A blended benchmark that adjusts its blend each day based on the value of account holdings in each category, such as asset class, security type, and sector. You can add allocation-weighted benchmarks to the dynamic Account Performance report and your PDF templates.

Allocation weighted benchmarks are useful for very diversified accounts that cannot be easily benchmarked with an index or blended indexes.

The calculation uses the beginning account value and accounts for any flows, then multiplies by the benchmark amount. This ensures performance is accounted for only once, by the benchmark.

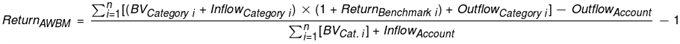

Allocation weighted benchmark is calculated:

where n = number of categories and BV = beginning value.

See also: