Contents

|

Enable the Schwab RMD Integration Disable the Schwab RMD Integration See When the Last RMD Data Sync Occurred |

Introduction

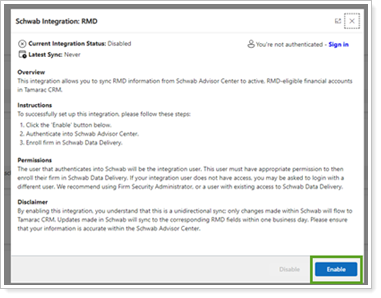

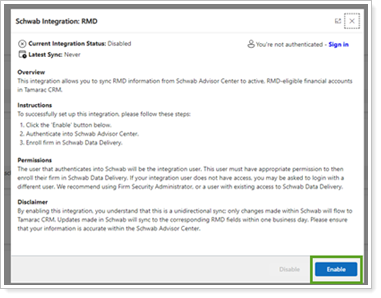

This integration syncs required minimum distribution (RMD) data from the Schwab Advisor Center to active, RMD-eligible Financial Accounts in Tamarac CRM. Once enabled, updates made in Schwab will sync to the corresponding RMD fields within one business day.

The data from the Schwab RMD integration appears in the RMD Planning dashboard. For more information, see RMD Planning Dashboard.

For information about RMD management on Financial Accounts, see Financial Accounts Integration.

This topic provides information about how to enable the Schwab RMD integration. For details on how to use its features, see Use the Schwab Required Minimum Distributions (RMD) Integration.

Enable the Schwab RMD Integration

This integration is disabled by default. A CRM Admin with Schwab Data Delivery access must enable the Schwab RMD integration.

To set up the Schwab RMD integration:

-

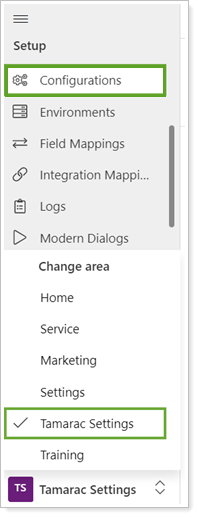

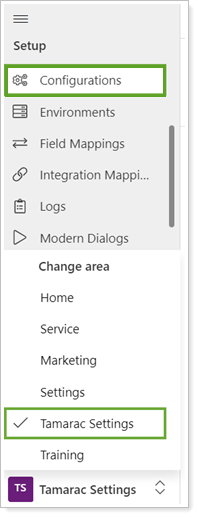

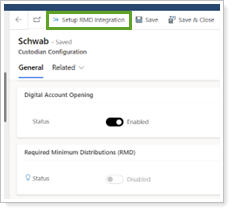

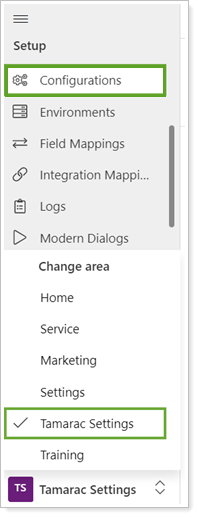

In Tamarac CRM, in the bottom left under Home, select Tamarac Settings.

-

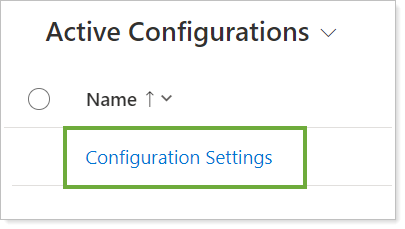

Under Setup, select Configurations.

-

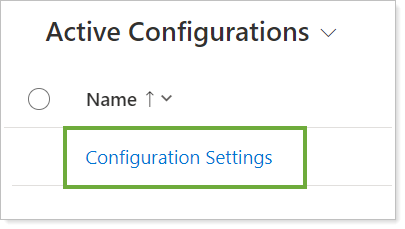

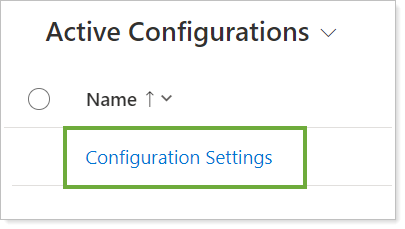

Select Configuration Settings.

-

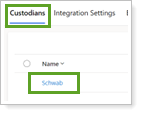

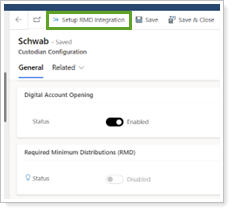

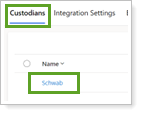

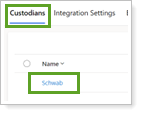

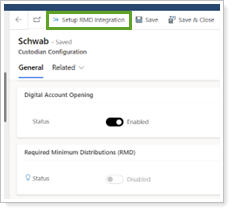

To open the configuration page, in Custodians, select Schwab.

-

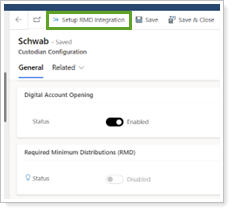

In the command bar, select Setup Integration and select RMD. The Schwab integration must be enabled to complete the RMD integration setup.

-

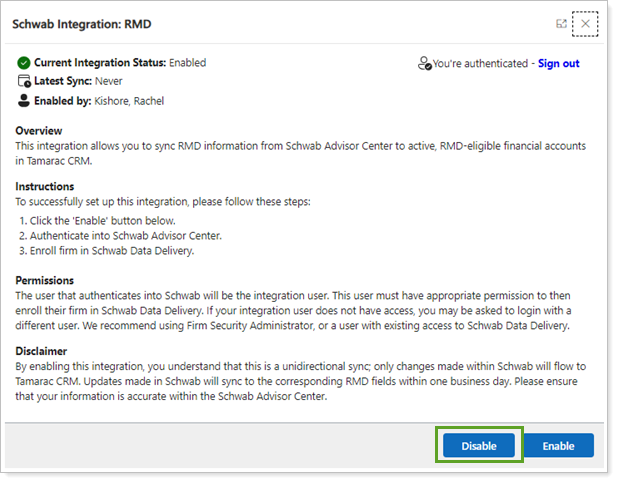

In Schwab Integration: RMD, select Enable.

-

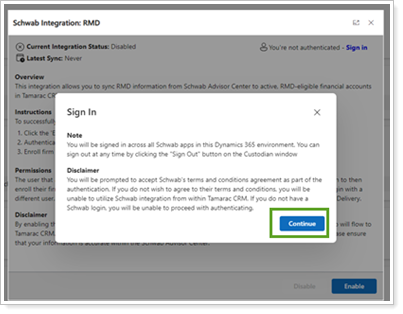

Review the Note and Disclaimer, then select Continue.

-

You’ll be redirected to Schwab. Sign in using your credentials and select Continue.

-

Enter the security code and select Continue.

-

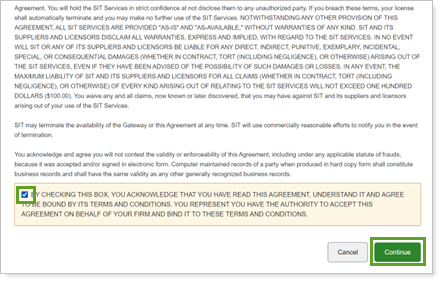

Select the check box to acknowledge and select Continue. You can close the tab when you've completed the authorization.

-

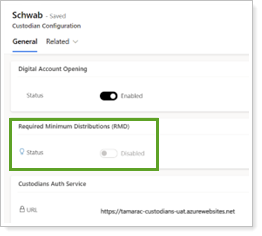

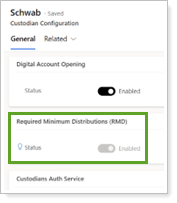

In Tamarac CRM, the RMD integration is now enabled.

Once synchronization is complete following the scheduled execution, the RMD Management fields will receive the latest values from Schwab.

Disable the Schwab RMD Integration

To turn off the Schwab RMD integration:

-

In Tamarac CRM, in the bottom left under Home, select Tamarac Settings.

-

Under Setup, select Configurations.

-

Select Configuration Settings.

-

To open the configuration page, in Custodians, select Schwab.

-

Select Setup Integration and choose RMD.

-

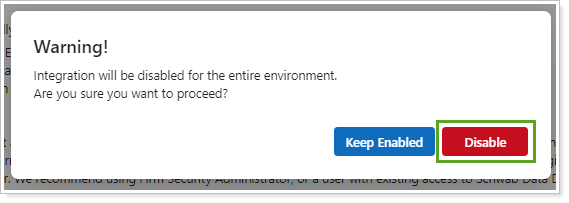

In Schwab Integration: RMD, select Disable.

-

In the confirmation, select Disable.

Change the Integration User

If you need to change which user is associated with the RMD integration, you can update the username and credentials. You do this process when the integration is already enabled.

To change the integration user:

-

In Tamarac CRM, in the bottom left under Home, select Tamarac Settings.

-

Under Setup, select Configurations.

-

Select Configuration Settings.

-

To open the configuration page, in Custodians, select Schwab.

-

Select Setup Integration and choose RMD.

-

In Schwab Integration: RMD, select Enable.

-

In the confirmation, select Re-Enable.

-

Follow the prompts to enter your password and security code and accept the agreement as your user. Once completed, the integration will be enabled under your user.

See When the Last RMD Data Sync Occurred

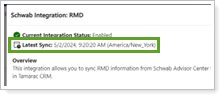

To see the latest synchronization data, select Setup Integration and choose RMD.

Most recent synchronization date and time appear in the Schwab Integration: RMD modal under Latest Sync.

Synchronize RMD Management Fields in Financial Accounts

When the Schwab integration is enabled, synchronization is executed daily at 9:00 AM EST/EDT. The synchronization works in one direction and the changes from Dynamics are not pushed to Schwab.

Financial Accounts will be synchronized if they meet the following criteria:

-

The Financial Account is active.

-

RMD Eligible is Yes.

-

Custodian is Schwab.

The next RMD fields are updated by the values from Schwab for the integrated Financial Accounts mapped by ID fields in Dynamics and Formatted Account (schema name: formattedAccount) field in Schwab:

| Dynamics Field | Definition |

|---|---|

|

RMD Withdrawals |

The amount of money that was already withdrawn. |

|

RMD Due Date |

The date by which the RMD must be withdrawn to avoid penalties. At present, individuals must start taking RMDs from qualified retirement accounts at the age of 73. |

|

RMD Required Beginning Date |

The date when the account holder must begin taking their RMDs. At present, individuals must start taking RMDs from qualified retirement accounts at the age of 73. |

|

RMD Current Year |

The RMD calculated based upon the prior year's end-of-year account value. |

|

RMD Current Quarter |

The quarterly RMD calculated based upon the prior year's end-of-year account value. |

|

RMD Current Month |

The monthly RMD calculated based upon the prior year's end-of-year account value. |

|

Year to Date Contribution |

The regular IRA contributions for the current year. Does not include rollovers or transfers. |

|

RMD Distributions Remaining Current Year |

The remaining RMD for the current year. |

|

Rollover Contribution This Year |

The total amount of redeposited funds distributed from a 401(k) account into an IRA account for the current year. |

|

Total Distributions Year to Date |

The sum of All Commodity Volume (ACV) distributions for the account holder's assets for the current year. |

|

ROTH IRA |

Indicates whether the account is a Roth IRA account. |

|

ROTH Conversions Year to Date |

The total amount of funds converted from a traditional-type IRA or 401(k) account into a Roth account for the current year. |

|

(Total - ROTH Conversions) Year to Date |

The difference between the total distributions and funds converted from a traditional-type IRA or 401(k) account into a Roth account for the current year. |

|

RMD Prior Year |

The RMD calculated based upon the end-of-year account value from 2 years ago. |

|

Prior Year RMD End Value |

The prior year's RMD end value. |

|

RMD Two Years Prior |

The RMD calculated based upon the end-of-year account value from 3 years ago. |

|

Prior Year Contributions |

The regular IRA contributions from the prior year. Does not include rollovers or transfers. |

|

Prior Year RMD Distributions |

The RMD withdrawn from the account for the prior year. |

|

RMD Distributions Remaining Prior Year |

The remaining RMD for the prior year. |

|

Total RMD Distributions Prior Year |

The sum of All Commodity Volume (ACV) distributions for the account holder's assets for the prior year. |

|

Tax Withholding Elected |

Indicates whether the account holder elected to withhold tax. |

|

Tax Withholding Federal Opted Out |

Indicates whether the account holder has opted out of federal income tax withholding. |

|

Tax Withholding Election Federal (%) |

The federal tax withholding percentage elected by the account holder. |

|

Tax Withholding State Opted Out |

Indicates whether the account holder has opted out of state income tax withholding. |

|

Tax Withholding Election State (%) |

The state tax withholding percentage elected by the account holder. |

|

Tax Withholding State Code |

The state where the state tax is being withheld. |

See Schwab RMD Data in CRM

For details on how to see and use Schwab RMD data in Tamarac CRM, see Use the Schwab Required Minimum Distributions (RMD) Integration.