Contents

Introduction

You can see financial account information from Tamarac Reporting and Tamarac Trading in Tamarac CRM. This integration gives you an overview of some key financial account data points in Tamarac CRM. When you want to drill down into financial details, you can quickly jump from Tamarac CRM to your Tamarac Reporting Dashboard which automatically displays the corresponding Tamarac Reporting financial account.

The system fields in Tamarac CRM that are included in the integration are updated from Tamarac Reporting during the daily sync with your portfolio accounting system. If you map custom fields, they will bi-directionally sync and update immediately in both systems.

New financial accounts from your custodian will be created in Tamarac CRM and existing financial accounts will be updated with the most recent data. Financial accounts in Tamarac CRM can be automatically assigned to the correct Tamarac CRM account if you are using Household integration and your Households are linked.

View Financial Accounts

Below is a review of the data on your financial accounts and the fields that are updated automatically from Tamarac Reporting and Tamarac Trading.

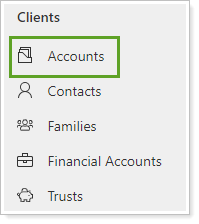

To open an existing financial account, follow these steps:

-

On the side menu, select Accounts under Clients.

-

Click to open the account you want to review.

-

Click Financial Information to find the Financial Accounts grid.

-

Select to open the Household-Financial Account record, then select the name of the Financial Account to open it.

-

In the warning message about navigating away without saving, select OK.

General

The following fields are available:

| Field | More Information |

|---|---|

| ID | The financial account number at the custodian. |

| Managed Value | The managed value of the financial account. |

| Total Cash | The total amount of cash in the account. |

| Custodian | The custodian where the financial account is held. |

| Name | Name of the financial account. |

| Type | Descriptor for the financial account, e.g. Joint, IRA, Roth IRA, etc. |

| Primary Contact |

Primary contact on this financial account. This is required for RMD tracking. |

| Secondary Contact | Secondary contact for this financial account. |

| Reporting Group | Shows if the account is a reporting group in Tamarac Reporting. It will always be unchecked for financial accounts. |

| Master Account ID | Custodian master this account is connected to. |

| Tax Deferred/Exempt | Tax deferred/exempt status, this will display as Yes or No |

| Trust Assigned | This field is a lookup to the trusts you have created. You can designate the trust related to this financial account. |

| Defined Contri. Plan | Identifies if this financial account is a defined contribution plan. |

| Requires Beneficiary | Select this check box to indicate that a beneficiary is required and to display the financial account on the Beneficiary Report. Clear this check box to remove the financial account from the report. |

RMD Management

You'll find RMD-related information on the RMD Management tab. It displays fields that help you track client eligibility, RMD amounts and due dates, and when the RMD was satisfied for the current year. Additional information about current year, prior year, and tax withholding are available for Financial Accounts custodied at Schwab through the Schwab RMD integration.

If you use the Schwab RMD integration, you'll see different details on RMD Management. For more information, see Schwab RMD Integration.

RMD Eligibility

Tamarac CRM automatically marks the RMD Eligible check box for financial accounts that it determines are eligible for RMD. It uses specific criteria to find the eligible accounts and updates twice a day. If needed, you can manually override this setting by clicking the Override RMD Eligibility check box, which enables editing for this field. The financial account will only be included in the RMD Planning Report if the check box is selected.

To determine RMD eligibility, Tamarac CRM:

-

Refers to the Tax Deferred/Exempt field and looks first for accounts that are Non-Taxable.

-

Excludes Non-Taxable Accounts where the financial account type includes any of the following word combinations:

Roth

roth

ROTH

-

Narrows the list to include only financial accounts where the primary contact on the account will be greater than the minimum age by the end of the year.

-

Since inherited IRAs are always included on the report, regardless of the age of the primary contact, they are designated by a financial account type that includes any of the following word combinations:

-

Inh

-

Inh.

-

inh

-

inh.

-

INHERITED

-

inherited

-

Inherited

-

RMD Fields

In Tamarac CRM, you'll see the following RMD fields.

| Field | More Information |

|---|---|

| RMD Eligible | Tamarac CRM automatically marks the RMD Eligible check box for financial accounts that it determines are eligible. |

| Override RMD Eligibility |

Tamarac CRM runs a job twice a day to automatically identify financial accounts which are eligible for RMD, using specific criteria. If you find that an account is inaccurately marked as eligible, you can enable overrides by clicking the Override RMD Eligibility check box, and then you can clear the RMD Eligible check box, or select it if it was not selected and should be. |

| RMD Withdrawals | Year-to-date withdrawals to satisfy required minimum distribution. This is a manually entered field. |

| RMD Requirement | This year’s required minimum distribution. This is a manually entered field. |

| RMD Due Date |

The date that RMD is due – this is a manually entered and editable field. ImportantComplete RMD Due Date BEFORE selecting the RMD Satisfied check box. If you complete this field after selecting the RMD Satisfied check box, the due date will not appear in the description on your reports. Instead, you’ll see a line that looks similar to Veal, Anne has satisfied RMD for . |

| Date RMD Satisfied |

The date that the required minimum distribution was satisfied this year. You must complete this field before selecting the RMD Due Date field in order to properly display the date in your report descriptions. This field will clear at the end of the year. |

| RMD Satisfied | Check to indicate that this year’s RMD has been satisfied. This field will clear at the end of the year. |

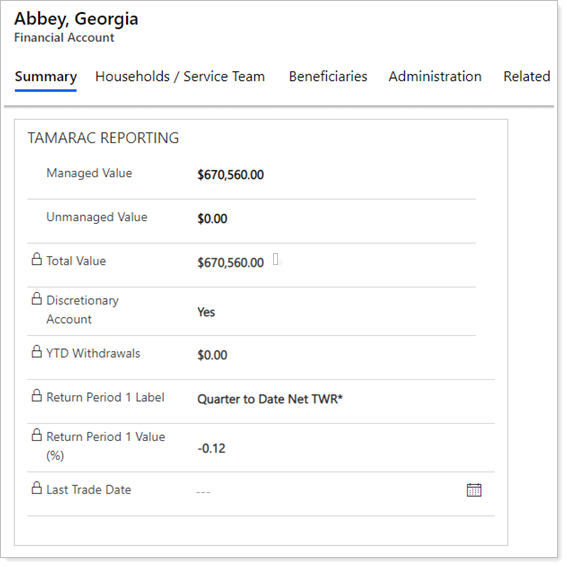

Tamarac Reporting

Tamarac CRM will aggregate transaction values for each financial account from Tamarac Reporting. The values will update following a sync in Tamarac Reporting.

The integration for this information is specific to Tamarac Reporting integration. If you are not using Tamarac Reporting, the integrated fields will be blank.

| Field | More Information |

|---|---|

| Managed Value | The managed value of the financial account. |

| Unmanaged Value | The value of underlying securities in the account that are marked as unmanaged for performance. |

| Total Value | The sum of the managed and unmanaged value for the financial account. |

| Discretionary Account | Indicates whether the financial account is discretionary. |

| YTD Withdrawals | Year to date withdrawals and transfer of securities transactions. |

| Return Period 1 Label |

The name of the first return period added to Tamarac Reporting. This field is configurable in Tamarac Reporting, to change the field that is integrated contact Tamarac Support. |

| Return Period 1 Value |

The return percent for the first return period added to Tamarac Reporting. This field is configurable in Tamarac Reporting, to change the field that is integrated contact Tamarac Support. |

| Last Trade Date | The date of the most recent buy or sell transaction in the account. |

| Previous Year | This subheading indicates the time period for the following fields. Previous year is a rolling 365/366 day period for all fields under the subheading. |

| Mgmt. Fee | Aggregates the expense transactions typed as management fee for this financial account. |

| Contributions | Aggregates all deposit and receipt of securities transactions for this financial account. |

| Withdrawals | Aggregates all withdrawals and transfer of securities transactions for this financial account. |

| Net Contributions§ | Value of contributions less withdrawals for this financial account. |

| Contribution Rate (%) | Value of net contributions/starting value for the financial account. |

| Managed Value as of 12/31 | Managed value for the financial account as of 12/31 of the previous year. |

| Last Reconciliation Date |

The last date a position reconciliation was performed on the account. This is updated by your portfolio accounting system. |

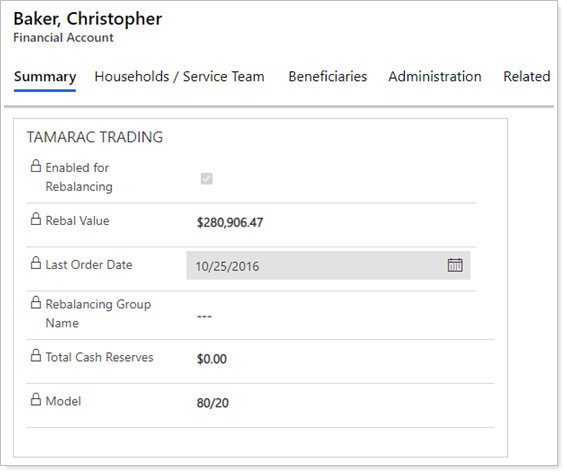

Tamarac Trading

Tamarac CRM will aggregate data for each financial account from Tamarac Trading. The values will update following an upload in Tamarac Trading.

The integration for this information is specific to Tamarac Trading integration. If you are not using Tamarac Trading, the integrated fields will be blank.

| Field | More Information |

|---|---|

| Enabled for Rebalancing | Shows if the account is enabled for rebalancing. |

| Rebal Value | The value of the account calculated as Total Account Value-Cash Reserves |

| Last Order Date | The last date an order was logged for the account. |

| Rebalancing Group Name | The name of the group in Tamarac Trading where the account is enabled for Rebalancing. |

| Total Cash Reserves | The total cash reserves specified for the account. |

| Model | The model assigned to the account. |

Account/Household

The Account/Household subgrid displays all households the financial account is associated with. In the case where there are multiple stakeholders for a financial account, you can associate it with each stakeholder’s household in Tamarac CRM.

For example, you manage a multi-generational family including the grandparents, parents, and children. The grandparents have a 529 account for the children, their household is in the Primary Account/Household field. The parents should also be able to see information about this account, their account can also be associated with the financial account as well.

| Field | More Information |

|---|---|

| Primary Account/Household | The household that owns the financial account. |

| Account/Household Subgrid | Displays all additional households that are stakeholders for the financial account. |

Service Team

The service team is used to identify the user for each role for that client relationship. This allows you to use Tamarac CRM’s automated business processes. You can also use these to create custom business processes which assign activities to a role instead of the specific users. If one person in your firm fills more than one role, you will need to list them in multiple roles.

Custom Fields

If you have not requested custom fields, you will not see this section. If you have requested custom fields, you will find your fields grouped in this section. To request custom fields, contact the Account Management team at TamaracAM@envestnet.com.

If you have mapped custom fields from Tamarac Reporting to Tamarac CRM and added them to your Financial Account custom form, you will see them in this section. Any mapped custom fields will bi-directionally update as soon as they are changed in either system.

For more information on mapping custom fields from Tamarac Reporting, see Custom Field Integration.

Administration

Select Administration to view the fields in this section. The Administration section allows you to enter details when a financial account is terminated.

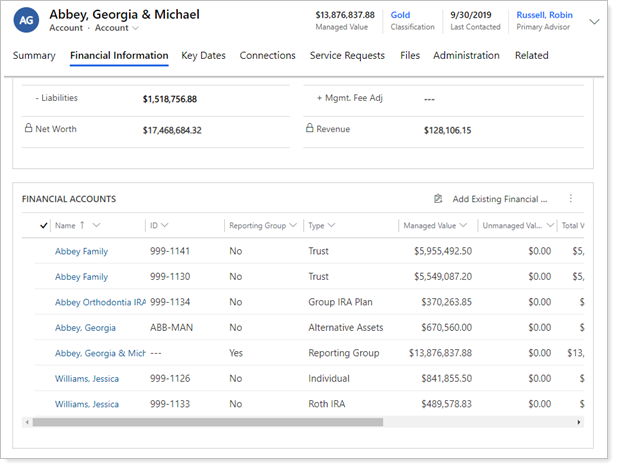

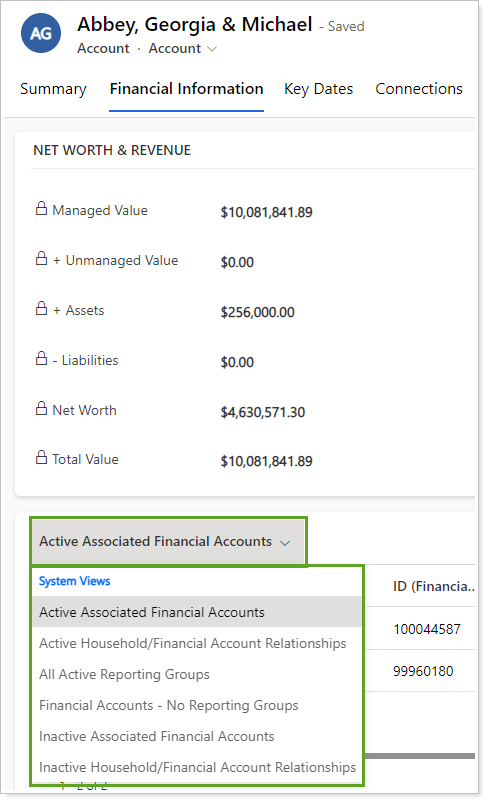

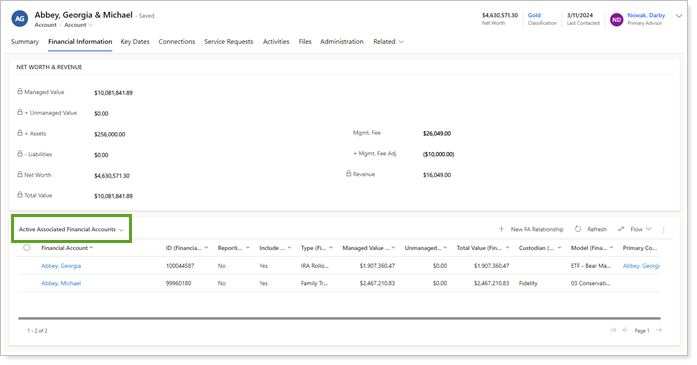

Financial Information

The Financial Information tab in Accounts automatically displays the Household/Financial Account Relationship for Active Financial Accounts as the default view. However, you can see other related views, such as:

-

All Active Reporting Groups

-

Financial Accounts – No Reporting Groups

-

Inactive Household/Financial Account Relationships

-

And more.

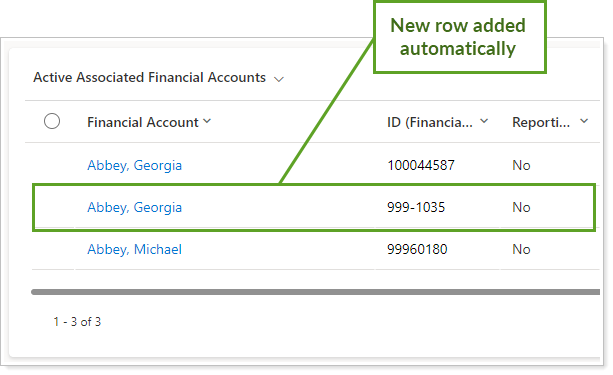

The sub-grid on the Financial Information tab shows the default Active Associated Financial Accounts view containing information related to the Financial Accounts associated to the Account. This shows all Household/Financial Account Relationship records related to active Financial Accounts related to the Account.

You can use additional views to see the following:

-

Active Household/Financial Account Relationships: All active Household/Financial Account Relationship records regardless of Financial Account status and if they are included in Net Worth related to the Account.

-

All Active Reporting Groups: All Household/Financial Account Relationships related to active Financial Accounts where they are marked as Reporting Groups related to the Account.

-

Financial Accounts – No Reporting Groups: All Household/Financial Account Relationship records for active Financial Accounts not marked as Reporting Groups related to the Account.

-

Inactive Associated Financial Accounts: All Household/Financial Account Relationship records for inactive Financial Accounts associated to the Account.

-

Inactive Household/Financial Account Relationships: All inactive Household/Financial Account Relationship records related to the Account.

See More Financial Account Information

In addition to views, expanded rows and Financial Account hyperlinks show you more relevant information, making it easier to manage your financial relationships.

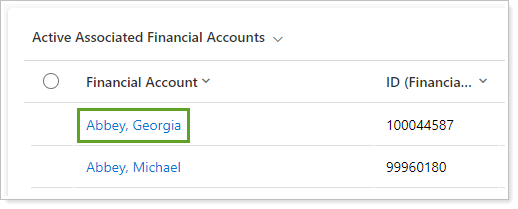

Open Financial Account Details

To see more details of the financial account, in the Account, under Financial Information, select the Financial Account name hyperlink.

Additional Financial Account Rows

When new Financial Accounts are added, new Household/Financial Account relationship records are created for each and added to the sub-grid. As additional Financial Accounts are added, more rows will automatically be added to your view.

Assign Financial Accounts

If you use both Tamarac Reporting and Tamarac CRM, the integration between the two systems can automatically link your financial accounts to the correct Households. This integration is enabled if you are using both Financial Account integration and Household integration. Please reference Enabling Integration for more detailed information on turning on the integration.

If your firm does not use integration to manage financial account membership, there is a one-time assignment that will need to occur for all new financial accounts. Please follow these steps once the financial account has been auto-created in Tamarac CRM.

Note

If you are currently in implementation, your implementation consultant will work with you to assign your existing financial accounts to their Account/Household in Tamarac CRM.

To assign a financial account to an Account/Household, follow these steps:

-

On the side menu, select Accounts under Clients.

-

Click to open the account that has a new financial account.

-

Click Financial Information and scroll down to find financial accounts.

-

Click Add Existing Financial Account.

-

Search for the financial account you want to add and select it.

Click All records to see more details about the accounts and groups. This will also allow you to change the view of the records you see in Lookup Records.

-

Click Add.

Creating Financial Accounts

Financial accounts are primarily created in Tamarac CRM through integration from Tamarac Reporting. Financial accounts can be manually created in Tamarac CRM.

The value of a manually created financial account will not be included in the Net Worth calculator on the account/household record. The managed value for accounts you create manually will be included in assets under management on the Firm Valuation report.

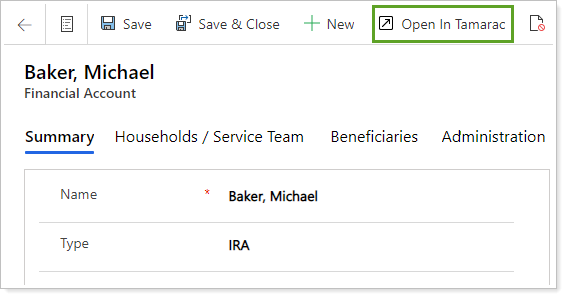

Contextual Single Sign-On

From Tamarac CRM, you can easily access more information about your financial accounts in Tamarac Reporting. Using the Open in Tamarac button automatically opens your Dashboard in Tamarac Reporting and uses contextual linking to display the most relevant data:

-

If the financial account was created from Tamarac Reporting, the Dashboard displays the financial account’s data.

-

If the financial account was manually created in Tamarac CRM, Tamarac Reporting searches for the corresponding financial account number and displays that data.

-

If no corresponding financial account number is available, your Tamarac Reporting Dashboard displays the most recently viewed account or group.

The contextual single sign-on can be initiated from an individual financial account record.