Contents

Rebalancing & Trading

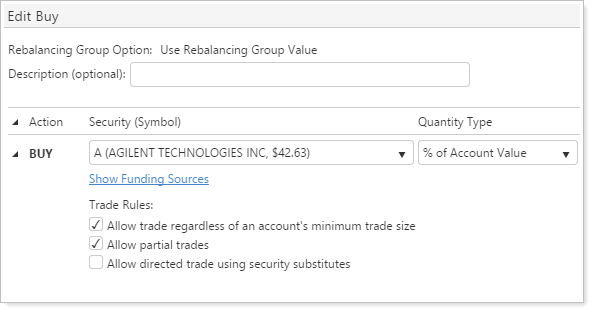

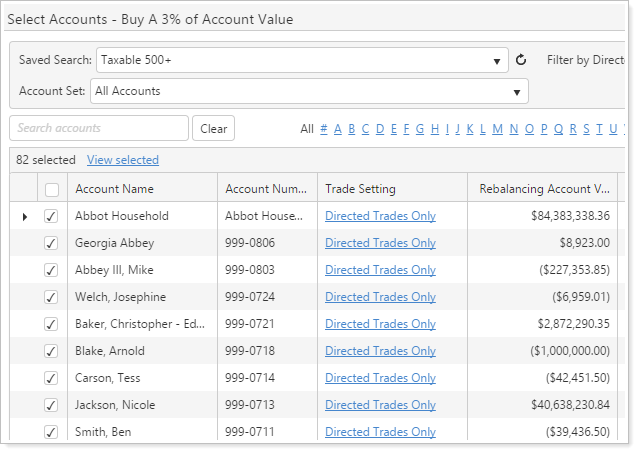

Redesigned Interface for Creating & Editing Directed Trades

Based on your feedback, we've completely overhauled the process for creating and editing trades and added some powerful features that many of you have asked for.

Highlights include:

-

Edit your trades once you've created the directed trade

-

Add and remove accounts once you've created the directed trade

-

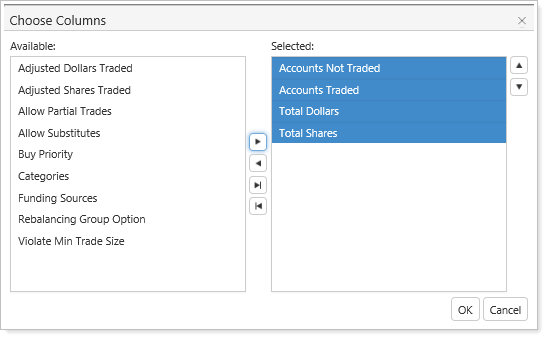

Determine the columns you want to see on the page – including Accounts Not Traded, Accounts Traded, Total Dollars and Total Shares

We are confident that the new design will make you more productive and give you the data you need to make more informed trading decisions. While we don't anticipate much of a learning curve when switching to the new design, be sure to check back after the July release for step-by-step instructions on these new workflows.

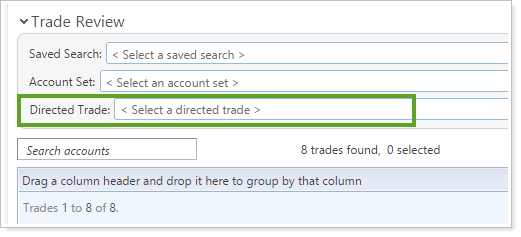

Filter the Trade Review Page by Directed Trade

When viewing the Trade Review page, sometimes you want to take a look at a specific directed trade. With this in mind, we've added a Directed Trade filter to the Trade Review page that makes it easy to see all securities impacted by a directed trade.

Product Security

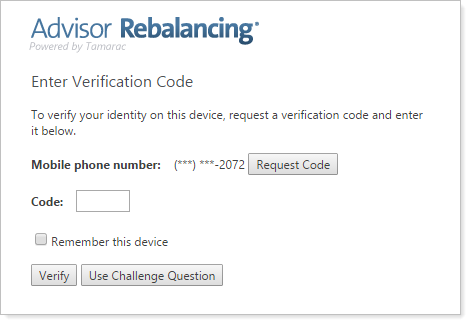

Mobile Phone Codes Added for Secure Sign-In

We're excited to expand your secure sign-in options and offer you an additional verification method. If your firm has implemented dual factor authentication, your advisors and clients can now choose between receiving a code on their phones or using the security questions introduced in the May 2015 release.

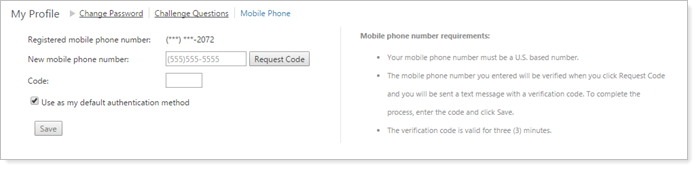

To use mobile phone codes instead of challenge questions, advisors or clients can select the Use as my default authentication method check box on the Mobile Phone tab of the My Profile page. This is also where they can enter or update the phone number for receiving the codes.

If you would like to take advantage of this feature, please contact the Account Management team (TamaracAM@envestnet.com) and they can assist you with a pricing quote.

Upload & Bulk Reports

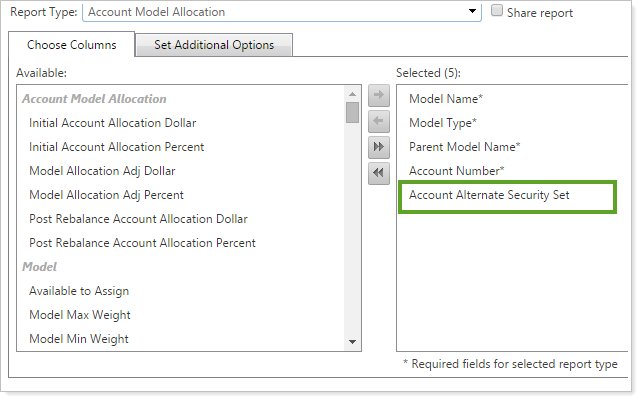

New Account Alternate Security Set Column on the Account Model Allocation Bulk Report

We've added an Account Alternate Security Set column as an available column on the Account Model Allocation bulk report.

Advisor OMS

Group Average Price for Advisor OMS Bulk Reports

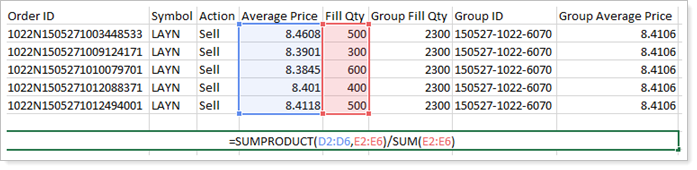

On the Advisor OMS Orders and OMS Allocations bulk reports, we've added a Group Average Price column that shows the weighted average price for all fills for the group. Below is an example of the calculation:

This could also be calculated as: (D2*E2)+(D3*E3)+(D4*E4)+(D5*E5)+(D6*E6) / SUM(E2:E6).

Reporting

Automatic Sorting for Category Grouping

When grouping by category, Advisor Rebalancing will use the category sort order as it appears on your screen. However, if you've enabled the category sync from Advisor View, Advisor Rebalancing will use the category sort order you specified in Advisor View. There is no setting to change the sorting behavior – it will occur automatically.

Search Updates

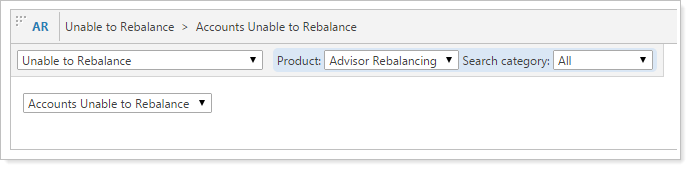

Update to the Accounts Unable to Rebalance Search Filter

Today, many of you use the Accounts Unable to Rebalance search filter to find accounts with rebalance errors. We've updated this filter to include accounts that have been saved but not rebalanced. Accounts that would appear as a result of this change include accounts with trades on hold and accounts with a total negative account value.

Integrations

Fidelity Wealthscape Integration

We're excited to provide integration with Fidelity Wealthscape. With this integration, you can:

-

SEE ACCOUNT AND CASH BALANCE DATA.Make more informed portfolio rebalancing and trading decisions based on real-time custodial data without logging into multiple applications.

-

SINGLE SIGN ON FROM WEALTHscape TO ADVISOR REBALANCING.You can log in to Advisor Rebalancing directly from Fidelity Wealthscape. You will remain authenticated so there is no need to have to reenter your user information each day.

Please contact your Fidelity representative to enable the Wealthscape integration with Tamarac.

Usability

New Look for the Support & Training Center

We think you'll appreciate the streamlined new look of the Support & Training Center. No functionality has been changed during this process, but with the cleaner design, we think it'll be easier to find the content you're looking for.

Learn More - Watch the Release Video