Contents

Introduction

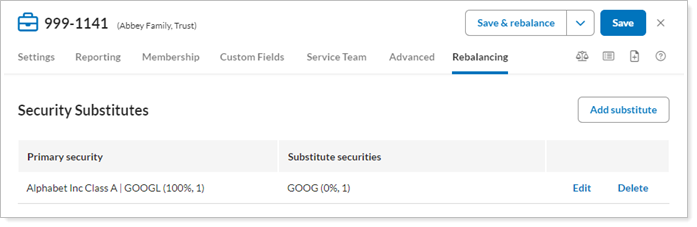

You can apply substitutes at the account level to make sure the substitute is suitable for the specific account. When you need to assign substitute securities for an account, you can use the Security Substitutes panel.

On this panel, you can add, edit, or delete security substitutes for an account.

For account-level security substitutes, the following rules apply:

-

You can't add a security as a primary more than once in an account. For example, you can't add MSFT as primary two times in one account, but you can add multiple substitutes to the MSFT primary security.

-

Two securities cannot have the same substitute in the account. For example, if GOOG substitutes for IBM, you can't add GOOG as the substitute for FB in the account as well.

-

You can't add cash (ticker $$$) as a primary or secondary security.

-

You can apply account-level security substitutes to financial accounts, sleeve accounts, and ownership accounts, but not to groups. Sleeve accounts and ownership accounts do not inherit account-level substitutes from parent accounts.

-

If a security has a substitute configured at the security level and at the account level, the account-level substitute overrides the security-level substitute.

For more information about when to use global or account-level substitute securities, see Security Substitutes.

Security Substitute Settings

You can access the Security Substitutes panel under Accounts. Click on the account you want to edit. Under Rebalancing, click Security Substitutes.

The following account configuration settings are available when you click Add Substitute:

-

Primary Security: Set the ticker for the security you want to use as the primary, or parent, security. This is the security that the substitute will replace.

-

Substitute Security: Set the ticker for security you want to use as the substitute security.

-

Rank: Specify the rank you want for the primary and substitute securities.

-

Target (%): Specify the target allocation for the primary and substitute securities.