Contents

FIX Flyer Integration to Place Trades Directly in the Tamarac Trading Platform

In late 2017, we announced a sweeping change to our trading platform, one that would fully integrate our powerful reporting software with the rebalancing and trading capabilities of Advisor Rebalancing. As we further improve Tamarac Trading, we're teaming up with FIX Flyer, a company that develops advanced technology for complex, multi-asset, institutional securities trading, to offer you a seamless trading experience within the Tamarac Trading platform. This new integration will offer the following benefits:

-

Equity, ETF, and mutual fund trading within a single workflow.

-

Trading with multiple custodians and brokers through a centralized system.

-

Status updates to show you real-time information about your trades.

-

User permissions and account settings in Tamarac Trading that allow you to control who completes trades and how individual accounts are traded.

Trading with the FIX Flyer integration is simple and uses the existing trading workflow within Tamarac Trading. Once you create your trades, approve them, and generate orders, you can send those trades directly to FIX Flyer using the Trade Actions dialog box. After you've sent your trades, you will be able to see within Tamarac that those orders were successfully added to your trade blotter in FIX Flyer.

You'll also be able to customize trading with FIX Flyer. You can set up custom broker options, update accounts with relevant trade configurations, and control who has access to trade with FIX Flyer using User Management.

Sleeve Account Type Search Filter Can Now Use Group Values

In February, we first introduced sleeve accounts, a powerful feature that allows you to view the performance of different models within clients' accounts separately. In addition to sleeve accounts, we also created tools to help you find and use these accounts, including search filters that help you find or exclude your sleeve accounts in saved searches.

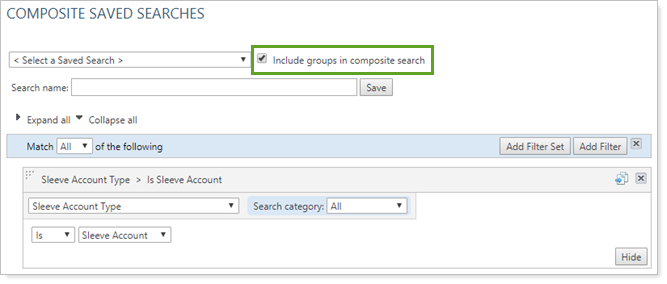

Initially, the Sleeve Account Type saved search filter didn't have the option to use group values. With this release, we've changed the Sleeve Account Type saved search filter to include group values, allowing you to use that filter in Composites that include groups.

This additional filter gives your composite reporting more flexibility to use sleeve accounts.

Save Directed Trades Overnight Using the Keep Overnight Feature

The Directed Trades feature is a powerful way to generate one-off trades and quickly apply those trades to multiple accounts. However, in the past, any trades you created using Directed Trades were deleted overnight. If you had to revisit a trade for any reason, you'd have to re-create it.

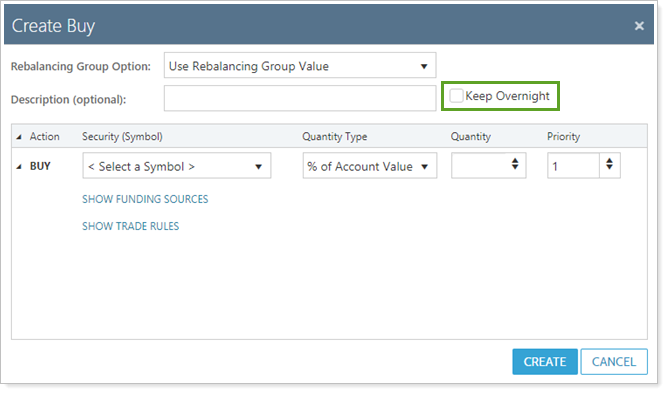

Now, Tamarac Trading gives you the option to save Directed Trades overnight using the new Keep Overnight option.

If you select Keep Overnight, your trade will be saved for tomorrow. This option does not save any accounts associated with the directed trade, but the trade itself will be available for you to use the following day.

Here are a few additional details about the Keep Overnight option:

-

This option is available on all directed trade types: buy, sell, final position, linked trade, and mutual fund swap.

-

If you set a buy priority for multiple directed trades, that priority will be saved overnight along with the trade. For example, if you create four directed trades with buy priorities of 1 through 4 and save trades 2 and 3 overnight, trade 2 will become trade 1 and trade 3 will become trade 2, preserving your intended priority.

-

Quantity, quantity type, funding source, and other trade parameters are also saved overnight.

Learn More - Watch the Release Video