Contents

Reporting

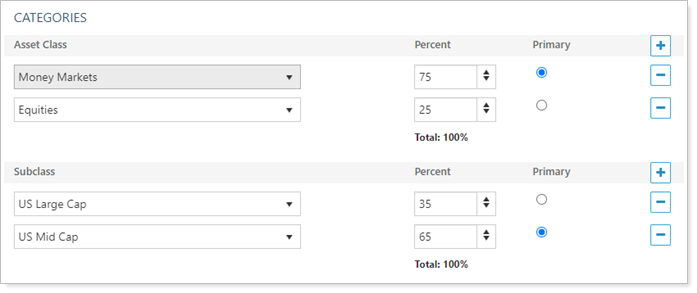

Assign Multiple Categories per Security

Security categories help you manage target allocations and help your clients understand how their assets are distributed. However, in the past, pooled investment vehicles such as mutual funds were difficult to categorize because they are often made up of multiple types of securities.

Now you can assign as many categories to a security as you want. When you assign multiple categories to a security, you designate a percentage for each category, allowing you to report on your clients' holdings with even greater detail and accuracy.

For example, if you have a mutual fund composed of 60% equities and 40% bonds, you can assign that mutual fund the equities category at 60% and the bond category at 40%. You will then see those designations reflected in your reports.

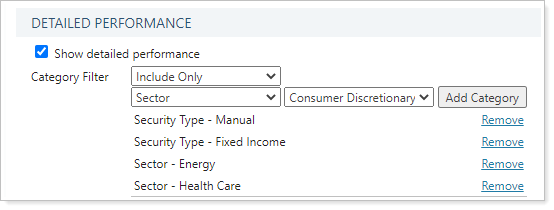

Filter by Category on the Account Performance Report

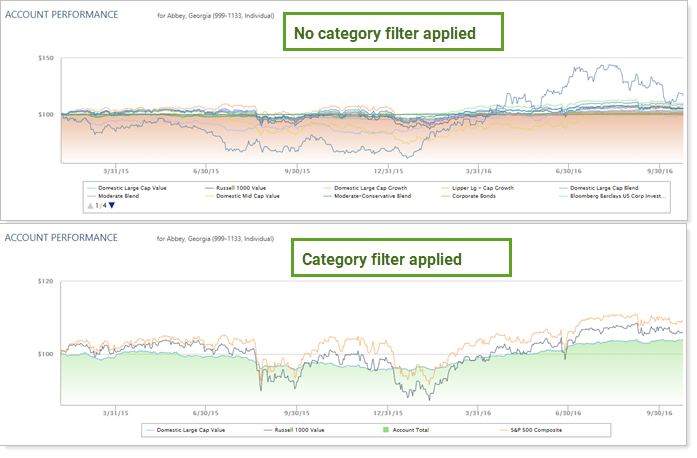

We know that the Account Performance report is a foundational piece of your reporting package and we've heard your feedback that you want to filter this report by specific categories to help you better analyze your clients' portfolios. To help you organize the report around the information most relevant to you and your clients, we've added the ability to filter by category.

Use the Category Filter on the PDF and dynamic Account Performance report to display performance data for only the categories you want.

Depending on your goal, choose to Include only certain categories, or Exclude only certain categories. This allows you to configure the report efficiently whether you'd like to display many categories or only a few.

To learn more, see Account Performance Report.

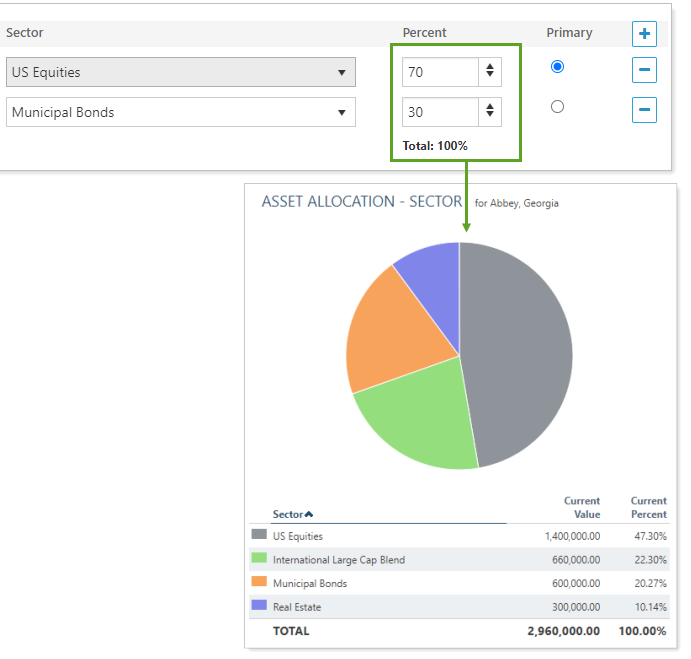

Report on Securities With Multiple Categories

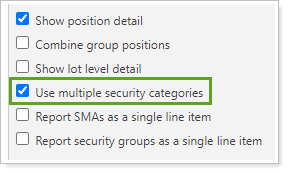

Once you’ve assigned multiple categories to a security, you can enable Use multiple security categories on the Holdings and Asset Allocation reports. This means that, when looking at these holdings-level reports, you can choose to view security categories that are more proportionally accurate.

When you group by a category other than Security Type, you'll see your assigned category percentages reflected in reporting. This means:

- You'll be able to view multiple categories for a single security.

- On reports that show lot-level detail, Tamarac Reporting will split lots proportionally according to the category allocation percentage.

- When you restrict the categories included in a report using Include Only or Exclude Only, only the percentage assigned to the applicable category will be included in the report.

With this change, all other reports besides the Holdings and Asset Allocation reports will only use the primary category.

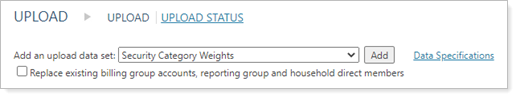

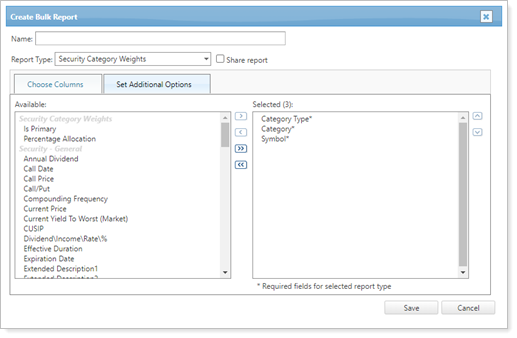

Upload and Generate Bulk Reports To Include Securities With Multiple Categories

Now that securities can have multiple categories, you can also upload multiple category data for securities. The Security Information bulk upload now lets you indicate primary data points such as Primary Asset Class and Primary Sector. The new Security Category Weights bulk upload lets you designate a category as primary and assign allocation percentages to your categories.

In addition, the new Security Category Weights bulk report can provide you with this category allocations data.

You can still continue to upload securities data that includes the previous field names such as Asset Class.

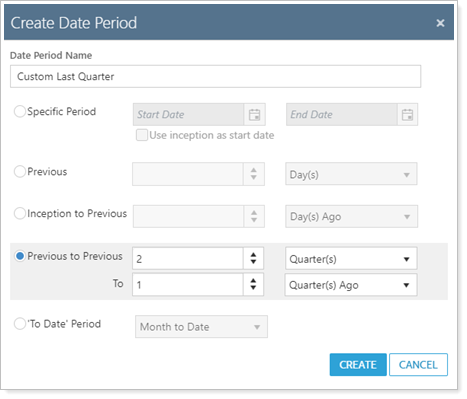

More Flexible Previous to Previous Date Period Options

The Previous to Previous date period allows you to run a report based on a dynamically updating period. For example, you might create a Previous 3 months date period to make it easy to review recent performance.

We've heard your feedback about this feature, and in this release we introduce even more flexibility and clarity to the Previous to Previous date period, allowing you to report on the precise data you need with the minimum amount of setup.

When creating a new Previous to Previous date period, you can designate both the start and end date in relation to the current date. The date period will then dynamically update so you can continue to use it going forward without creating a new date period.

For example, let's say you want to compare performance this quarter with performance during the same quarter last year. You can create a new date period that begins four quarters ago and ends three quarters ago, isolating the historical quarter you're interested in. If you need this data regularly, you can continue to use this same date period without the need to create a new date period with specific start and end dates.

For more information about creating and using Previous to Previous date periods, see Dates and Date Periods.

Integrations

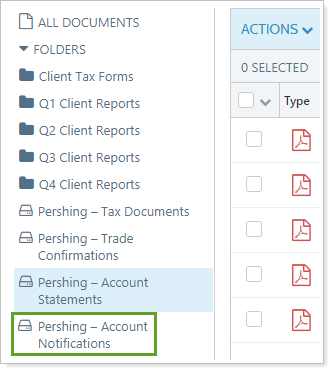

Notifications Added to the Pershing Document Vault

For those of you who use the Tamarac integration with the Pershing document vault, you now have a new type of document you can add to the available documents. Currently, you can view statements, trade confirmations, and tax documents. With this release, the new Pershing – Account Notifications folder appears for firms with the Pershing integration. As with other folders, this folder will now show a list of notification documents from Pershing. This update adds an additional way to classify and find critical documents.

Platform Improvements & Performance Enhancements

Part of our ongoing effort to improve the speed and reliability of the Tamarac Platform includes a number of enhancements under the hood. This table highlights improvements we made since our last release:

| improvement made | type of improvement |

|---|---|

| We added additional automation to the morning data process, reducing the need to manual inputs and potentially allowing syncs to begin sooner. | Code/Database |

| We optimized a status check process in PortfolioCenter to make it faster and reduce the load on our servers, further helping to speed the morning process. | Code/Database |

| We improved the way we process bulk uploads to fix an issue some firms had bulk reports. With this fix, many of these firms may see that large uploads finish more consistently. | Code/Database |

| For those who use Tamarac Trading, we're continuing to add features to the beta version of the Rebalance page. This page loads 43% faster than the original Rebalance page. In addition, we're introducing the beta version of the Rebalance Summary report which loads significantly faster than the original version of the Rebalance Summary. | Tamarac Trading |

Learn More - Watch the Release Video