Contents

Client Portal & Reporting

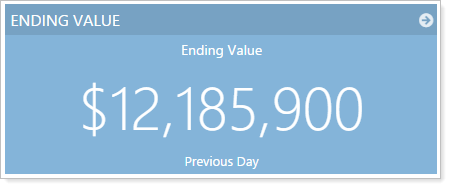

Add Dollar Signs to Dashboard Tiles

Since we completely overhauled the client portal in July, we've been inundated with positive feedback. However, many of you let us know via the Suggestion Box that you wanted dollar signs to appear in front of dollar amounts on dashboard tiles. We heard you loud and clear.

Before this release, dollar amounts appeared just as they do on all other reports, with no dollar signs. With this release, dollar signs will appear in front of dollar amounts on dashboard tiles. There's no setting to enable – this change will occur automatically.

Bon Voyage to Classic Views for Client Portals

Classic views for client portals served us well for many years, but it's almost time to say goodbye. The new client views we released in July offer many improvements that all of you have been raving about. This year, classic views will go away forever, so make sure you've transitioned to the new client views. To learn more about getting started on the new client views, visit Setting Up Client Portals.

With this release, once all classic client views are no longer assigned to clients, the Classic Client Views menu item will no longer appear in Advisor View and we'll delete any Saved Searches associated with classic client views. If you anticipate you'll mostly be transitioned to the new client views by the February release, we recommend creating Saved Searches for the new client views that mimic your classic client view Saved Searches.

Manual Securities and Committed Capital

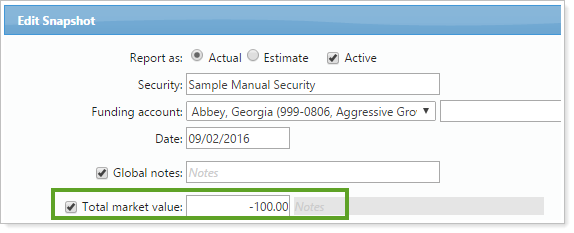

Enter Negative Values for Manual Security Snapshots

For some alternative investments—particularly committed capital investments—fees may be charged up front, before any investments are made and before any capital is called. From the investor's perspective, the value of that investment would be negative because the total value is the fees. After the first capital call and the first investments are made, the position would eventually turn to a positive value.

Before this release, Advisor View did not accommodate initially displaying the value as a negative amount because you could only enter manual securities as positive values.

To support this scenario and many others, when entering the total market value for your manual securities, you now have the option to enter negative values. To enter a negative value, simply type a dash before the number in the Total market value box.

Upload Committed Capital

If you use committed capital, entering capital in bulk through the user interface can sometimes be a time-consuming task. To make the process easier, we're introducing the ability to bulk upload committed capital. You can upload this information on the new Account Committed Capital upload data set.

Below is an example of the upload data set:

| Committed Capital | Account Number | Symbol |

|---|---|---|

| 100 | 999-0803 | COMCAP |

| 500 | 999-0806 | COMCAP |

| 500000 | 999-0808 | COMCAP |

We've also added an Account Committed Capital bulk report that you can download as well. You can download the bulk report, make your changes, and then upload it back into Advisor View.

Integrations

Fidelity WealthCentral® Renamed to Fidelity Wealthscape™

With this release, we've replaced all references to Fidelity WealthCentral with Fidelity Wealthscape.

On December 16 of 2016, Fidelity Clearing & Custody Solutions introduced Wealthscape, the gateway to your total advisor platform. Wealthscape is a rebranded version of the Streetscape® and WealthCentral® platforms, designed to deliver increased advisor productivity and collaboration. Beginning on December 12 of 2016, Streetscape and Wealthscape users experienced a new log in process – and we've updated Advisor View to align with this new branding.

As Fidelity's next-generation technology centers on an enhanced workstation, Wealthscape serves as a gateway to connect with Fidelity tools and third-party solutions. Helping you digitize, improve productivity and collaboration, and focus on what drives value to clients.

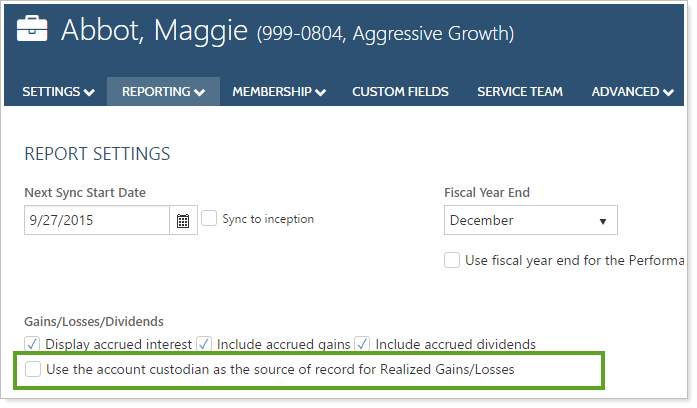

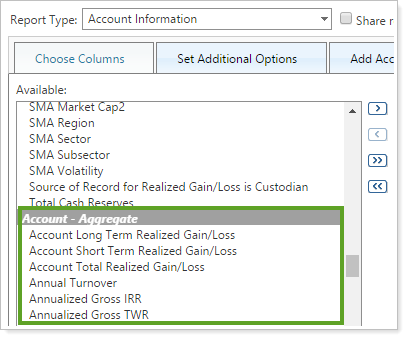

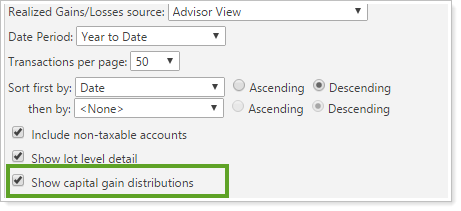

Use the Custodian As the Source for Gains & Losses

We're excited to announce that we've now extended the custodian realized gains and loss reporting to more reports, including the Comparative Review report and the Account Information bulk report.

As of this release, Tamarac supports the following custodians: Pershing, Schwab, and TD Ameritrade. Data is updated as it's received from the custodian. For more information, visit Tamarac Cost Basis Offering for Advisor View.

If you take advantage of this new setting, you can see capital gains distributions combined with custodian-sourced realized gains and loss data on the reports below:

-

Realized Gains and Losses(PDF and Dynamic)

-

Comparative Review(PDF and Dynamic)

-

Account Information Bulk Report(The Account - Aggregate section)

We have also added the ability to include capital gains distributions with custodial realized gain and loss data on all reports listed above. In the past, Advisor View prevented you from showing capital gains distributions when using the custodian as the source of record.

Usability

Accounts Save Ten Times Faster

Advisor View now saves your accounts 10 times faster than before! You'll notice these performance improvements when you're saving accounts on the Accounts page and when you're uploading accounts.

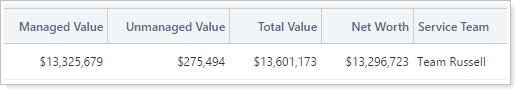

See More At-A-Glance Information on the Household page and Edit Household Panel

When working on the Household page and the supporting panels, we understand that you need as much information as possible at your fingertips. Based on your feedback, we've added the following columns to the Households page:

-

Managed Value (this column was previously named Total Value)

-

Unmanaged Value

-

Total Value

-

Net Worth

We also added the Total Value column to the Direct Members and All Members pages of the Edit Household panel.

Learn More - Watch the Release Video