The Straight Line method calculates an evenly distributed amortization or accretion schedule across the life of the bond, spreading the premium or discount amount evenly over all periods. You can use this method with fixed income, and mortgage-backed securities.

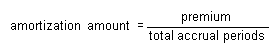

Amortization Amount

Tamarac Reporting uses this formula for amortized amount per period:

Remember, the premium (or discount) is the difference between what you paid for a bond and the total of all amounts (minus qualified stated interest) payable on the bond through redemption. For example, if you pay $1,025 for a $1,000 maturity bond, your premium is $25.

Total Accrual Periods

Total Accrual Periods is number of standard length adjustment periods from acquisition to redemption. It is determined by the amortization frequency in the security type settings and the day type and redemption date for the security.

Exceptions

The fixed income security details has an Amortize To setting where you can tell Tamarac Reporting whether to amortize to the maturity date, call date, or pre-refund date. This setting determines the maturity date used in these calculations for Fixed Income. If you set the security to use the call date or pre-refund date but the security does not have those dates defined, Tamarac Reporting uses the maturity date.

To learn more about amortization in Tamarac, see Amortization and Accretion Report and Set Up Securities and Accounts for the Amortization and Accretion Report.

To set amortization method for a security category, use Amortization Method.