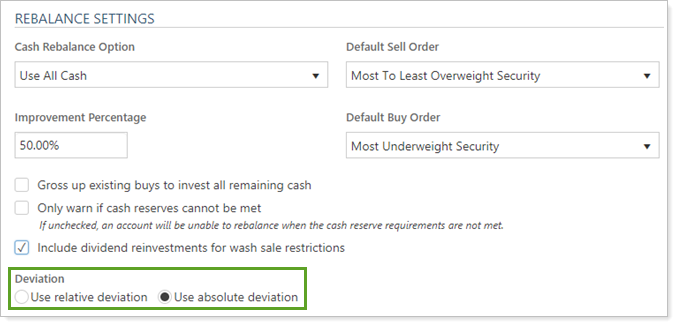

Rebalance Settings on the Rebalancing System Settings page allow you to customize how Tamarac Trading adheres to logic during a rebalance and how it calculates information during that process. These settings are widely applicable to many different rebalance types. Deviation controls how Tamarac Trading calculates deviation away from model targets.

These are the options available:

-

Use relative deviation: When calculating recommended trades, relative deviation calculates deviation relative to the parent model's target.

-

Use absolute deviation: When calculating recommended trades, absolute deviation uses the absolute calculation of deviation.

See Deviation in Action

You have a Fixed Income model that's holding 45% and a Large Cap model that's holding 6%. The target for Fixed Income is 50% and the target for Large Cap is 10%, so both models are underweight.

The account has excess cash, so you perform a Buy Only to Invest Cash rebalance on the account:

-

If using absolute deviation, Tamarac Trading will buy in Fixed Income because it has a larger absolute deviation.

-

If using relative deviation, Tamarac Trading will buy in Large Cap because it has a larger relative deviation.

Model Current Target Absolute Deviation Relative Deviation Fixed Income 45% 50% 5% 10% Large Cap 6% 10% 4% 40%