the MSFT primary security.

-

Two securities cannot have the same substitute in the account. For example, if GOOG substitutes for IBM, you can't add GOOG as the substitute for FB in the account as well.

-

You can't add cash (ticker $$$) as a primary or secondary security.

-

You can apply account-level security substitutes to financial accounts, sleeve accounts, and ownership accounts, but not to groups. Sleeve accounts and ownership accounts do not inherit account-level substitutes from parent accounts.

-

If a security has a substitute configured at the security level and at the account level, the account-level substitute overrides the security-level substitute.

Equivalent Securities

Equivalent securities can be established slowly, over time, in individual accounts by adding them to your models. Then, use ranks to create high buy or sell priority for these equivalent securities, depending on your strategy. For more information, see Goals and Ranks in Models.

See Substitute and Equivalent Securities in Action

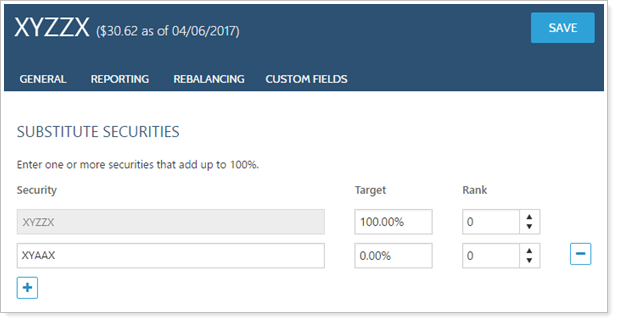

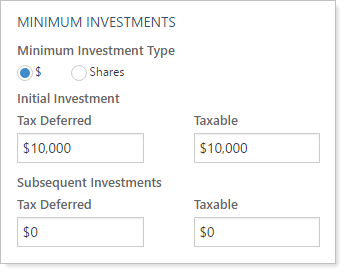

One of your models includes the XYZZX mutual fund, an actively managed fund with a minimum investment of $10,000.

You have a new client who will be investing less than the minimum amount required to purchase XYZZX. In the client's account on the Substitute Securities panel, you add XYZZX as a parent security. You add a substitute security a different share class of the mutual fund, XYAAX, which has a lower minimum investment.

Then, using Trade File Group Settings, you specify a minimum investment for XYZZX so that any buys less than $10,000 will not be recommended.

When the client opens an account, he will be invested into XYAAX without having to create a separate model to accommodate the alternate share class.