Back

Back

Back Back |

|

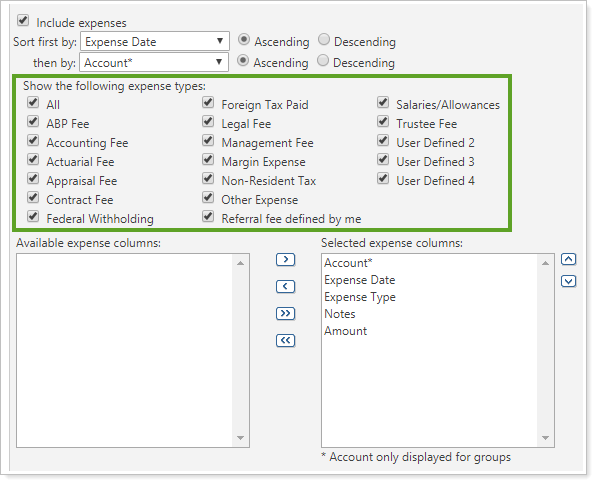

Show the Following Expense Types

| Applies to: | ||

|---|---|---|

| ✔ Dynamic |

✔ Client Portal |

|

This setting allows you to choose which expense types appear on the Income and Expenses report.

Use this setting to help focus the Income and Expenses report. For example, rather than seeing all the available expense types, you can create a report just to see management fees, and another report just to track withholdings and tax-related expenses.

The following types are available:

|

|

|

You can set up four custom user-defined expense types in PortfolioCenter and then filter by them on the report. Examples of user-defined expense types could be Separate SMA Fees or Non-Performance Reducing.

All the fee types are selected by default.

Clear the check boxes next to fees you want to exclude.

Clear the All check box to clear the check boxes next to all the expense types at once.

Select the All check box to select the check boxes next to all the expense types at once.

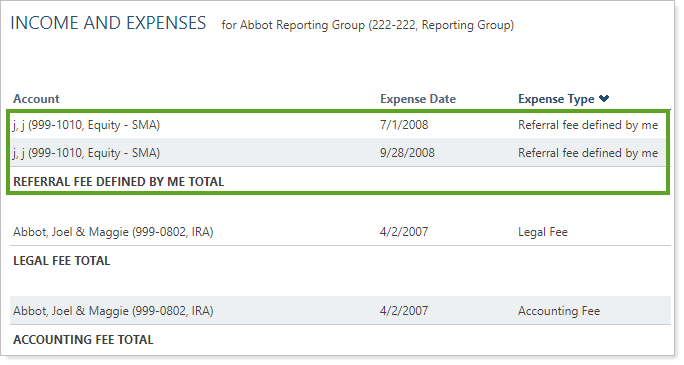

For example, when you select All, the report displays all the expense types. Each one is displayed in its own section, with a subtotal for each section.

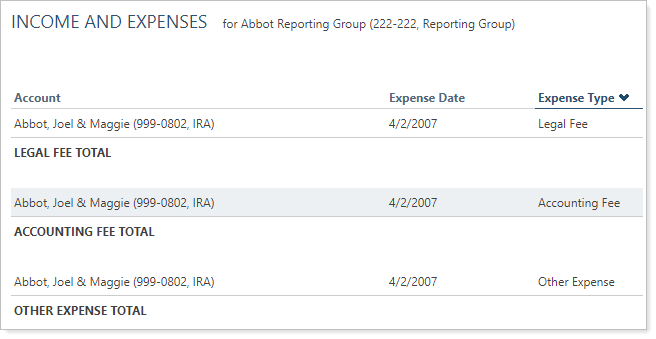

In the previous example, one user-defined expense type was Referral fee defined by me. When you clear the check box next to Referral fee defined by me, you see:

Functionality is the same in the PDF report templates as in dynamic reports.

The following settings are related: