Contents

Rebalancing & Trading

Negative Value Positions Now Available

We know some of you use strategies with your clients that depend on holding securities with negative values, such as short positions and options. Previously, you couldn't see these positions in Advisor Rebalancing.

With this release, we're pleased to share that Advisor Rebalancing can now support positions with negative values. In addition, we're adding additional features to help protect any long positions you have with corresponding negative value positions. These changes allow you to see a fuller and more accurate picture of your clients' holdings. Clients' holdings in Advisor Rebalancing will also more accurately reflect those seen in Advisor View or in your portfolio accounting system.

Enabling Negative Value Positions

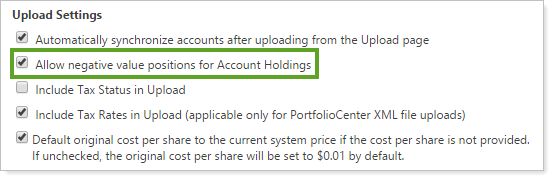

To enable negative value positions in client accounts, we added the Allow negative value positions for Account Holdings option in the Upload Settings section of the System Settings page.

Adding Negative Value Positions

If you use Advisor View and have negative value positions enabled in Advisor Rebalancing, you can now see any negative value positions that appear in Advisor View when you view client holdings, a client's Rebalance Summary, and other reporting in Advisor Rebalancing.

You can also add negative value positions into clients' accounts through upload; the new IsLongPosition field allows you to indicate whether a position is long or short.

Viewing and Using Negative Value Positions

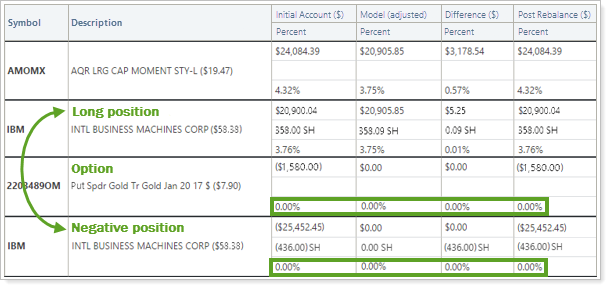

Once enabled, negative value positions will appear separately from any corresponding long positions; on the Rebalance Summary, negative value positions will appear on a different line from long positions with the same ticker. Negative value positions will not contribute to any totals on the Rebalance Summary, including Rebalancing Account Value and Total Account Value.

You will not be able to trade negative value positions in Advisor Rebalancing. This includes trading using custom strategies, quick trades, and directed trades.

Negative value positions will have these characteristics:

-

Initial Account and Post Rebalance values will always appear as 0%.

-

Negative values are excluded from the Dashboard AUM as well as other dashboard widget reports.

Long positions with the same ticker as a negative value position will receive the following treatment in your clients' accounts:

-

Securities are automatically put on hold; Advisor Rebalancing will warn you about this hold restriction during rebalances and directed trades.

-

You can trade these positions using a custom strategy, and a restriction override won't be required.

While these long positions aren't fully restricted, the additional hold restriction provides protection against trading away a long position covering a negative value position when that's not desired.

Improved Trading Logic to Prevent Wash Sales in Dividend Reinvestments and Tax Loss Harvesting

We've made improvements to help you better serve your clients with tax-sensitive accounts. Previously, Advisor Rebalancing offered tools to help you prevent wash sales in your clients' accounts. In a few cases, it was possible for some recommended trades to cause unintended wash sale rule violations.

To prevent this, we've improved trading logic for dividend reinvestments and in tax loss harvesting rebalances, so you can more reliably avoid violations of the wash sale rule:

-

Dividend reinvestmentWe've changed how your accounts treat dividend reinvestments. Buys created through dividend reinvestment will be treated like any other buys, and you'll be warned about potential wash sale rule violations. You'll also be able to see dividend reinvestments in the Recent Sells & Buys section of the Account Settings page.

-

Tax Loss HarvestWe've changed tax loss harvesting rebalance logic so that the rebalance considers the account-level setting to either allow or prevent wash sales. If the account doesn't allow wash sales and the position isn't being fully liquidated, you'll be warned about potential wash sale rule violations. If you are liquidating the entire position, the wash sale rule won't apply.

Dashboard

Add Direct Page Links and View Underlying Accounts in Some Dashboard Widgets

After adding new dashboard features in May 2016, we heard feedback from many of you that you'd like us to expand the capabilities of these widgets and make them even more customizable.

We're pleased to announce that we've added two features to your Dashboard widgets. First, you now have the ability to set page links for some of the widgets. Second, you can view underlying accounts immediately on some widgets, without having to navigate away from the Dashboard. These new features allow you to quickly take action and work more efficiently.

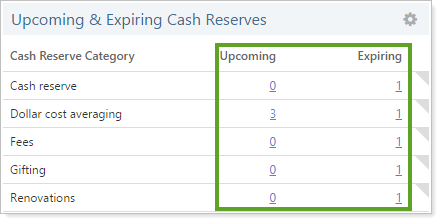

The following widgets now allow you to add page links and view accounts:

| Widget | Add Page Links? | View Underlying Accounts? |

|---|---|---|

| Saved Searches | Already available | Yes |

| Models & Categories | Yes* | Yes |

| Upcoming & Expiring Cash Reserves | Yes | Yes |

| Securities | Yes* | Yes |

| *To see page links, include the Accounts or Groups columns within the widget settings. | ||

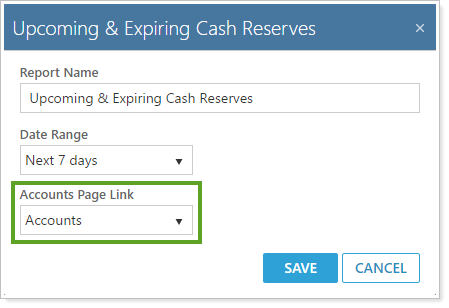

You can add links to the results you see on the widget with the new Account Page Link option.

Once set, links will display on the widget, allowing you to jump directly to your desired page for further action. Once there, the page you chose will be filtered by a custom account set based on the results in the widget.

In addition, you'll now be able to view underlying accounts from these widgets immediately, without having to navigate away from the Dashboard. To view underlying accounts, click the ![]() icon.

icon.

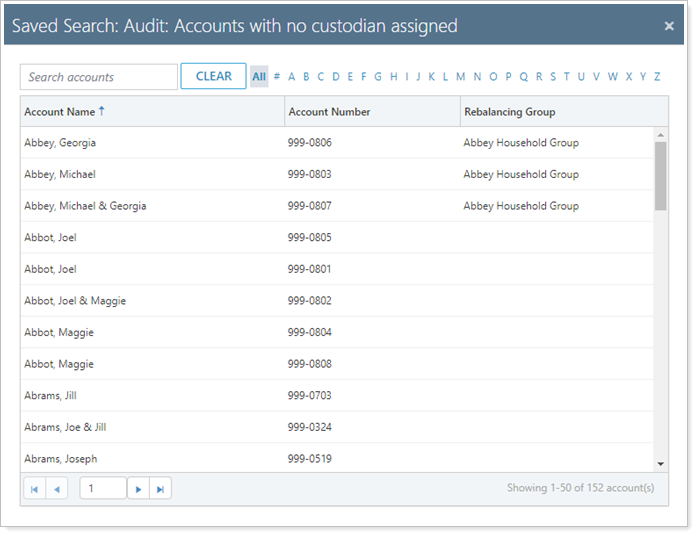

A dialog box then opens, allowing you to view and search within the underlying accounts.

Integrations

New Pershing EOD Mutual Fund Trade File Now Available

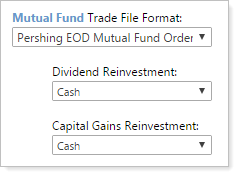

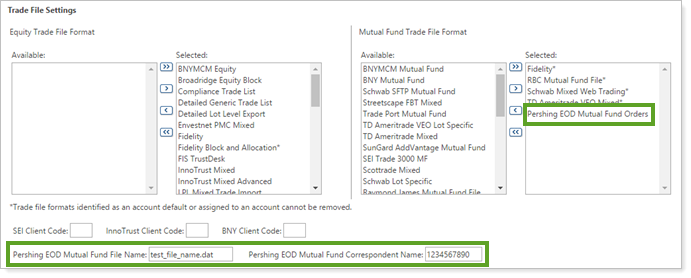

We've added a new Pershing trade file called Pershing EOD Mutual Fund Orders, which offers an additional option for trading mutual funds with Pershing. When you assign this trade file to an account in Account Settings, you can specify if you'd like to handle Dividend Reinvestment and Capital Gains Reinvestment in either Cash or Shares.

To accompany this trade file, we've also included two new fields on the System Settings page. Contact Pershing to find out more about how to configure the Pershing EOD Mutual Fund File Name and Pershing EOD Mutual Fund Correspondent Name fields.

Note

The Pershing EOD Mutual Fund Correspondent Name field must be 10 characters long. If you are given a name that is less than 10 characters long, enter spaces for the rest of the characters.

Improved Schwab Trade Files Now Allow Fractional Shares

For those of you who trade with Schwab, we've improved the functioning of two trade files: Schwab Web Block Trading and Schwab Allocation Web Trading. Both of these trade files will now support fractional shares, often the result of dividend reinvestments. This will make trades in, and liquidations of, these positions more precise.

Advisor OMS

Improved Pro-Rata Allocation Logic for Remaining Shares

Those of you who use Advisor OMS for trading will be pleased to know that we've improved how Advisor OMS treats partial allocations. Previously, when a trade in Advisor OMS couldn't be fully filled, Advisor Rebalancing would distribute shares equally on a pro-rata basis among the accounts. Advisor Rebalancing would then allocate any remaining shares first to accounts where the security has the greatest deviation from its target. In some cases, this could cause one account to get full allocation while other accounts were only partially allocated.

Since we know equitable treatment for all accounts is important, we've improved how these remaining shares are disbursed to their accounts.

Now we use this logic to allocate the remaining shares:

-

Shares are first allocated on a pro-rata basis, rounding down, if needed.

-

Advisor Rebalancing creates an order of the accounts, starting with the account furthest from full allocation and ending with the account closest to full allocation. This is calculated on a percentage basis (Allocated Shares / Allocation Quantity).

-

Remaining shares are allocated one at a time, starting at the top of the list, until there are no more shares to be allocated.

This improved logic ensures your Advisor OMS trades are allocated equitably.

Usability

Support Added for Microsoft Edge Browser

Since the release of Windows 10, we've been conducting extensive testing and are now adding Edge to the list of officially supported browsers for the Advisor Xi® Suite.

Learn More - Watch the Release Video