Contents

How Group Allocation Weighted Benchmark By Works

| Applies to: | ||

|---|---|---|

| ✔ Dynamic |

✔ Client Portal |

|

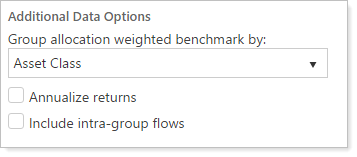

This setting allows you to choose which category of allocation weighted benchmark is used in the return calculations.

The categories available are determined by your firm. For more information on setting up categories, see Security Categories.

In Dynamic Reports

If you choose a category that does not have an allocation weighted benchmark assigned to it, no benchmark will be displayed and the following footnote will be added to the report.

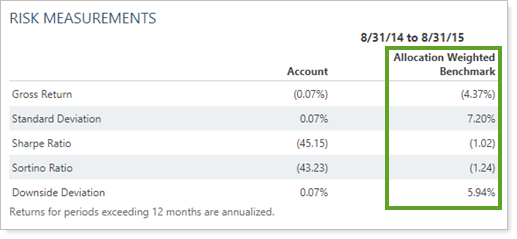

You will only see the selected allocation weighted benchmark if you select the Include allocation weighted benchmark check box.

For example, if you set Group allocation weighted benchmark by to Asset Class, statistics for the allocation weighted benchmark assigned to the selected category are shown.

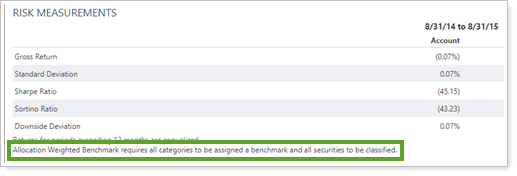

When you set Group allocation weighted benchmark by to category with no benchmark assigned, or OR when Include allocation weighted benchmark is not selected, the report displays no statistics for allocation weighted benchmark.

Note the footnote at the bottom, which states: Allocation weighted benchmark requires all categories to be assigned a benchmark and all securities to be classified.

In PDF Reports

Functionality is the same in the PDF report templates as in dynamic reports.

In the PDF template, make sure to select the Include allocation weighted benchmark option in whichever of the report sections—Risk vs. Return Scatter Plot, Risk Measurements, or Relative Statistics—you want to display the sorted allocation weighted benchmark.

In Client Portal Reports

An allocation weighted benchmark is a blended benchmark that adjusts its blend each day based on the value of account holdings in each category, such as asset class, security type, and sector. You can choose how your location weighted benchmarks will be grouped on client portal reports.

Reports With This Setting

Performance ReportsFinancial Planning Reports