Contents

Reporting

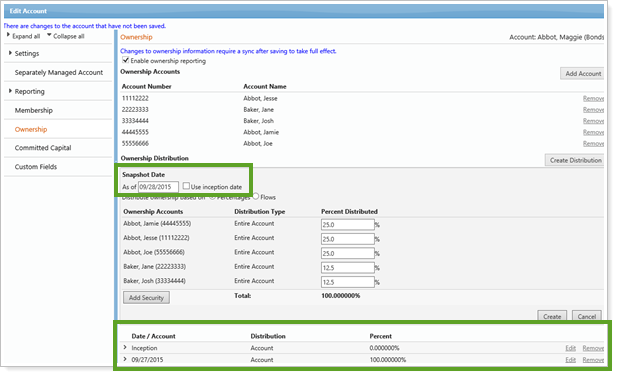

Set Partial Ownership for Accounts and Run Reports for Partial Owners

We're introducing a new and unparalleled level of reporting for accounts with multiple owners, such as trusts and investment partnerships. You can report on the current holdings for each partial owner and then build client views so those owners can see their reports at any time.

The following features help you manage the ownership accounts:

-

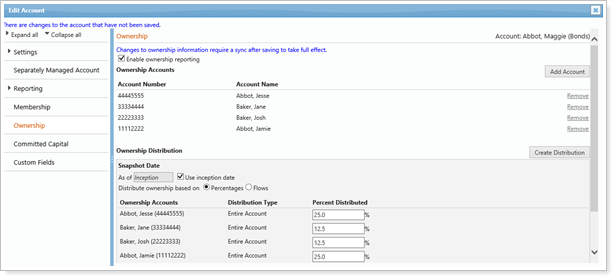

Set up and maintain ownership accounts.The Edit Account window has a new Ownership tab that allows you to add ownership accounts and set distribution percentages for ownership at the account or security level. Once you add an ownership account on this page and save it, the new account is immediately available for configuration on the Accounts page.

Note

There is no additional charge for ownership accounts.

-

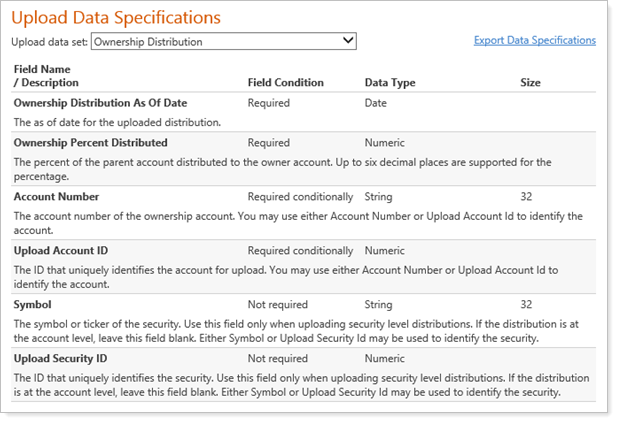

Upload ownership information.A new upload data set allows you to upload information related to ownership.

-

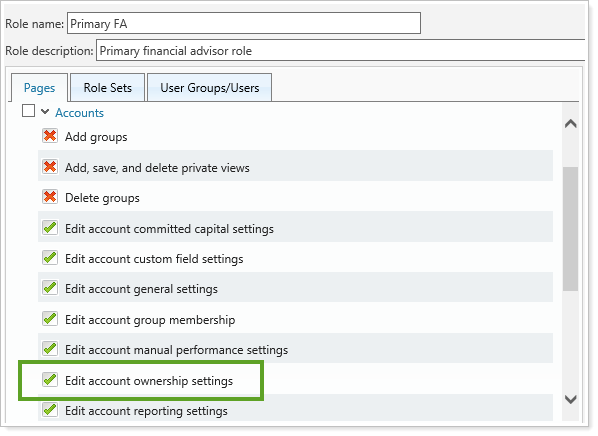

Permissions.You can control who creates and manages ownership accounts by managing roles on the User Management page.

Note

When this feature is enabled, your administrator will need to add Ownership permission for the appropriate users. For any new Accounts permissions assigned after that, it will be granted by default, although you can manually exclude the permission if desired.

-

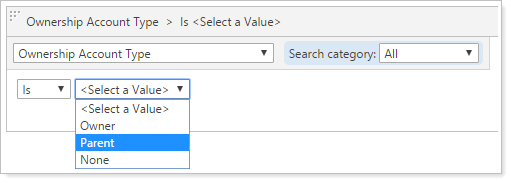

Saved Search options.A new Ownership Account Type saved search filter allows you to find ownership or parent accounts. Filtering out ownership accounts will allow you to maintain a clear picture of actual assets under your management.

This filter is available for the following search types:

-

Accounts

-

Accounts and Groups

It is also available for account set saved searches and composite saved searches.

-

-

Track history.You can see how the ownership of a parent account has changed over time by reviewing previous distribution snapshots. Snapshots are created when you set an As of date for your updates.

Important

Once you enable this feature, it cannot be disabled.

Our Introduction to Percentage Ownership video provides more details about this feature.

To enable this feature, contact your Tamarac Service Team.

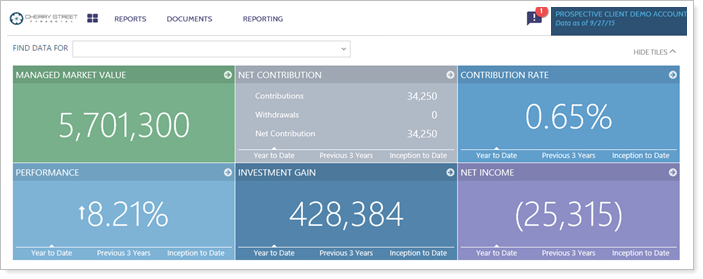

Create Generic Demonstration Accounts and Client Portals

We're excited that the new Ownership feature provides functionality that many of you have requested—you can now create realistic accounts to use for demonstrations. They will be based on actual assets under your management and you'll never have to worry about compromising your clients' confidentiality since new ownership accounts are created with no client-identifying data.

You can customize these accounts for specific clients, or you can set up general examples to highlight your firm's strengths. You can then give prospective clients access to generic client portals that match their interests or needs. For example, the client portal could contain accounts which highlight a specific investment strategy or focus on a specific account size. Account size is easily adjusted by choosing a smaller or greater percentage of the parent account—this proportional strategy maintains a true representation of actual investment results, allowing you to create accurate and relevant examples.

Example

A prospective client has a conservative risk tolerance. You have an account with a conservative investment strategy that has performed well and demonstrates why your firm would be a good match for the client. In order to convince the client, you create an ownership account based on that account and adjust its percentage to match the prospective client's potential investment amount.

The resulting ownership account will help you show your prospective client a realistic and customized picture of what your firm can provide.

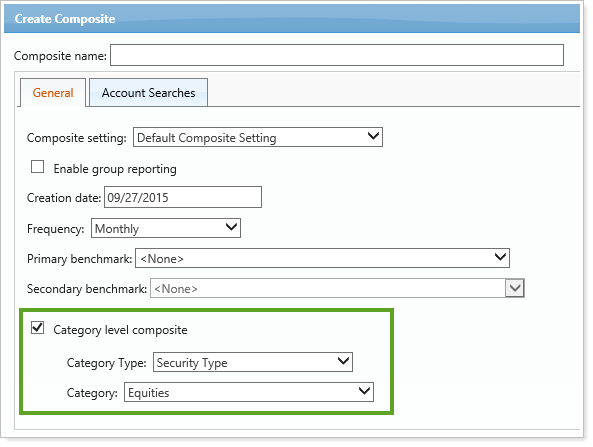

Set Category Level Data for Composites

We're continuing to expand your report options, and you can now determine the level of data shown for composites on your reports.

You can show account level data on your reports as before, or you can now choose to show category level data instead (e.g., asset class). You can set the specific category and category type when you create the composite.

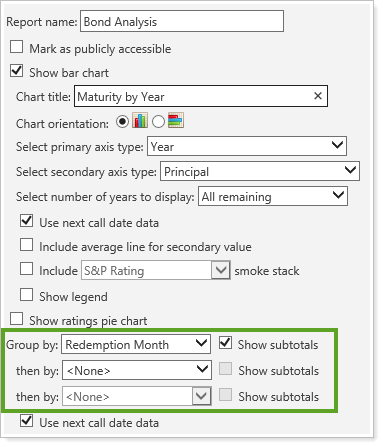

Group and Sort Options Added to the Bond Analysis Report

New sorting options for the Bond Analysis report allow you to sort by up to three levels for the Group by settings, giving you greater control over how positions are displayed on your reports.

We also added Redemption Month as an additional option for this report, so you can now group by Redemption Month, along with Redemption Year and other existing options.

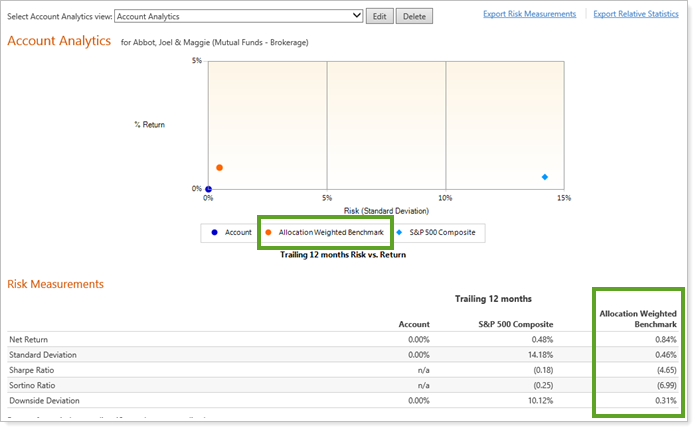

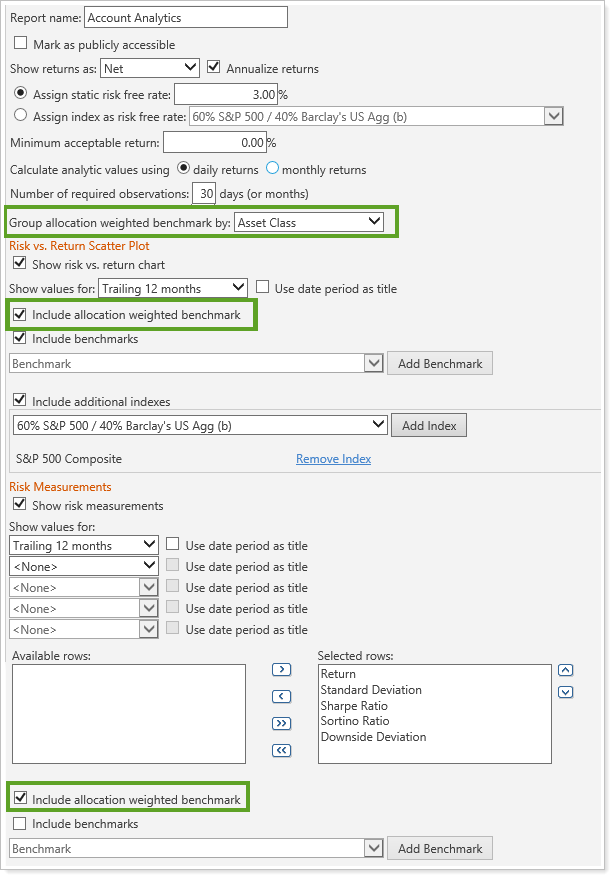

Include Allocation-Weighted Benchmark for Account Analytics Report

The allocation-weighted benchmarks you've used for the Account Performance report and for your PDF templates can now be added on your Account Analytics reports as well.

When you edit your reports, they can be added to both dynamic and PDF reports, including the PDF Dashboard.

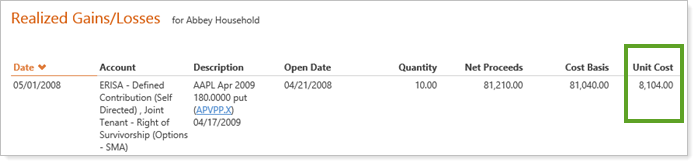

New Unit Cost Column on the Realized Gains/Losses Report

You can now see a Unit Cost column on the Realized Gains/Losses report. This column is available for both the dynamic and PDF versions of the report, including the dashboards—and it is also available in client views that include the Realized Gains/Losses report.

PDF Reports

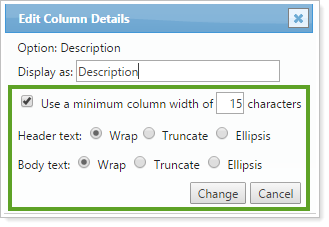

Set Custom Column Widths for Additional PDF Reports

In September 2015, we introduced the ability to adjust column widths for PDF reports so you could improve the appearance of your reports. You can fit more on the page by adjusting the column widths, and can reduce potential rendering errors by ensuring your columns fit within the page margins. Previously, it was only possible to set custom column widths for the Account Ledger, Comparative Review, Holdings, and Transactions Reports.

We've expanded the number of PDF reports that allow custom column widths and they now include:

-

Bond Analysis

-

Unrealized Gains/Losses

-

Realized Gains/Losses

-

Position Performance

-

Income and Expenses

-

Performance History

-

Projected Income

You can choose how your text will be displayed if your column width is narrower than your text. It can:

-

Wrap. The row height will be increased so that you can see all the text.

-

Truncate. The text will be cut off at the minimum width you set.

-

Show an ellipsis. You'll see an ellipsis after your truncated text to indicate there's more text than what is shown.

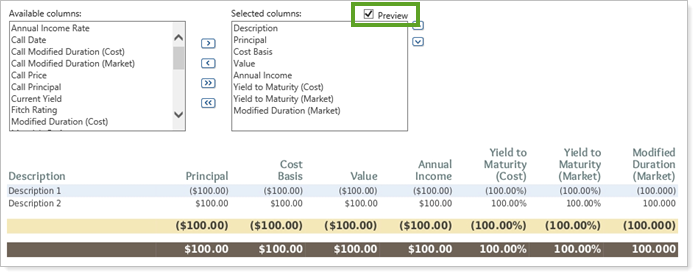

Once you enable minimum column width and click Change, you will have additional settings options—including an easy-to-use preview that allows you to see how your column widths will appear when you run your reports, or even see how a different theme would look.

Bulk Reports

Specify Column Names and Bulk Report Types in the Bulk Report API

Some of you have taken advantage of our Bulk Report API and have built your own application that allows your vendors, or others who don't have access to our Advisor Xi® suite, to:

-

Schedule reports to run on a daily basis

-

Export data to other systems

Previously, you were limited to bulk reports you had built in Advisor View or Advisor Rebalancing. However, with this release, the functionality of the Bulk Report API has been expanded. Along with running existing bulk reports, you can now also dynamically build reports, specifying column names and bulk report types. Please contact Account Management if you'd like to take advantage of this new feature.

To learn more, please search for Bulk Reporting API Master Article in the Support & Training Center.

Security

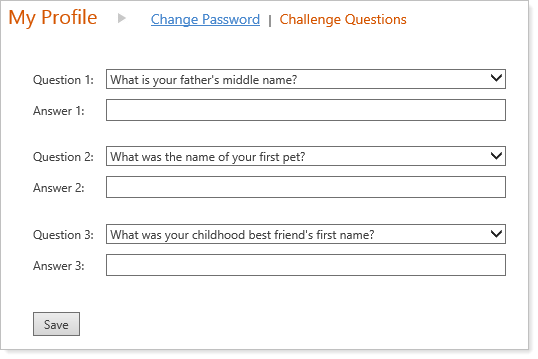

New Authentication Challenge Questions

We heard from a few of you that it wasn't always easy to remember the answers to our authentication questions. In order to make it simpler to sign in, we added some additional challenge questions:

-

What is your father's middle name?

-

What is the first name of your first boyfriend or girlfriend?

-

What is your spouse's middle name?

-

What was the name of your first pet?

-

What is your mother's middle name?

-

What was your childhood best friend's first name?

Learn More - Watch the Release Video

.