Contents

Reporting

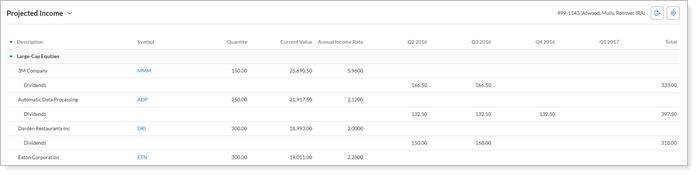

Separate Interest and Dividends in the Projected Income Report

On the Projected Income report, we've made it easier to identify when interest and dividends were paid for each security. Now you can break interest and dividends out into separate rows under each security for greater detail. If you'd like to continue seeing the report as it's always been, with the interest and dividends combined in the same row with the security, select the new Combine interest and dividends setting. This is the default setting.

For more information, see Combine Interest and Dividends.

This option is only available when you have already selected Show position detail. For more information, see Projected Income Report.

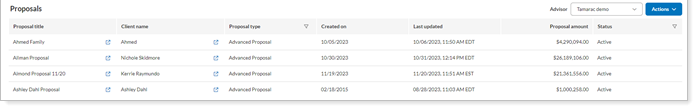

Updated Envestnet Platform Pages

Advisors who also use the Envestnet platform will appreciate the updated Service Requests and Proposals pages we’re rolling out this release. This update brings you a more modern and intuitive experience, keeping with our ongoing effort to enhance your experience with the Tamarac platform.

Service Requests Page

Proposals Page

New Client Portal

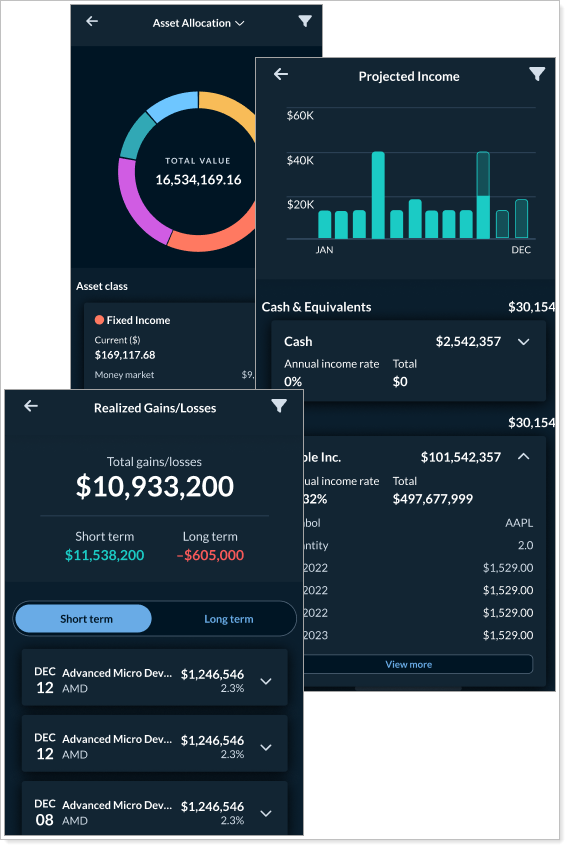

Coming soon: Mobile App Offers More Pages and Features

In this 24/7, always-on world, your clients need to access all their financial information from their mobile device. That’s why, shortly after this release, we bring you and your clients a dramatically expanded mobile app. This means that your clients can access any information from the client portal anywhere, any time. You build trust with your clients by giving them the information they need when they need it.

Reports pages

Mobile-friendly versions of every desktop page and widget, providing a comprehensive mobile client portal experience. Interactive charts and graphs provide additional detail when clients tap or press on data points.

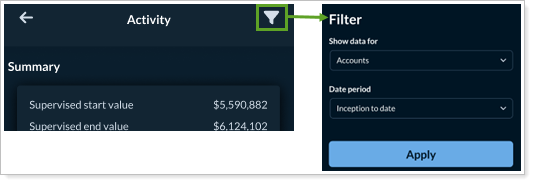

Familiar page controls

Familiar Show data for and date selection behavior from the desktop client portal provide intuitive data customization on each page.

Additional Expanded Features

This updated mobile app also includes the following experience enhancements:

-

Expanded dashboard access lets clients see and switch among all available dashboards.

-

Colors that follow the assigned Branding template, ensuring clients a consistent brand experience.

-

Responsive app that supports both portrait and landscape screen orientation.

Get started

When you add a page to a Reports template, it is automatically included in the mobile version of the client portal.

Coming soon: New Automated Branded Mobile App Workflow

When we first introduced the client portal mobile app, it offered a clean, unbranded, generic experience. We’re excited to offer you the ability to directly create a fully branded mobile app experience for your clients. Shortly after this release, the branded app workflow will be more automated, allowing you to create a branded app faster than before.

This new workflow features a user-friendly interface to learn how to set up your Apple and Google developer accounts, upload a logo, define your meta data, and submit the app for review to app store.

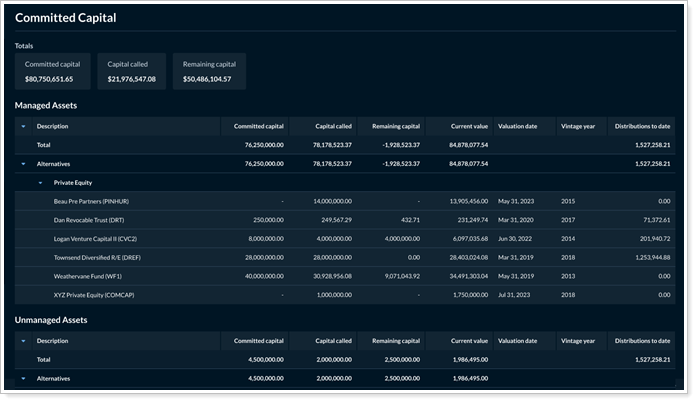

Introducing the Committed Capital Report and Widgets

If you use the Committed Capital report in Tamarac Reporting, you know that it’s a valuable resource for tracking venture capital funds. Providing clients with the ability to track their committed capital fosters transparency and keeps them informed about the status of their investments. This real-time monitoring is crucial in the dynamic and rapidly changing landscape of venture capital. This we release, we introduce this report as a page and widget for the new client portal.

On the page, you’ll find all the familiar features you use on the Committed Capital report in Tamarac Reporting—multiple grouping options, managed and unmanaged assets, and more.

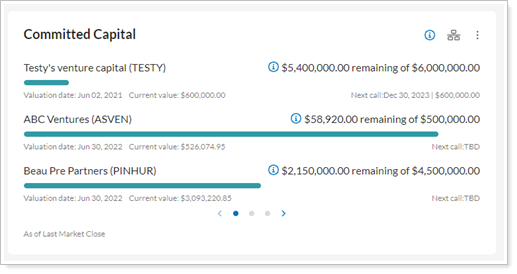

Two new dashboard widgets accompany the Committed Capital page:

- Fulfillment tracker

This widget shows all unfulfilled or outstanding capital calls in that date period. It provides a lot of details about each capital call in a clean, clear visual summary.

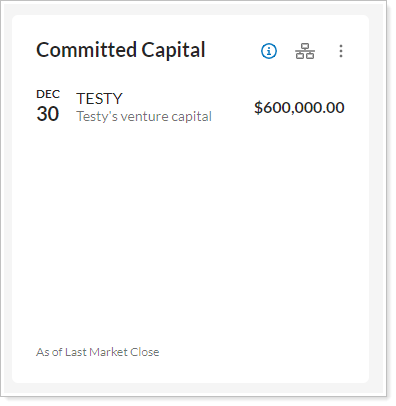

- Call calendar

This widget shows the date, ticker, name, and next call amount for all upcoming calls. It gives a simplified view of calls by date, helping keep clients from being overwhelmed by information.

See More Tax Status Data on the Realized Gains/Losses Page

Because it’s a tax-focused report, in the past, the Realized Gains/Losses page and widget in the new client portal only included taxable accounts. However, we know that some of you want to see a full list of all a client’s accounts on that page, regardless of tax status. With this release, you can now choose to include or exclude taxable accounts, as appropriate. This customization allows you to create reports tailored to your clients’ needs, creating a more meaningful client portal experience.

Clearer Messages When There’s No Data to Show on a Widget or Page

Sometimes clients may choose a widget or page configuration that shows no results. This is an expected outcome if the account or group doesn’t have data for the date or date period selected.

With this release, we’ve clarified the message that clients see when there’s no data to show for a page or widget to tell them what they can do to see results. This will help stop clients from assuming anything is wrong and make it easier for them to use their time wisely.

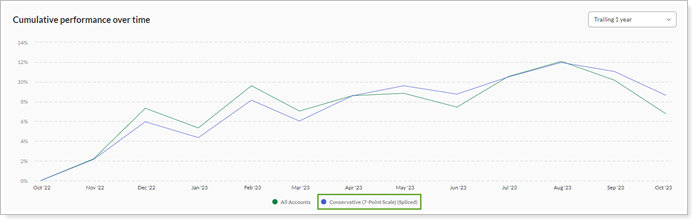

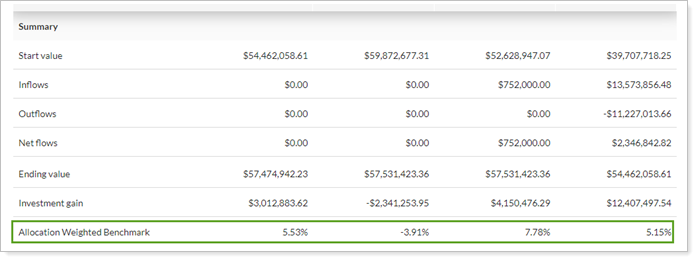

Include Category-Level and Allocation-Weighted Benchmarks in Client Portal Pages

As part of our ongoing commitment to providing the most robust client portal experience on the market, we’ve expanded the benchmarks clients can see in the portal. Now you can include category and allocation-weighted benchmarks to some pages. This gives clients a reasonable comparison for how their investments are performing at the category level.

These benchmarks are available for the following pages:

-

Account Performance. Clients can see the category-level and allocation-weighted benchmarks in the chart and table.

-

Asset Allocation. Clients can see the category benchmark listed in the table.

-

Summary. Clients can see the allocation-weighted benchmark in the table.

Learn More - Watch the Release Video