Contents

Sell Based on Tax Optimization

Advisor Rebalancing now gives you the option to sell securities in the most tax efficient way possible. When you select this option, Advisor Rebalancing will temporarily ignore model ranks and rebalance to your investment targets at the lowest possible tax cost to the client.

To create tax optimization, Advisor Rebalancing will ignore any ranks and sell in the following order:

-

Losses

-

No tax consequences

-

Gains

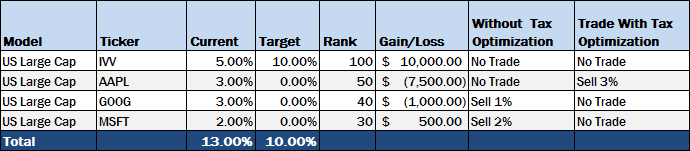

Example:

In the example above, when using tax optimization, Advisor Rebalancing will sell AAPL because it has the greatest loss. Without tax optimization, Advisor Rebalancing will use ranks and sell the lowest ranked securities first until it reaches the target for the model.

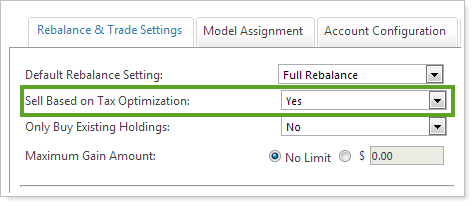

To enable this new feature for an account, click Account Settings on the Accounts menu. On the Rebalance & Trade Settings tab, click Yes for Sell Based on Tax Optimization.

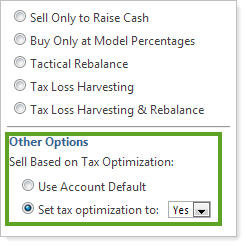

If you want to sell based on tax optimization for a single rebalance only, you can also set your preference on the Set Rebalance Settings dialog.

Set the Current Rebalance Type on the Account Settings Page

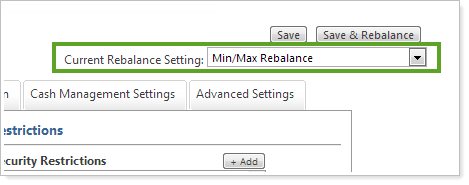

Sometimes when you're on the Account Settings page you may want to rebalance an account using a non-default rebalance setting. With this scenario in mind, you can now set the current rebalance setting on the Account Settings page.

Advisor Rebalancing will use the rebalance setting you select in the Current Rebalance Setting list when you click the Save & Rebalance button. Advisor Rebalancing will reset this value to the default rebalance setting at the end of day.

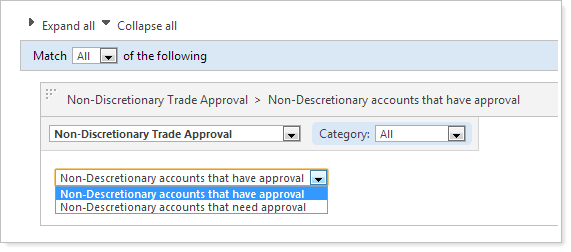

Quickly Find Non-Discretionary Accounts That Require Trade Approval

In the February 2013 release of Advisor Rebalancing, we released a powerful new safeguard that prevents rebalanced accounts from being sent to the Trade List until you receive authorization. In this release, we've added a new saved search filter that makes it easy to find non-discretionary accounts that require trade approval.

To add this filter to a saved search, click Add Filter on the Saved Searches page. In the list of search filters, click Non-Discretionary Trade Approval.

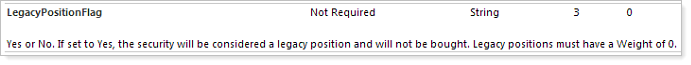

Designate a Legacy Position When Uploading Alternate Security Sets

In our last release, we made it easier to set up and maintain legacy positions. In this release, we've made the process even easier by allowing you to designate legacy positions in the Alternate Security Sets data set.

To take advantage of this new feature, simply add LegacyPositionFlag with the value of Yes or No to your Alternate Security Sets upload data set.

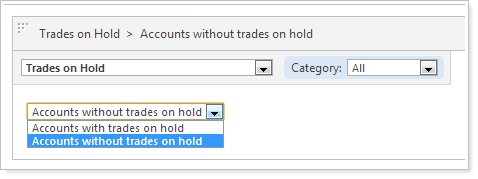

Find Accounts With or Without Trades on Hold

Finding accounts with trades on hold is now easier. With this release, you can quickly identify accounts with or without trades on hold.

To add this filter to a saved search, click Add Filter on the Saved Searches page. In the list of search filters, click Trades on Hold and specify the appropriate criteria.

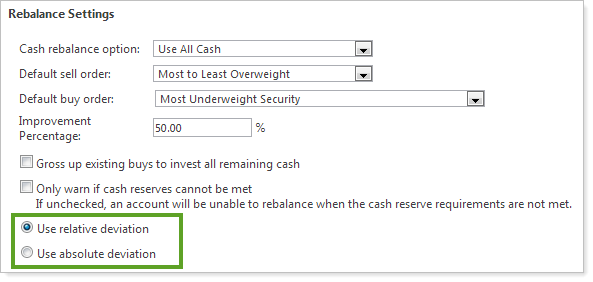

Use Relative or Absolute Deviation for Rebalances

Over the years, a few of you have asked to use relative deviation for rebalances. For example, let's say you have a fixed income model that's holding 45 percent and a large cap model that's holding 6 percent. The target for the fixed income model is 50 percent and the target for the large cap model is 10 percent.

When you perform a buy only to invest cash rebalance on this account using absolute deviation, Advisor Rebalancing will buy in the fixed income model because it has the larger absolute deviation. If you use relative deviation and perform a buy only to invest cash rebalance on this account using relative deviation, Advisor Rebalancing will buy in the large cap model because it has a greater relative deviation.

| Model | Current | Target | Absolute Deviation | Relative Deviation |

|---|---|---|---|---|

| Fixed Income | 45% | 50% | 5% | 10% |

| Large Cap | 6% | 10% | 4% | 40% |

To enable this option, on the Setup menu, click System Settings. Under Rebalance Settings, click Use Relative Deviation.

In addition, we also added a Difference Percent (Relative) column and a Difference Percent (Absolute) column to the Trade Summary page.