Contents

How Include Annualized Returns or Cumulative Returns Works

| Applies to: | ||

|---|---|---|

| Dynamic |

Client Portal |

|

Annualization converts a cumulative rate over a number of years to the average yearly rate that when compounded over the entire period results in the cumulative rate. The goal of annualization is to normalize returns and state them in terms of what has been achieved in an average year for the account or position. This makes it easier to compare the performance an account has achieved relative to others that have been open for different lengths of time.

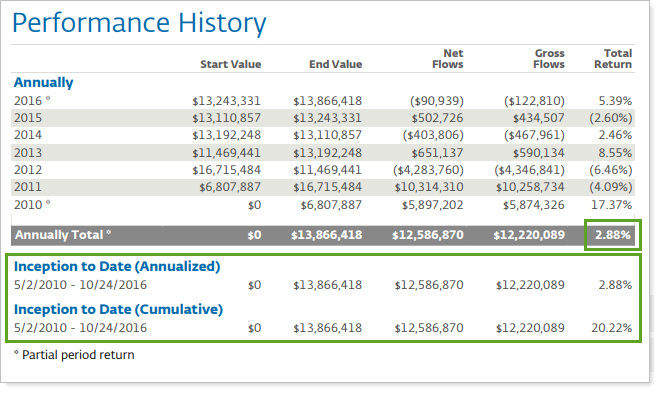

This setting allows you to designate which returns are reported in the Performance History report: Annualized returns, cumulative returns, or both.

You might want to use annualized returns when using the report for comparisons: comparing accounts to a benchmark, comparing account data for different advisors, or comparing positions that have been held for differing periods of time. Annualization only applies to date periods greater than 12 months. Any date period less than or equal to 12 months—such as monthly, quarterly, or annually—are reported as cumulative returns.

Cumulative returns allow you to show how far an account has come, return-wise, over the date period. This is helpful when talking with a client about what's happened in an account over time.

In Dynamic Reports

This report is available in PDF reports only.

In PDF Reports

When you select a return option, the report creates a unique section for that return.

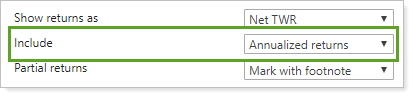

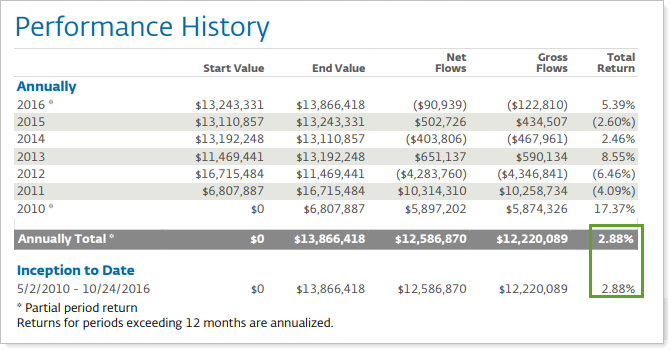

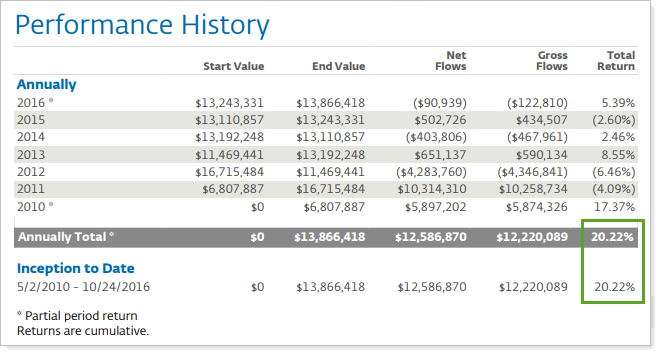

You can choose the following options for returns:

-

Annualized returns. The report displays only annualized returns.

-

Cumulative returns. The report displays only cumulative returns.

-

Annualized and cumulative returns. The report displays both annualized and cumulative returns.