Contents

|

Directed Trades with Substitute Securities Set Upper and Lower Thresholds for Each Cash Reserve Specify Fund Redemption Fees by Custodian |

Directed Trades with Substitute Securities

When placing a directed trade for a security with security restrictions, Advisor Rebalancing can now perform the trade action using substitute securities if substitutes are available for the security and you have enabled this new option.

For example, assume IBM and MSFT are substitutes for AAPL with the following goals, ranks, and amounts held:

| Security | Rank | Goal | Amount Held |

|---|---|---|---|

| AAPL | 3 | 100% | $10,000 |

| MSFT | 2 | 0 | $10,000 |

| IBM | 1 | 0 | $10,000 |

If you create a directed trade to sell 50 percent of APPL, the directed trade would result in selling $5,000 of APPL without this new option enabled. With the option enabled, the directed trade would result in selling $10,000 of IBM and $5,000 of MSFT (the lowest ranked substitutes), for a total of $15,000 – half of the sum of APPL and its substitutes.

Conversely, a directed trade to buy a security with restrictions may result in purchasing the security's substitute if possible.

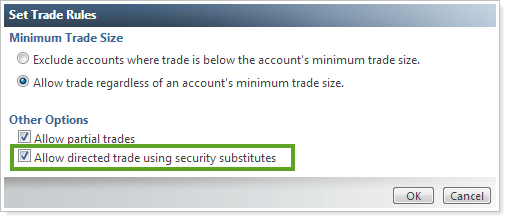

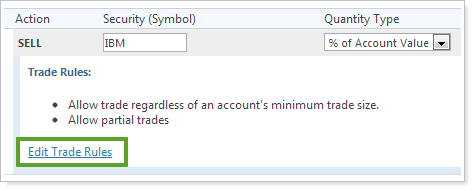

To use substitute securities for directed trades, click Edit Trade Rules for the directed trade. In the Set Trade Rules box, select the Allow directed trade using security substitutes check box.

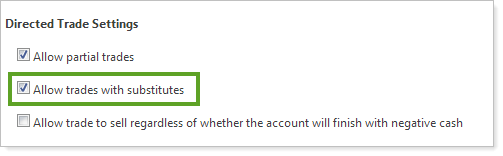

If you want to enable this option for all directed trades, on the System Settings page, click Allow trades with substitutes.

Improved Web Browser Support

Advisor Rebalancing now supports the following Web browsers:

| Operating System | Supported Web Browsers |

|---|---|

| Windows 8 | Internet Explorer 10, Firefox, Google Chrome |

| Windows 7 | Internet Explorer 8, Internet Explorer 9, Internet Explorer 10, Google Chrome, Firefox |

| Windows Vista | Internet Explorer 8, Internet Explorer 9, Firefox |

| Windows XP | Internet Explorer 8, Internet Explorer 9 |

| Mac OS | Safari |

Set Upper and Lower Thresholds for Each Cash Reserve

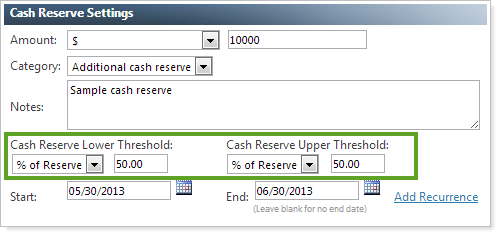

Many of you use upper and lower tolerance thresholds to maintain your cash reserves. However, some of you asked for some additional flexibility in specifying the thresholds. You told us you wanted to set unique thresholds for each cash reserve. We've listened to your feedback and have implemented your suggestions.

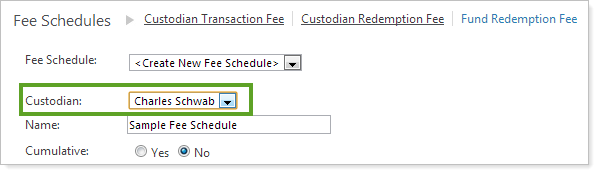

Specify Fund Redemption Fees by Custodian

With this release, you can now specify a different fund redemption fee for each custodian. Before this release, Advisor Rebalancing only supported setting a fund redemption fee for all custodians.

To see this new functionality, click Fee Schedules on the Setup menu, and then click Fund Redemption Fee. Use the Custodian list to specify a custodian or click All Custodians to specify a fund redemption fee for all custodians.

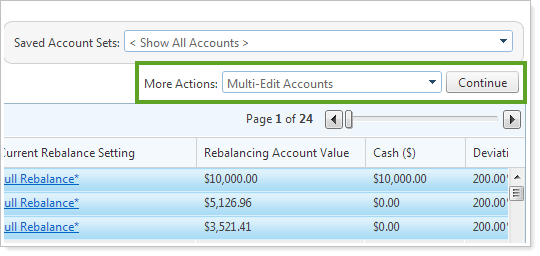

Quickly Send Accounts to Account Multi-Edit

Sometimes when you're working on the Rebalance and Rebalance Review pages, you may want to quickly make changes to the settings for the selected accounts or all accounts within a particular rebalancing group . With this in mind, you can now easily send your accounts to the Account Multi-Edit page from the Rebalance and Rebalance Review pages.

To take a look at this new feature, on the Rebalance and Rebalance Review pages, simply select the accounts or rebalancing groups you want to send to the Account Multi-Edit page. In the More Actions list, click Multi-Edit Accounts and then click Continue.

Usability Enhancements

We've made the following changes to make Advisor Rebalancing as easy to use as possible:

-

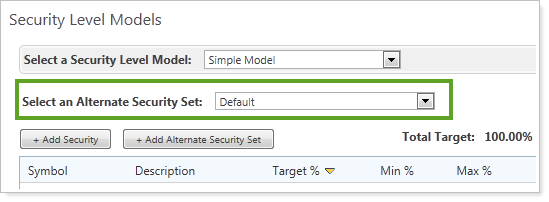

If you haven't created an Alternate Security Set for a Security Level model, Advisor Rebalancing will now hide the Select an Alternate Security Set list on the Security Level models page.

-

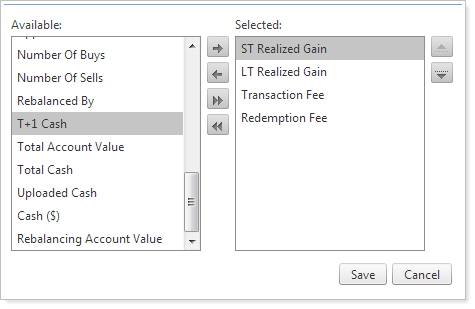

We've added Long-Term Realized Gain, Short-Term Realized Gain, Transaction Fee, and Redemption Fee columns to the Rebalance Review page.

-

Security Level models that do not have an assigned Alternate Security Set will also show as N/A on the Model Assignment page.