Reconciliation tolerances are used in automatic reconciliation and serve as thresholds when comparing your trade orders with the actual trade executions from your portfolio accounting system. Percent of Transaction Amount lets you set an upper and lower threshold when Tamarac Trading compares the total dollar amount of orders to trade executions, including any fees applied to the trade. For example, a 1% tolerance would auto-reconcile trades where the total amount of the trade is within 1% of the actual transaction amount.

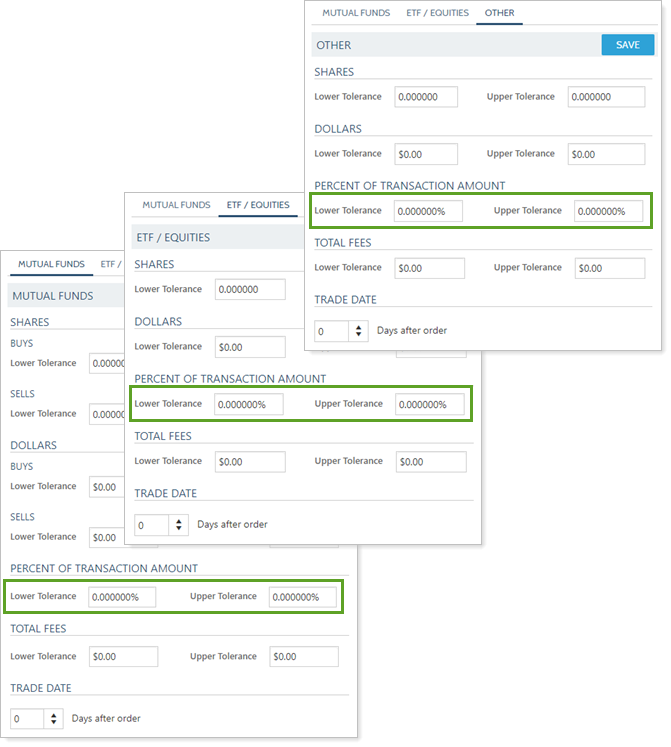

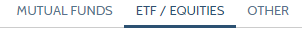

You can set separate reconciliation tolerances, including tolerances for Percent of Transaction Amount, for different security types on separate tabs of the Reconciliation Tolerances page. These are the security types available:

-

Mutual Funds.For mutual funds, as long as any of the tolerances match, with the exception of Trade Date and Total Fees, the trade will auto-reconcile.

- ETFs and Equities.For ETFs and equities, as long as one field matches exactly, in either the Shares or Dollars fields, differences in other fields are ignored and the transaction will auto-reconcile.

-

Other.The other category is most often used for dummy tickers.

IMPORTANT

If you navigate to a different security type page—for example, clicking ETF/Equities while on the Mutual Funds page—your changes will not be saved.

After you submit orders, reconciliation occurs the following business day. Tamarac Trading uses each of your tolerance settings—in addition to account number, trade type, and symbol—to determine which trades can be automatically reconciled. Those trades that fall outside of the tolerance settings can be manually reconciled.

Best Practices

-

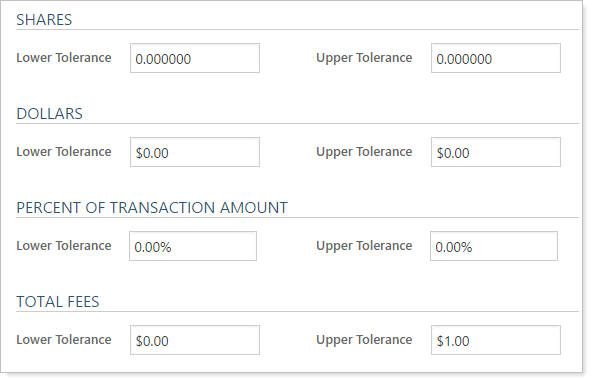

Leave all Shares and Dollars fields at 0, your Percent of Transaction Amount fields as 0, and use $1 for Total Fees tolerances. This ensures that those transactions that are truly accurate will auto-reconcile. If problems arise in future reconciliation, you can identify them early and adjust accordingly.

-

In general, equities trades should match share-for-share while mutual funds trades should match dollar-for-dollar.

Learn More

For more information, see the following: