Contents

Introduction

You can include a single security multiple times within an Allocation model. If you include the same security in more than one model within an Allocation model, Tamarac Trading will split the initial and post rebalance allocation proportionally based on the security's target.

Initial and post-rebalance allocations are always allocated pro-rata based on the model weights to all the models that hold that security. Any proposed trades are netted against one another so that only one order is created per security. To view the individual trades per Security Level model, the Rebalance Summary should be grouped by Model. When grouped by Class, trades will be displayed per security.

This feature only applies to goal-based models.

See Overlapping Securities in Models in Action

The following example illustrates how overlapping securities in models behave:

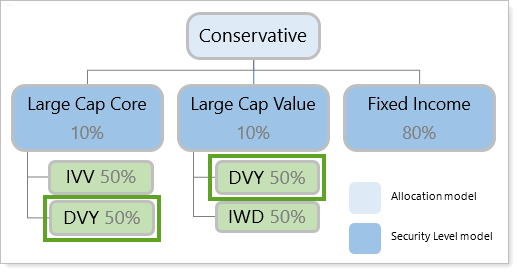

You created the following allocations for the Conservative Allocation model:

As you can see, DVY is allocated to two Security Level models, 50% to Large Cap Core and 50% to Large Cap Value.

A new account is assigned to Conservative and is uploaded with an allocation of 12% to DVY. The initial allocation will be split by 50%, allocating 6% to Large Cap Core and 6% to Large Cap Value.

You rebalance the new client's account. Tamarac Trading proposes a sell of 1% in both models, but only one trade will go on the trade file. The trade would be the net action of all recommended trades for DVY, in this case, a sell of 2% of DVY.